Infrastructure investment: opening up new avenues of investment opportunity

Written By:

Jason Conway, Senior Investment Editor, BNY Mellon Investment Management.

Jason Conway of BNY Mellon examines the opportunities for investors in the burgeoning infrastructure sector

With global public sector organisations facing increasing cost pressures, many are now seeking new private investment and funding for infrastructure development, creating an ever-wider range of investment opportunities. While private sector involvement in infrastructure projects goes back centuries – with many major railway and canal networks originally funded by private capital – a growing number of projects that would once have been handled by the public sector are now being run by private corporations and consortia. The trend towards deregulation of previously state-owned utilities – embraced by markets such as the UK – has opened up new avenues of opportunity for investors keen to gain exposure to this sector, allowing governments to focus increasingly limited resources on their most critical priorities.

Airports, hospitals, roads, utilities and even renewable energy projects such as wind farms are just some of the assets investors can gain exposure to in this rapidly-expanding sector – with each asset carrying its own balance of investment risk and return. With interest rates and bond yields at historic lows, infrastructure investment can deliver competitive returns while adding valuable diversification to portfolios.

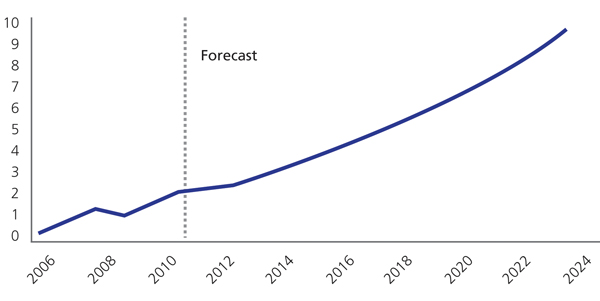

Although the infrastructure investment market is relatively new, it is becoming progressively global in nature and has seen the volume of its assets grow exponentially in recent years. While the 2008 global financial crisis did have a significant impact on the sector, prompting a dip in overall global infrastructure spending, levels are now showing clear signs of recovery.1

Global forecasting and modelling specialist Oxford Economics estimates worldwide infrastructure spend will reach US$9 trillion a year by 2025, and expects close to US$78 trillion to be spent globally between 2014 and 20252 in both developed and emerging markets. Much of this total will require significant private support and investment.

The way in which investors address the challenges and opportunities infrastructure investing presents in the longer term will depend on the requirements of their individual investment portfolios and needs. However, infrastructure investment can be complicated, and this fast-growing sector carries risks along with its opportunities, which must be carefully considered.

Why infrastructure

While all investments carry a degree of risk, infrastructure investments can produce positive and stable returns in uncertain markets. Governments keen to attract private capital and investment in their infrastructure are typically inclined to provide fair returns in order to secure funding. While the nature of infrastructure projects varies widely – from construction projects to maintenance of existing projects and schemes whose returns depend on usage and consumption, such as toll roads and power stations – all have the potential to provide significant, often long-term, returns to investors.

According to the UK Treasury3, infrastructure assets are often characterised by:

- Strong competitive positions, natural monopolies or high barriers to entry

- Stable and predictable cash-flows, often linked to inflation

- Relative insulation from the business/economic cycle

- Diversification due to low-correlation with other asset classes

Infrastructure is considered a resilient asset class, which generally offers low volatility compared to other asset classes with its risks able to be spread across a number of individual project investments. These investments can also form a useful diversifier within a broader multi-asset portfolio. As the chart below illustrates, infrastructure spending continues to grow steadily, and is a market which is expected to see significant global growth in the years ahead.

Figure 1: Global infrastructure spending to reach $9 trillion by 2025, $trillion, current prices

Source: Oxford Economics/PwC. 2014

Considerations

Infrastructure investment is a specialised area with its own unique set of properties, advantages and disadvantages. Individual investments within this sector can vary enormously, making comparisons across the sector difficult. As such, good research and market knowledge is critical when selecting investments.

Liquidity is one of the main concerns with this asset class. A key feature of infrastructure investments is their long-term nature, with underlying construction and management contracts running for a number of years, and, in some cases, many years. While this could hamper liquidity, entry can be gained to the asset class through relatively liquid markets in listed funds and/or equities, including other infrastructure sector-related securities. These can all be accessed via dedicated investment managers with a thorough knowledge of the sector, or through collective investment funds and trusts.

Risks

Like any other investment, infrastructure is not a risk-free asset, but the level of risk each investment carries varies widely and depends on its underlying nature. So-called “greenfield” assets, such as construction projects, offer low margins and are often highly volatile investments with scope for cost overruns, construction-related problems and even, in extreme cases, cancellation. They can, however, as compensation for added risk, offer attractive returns.

Infrastructure assets focusing on the redevelopment or improvement of existing assets can potentially lower risks. Mature assets, which involve managing existing operational infrastructure such as hospitals and other public services can provide stable revenues, lower volatility and significantly lower risks, though even these may still be subject to various low-level threats.

In turn, projects dependent on a steady income stream – such as toll roads or bridges – may miss targets and underperform expectations. National governments often underpin infrastructure projects and provide various guarantees to private investors to provide funding, but it should be noted that even these can carry at least some degree of political risk. Investors in global infrastructure should pay close attention to the credit rating of countries whose projects they invest in, particularly if they are targeting less developed or emerging markets.

Collective investment schemes – such as infrastructure-focused investment trusts – have proved popular in recent years but also carry some risk, with some trading on large premiums to their net asset value (NAV) thanks to their popularity among income seeking investors.4

As with many other types of investments, exposure to higher-risk infrastructure investments often carries the potential of higher returns, and investors and their advisers must assess the likely risk/reward ratio with which they are most comfortable. Global infrastructure investing can potentially expose investors to the currency volatility of underlying assets, though these issues can usually be addressed by employing hedging strategies such as currency overlays.

The road ahead

As the infrastructure investment market matures and develops, it looks set to offer some major new opportunities. Even highly developed markets such as the UK, US and Australia face pressing infrastructure development needs. Many of the national governments currently tasked with regenerating crumbling infrastructure, and streamlining and improving essential services, increasingly seek private funding and support for their projects.

In the UK, the government this year enacted The Infrastructure Act, designed to make it quicker and simpler to develop nationally-significant infrastructure projects. The act will allow the creation of Highways England, a government-owned company that will use access to long-term funding to ensure improvements on the country’s major road network are streamlined, cost effective and encourage investment.

The legislation will also give local people the right to buy a stake in renewable energy projects, while cutting red tape for nationally-significant infrastructure projects to boost investment. The move is a positive step forwards for UK infrastructure development, and could ultimately create significant new business and investment opportunities. However, it is just one development among many in a rapidly-expanding global infrastructure market which is expected to see exponential growth over the next decade.

From an investment perspective, this market is likely to require ever more careful consideration and due diligence of individual projects to balance potential risks and returns. Nevertheless, the financing of future infrastructure projects offers significant potential. Looking forward, private investors are likely to play a much greater role in their development in future which may ease growing constraints on public budgets and assist critical infrastructure development. This dynamic sector could attract a new generation of investors keen to capitalise on the potential investment strengths and defensive qualities the sector offers, while becoming stakeholders in the facilities and utilities which provide essential services worldwide.

1. Capital projects and infrastructure spending. Outlook to 2025. PwC/Oxford Economics. 2014.

2. Capital projects and infrastructure spending. Outlook to 2025. PwC/Oxford Economics. 2014.

3. Investing in UK Infrastructure. HM Treasury/UK Trade & Investment. 01.07.14

4. Mark Dampier: An alternative to infrastructure investment trusts. Money Marketing. 14.10.14.

More Related Content...

|

|

|