Inflation protection through global listed infrastructure

Written By:

|

Sheridan Bowers |

Sheridan Bowers from Vontobel Asset Management discusses the attractions of investing in global listed infrastructure – real assets that can help protect from inflation in a period of uncertainty

There are two powerful global trends leading to an increased demand for infrastructure: a growing population and improving living standards.

Inflation, rising interest rates, energy prices and geopolitical tensions continue to be on the top of investors’ minds, and are likely to impact economic growth in 2023. While the current macroeconomic environment remains challenging, we believe investments poised for long-term growth, like infrastructure, should be part of investors’ portfolios. Although many LGPS funds might already have direct infrastructure investments, listed infrastructure provides access to global assets in a liquid way, increasing diversification and flexibility in portfolios.

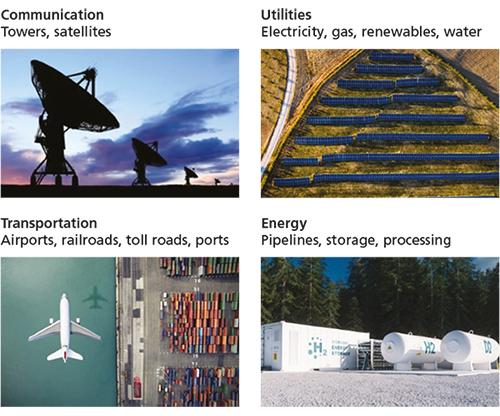

Infrastructure includes different assets, which can be split into four general sectors and remembered through the acronym CUTE: Communications, Utilities, Transportation and Energy.

Figure 1: Four attractive sectors¹

Predictable cash flows, with inflation protection

The strong secular trends that are taking place support a steady growth for communications and utility companies. On the other hand, transportation and midstream energy companies tend to benefit during economic recoveries.

Additionally, midstream energy companies and renewables-focused utilities are positioned to provide the energy security necessary for global economies to grow over the long term.

Companies engaged in the infrastructure industry are exposed to the risk of the monopoly of the public sector, which sponsors most infrastructure projects. However, infrastructure assets operate in an environment of limited competition due to natural monopolies, government regulations or concessions. This translates into significant economies of scale and high barriers to entry from competitors.

While many can argue that infrastructure assets are exposed to several dependencies from the public sector, e.g., fiscal (spending) policy of the government, investors should remember that infrastructure enjoys an inelastic demand as it is an essential and irreplaceable public need. Therefore, infrastructure can provide a predictable return over time, because most companies have long-term regulatory contracts to operate their assets. This means that infrastructure has the potential to generate consistent, stable cash flow streams, usually with lower volatility than other traditional asset classes.

As revenues from infrastructure assets are typically linked to inflation and are often supported by regulation, it can also offer inflation protection. In certain instances, revenue increases linked to inflation are embedded in concession agreements, licenses, and regulatory frameworks. While in others, infrastructure companies can pass inflation to consumers via price increases due to the essential nature of the assets and their inelastic demand.

The advantages of investing in listed infrastructure

Infrastructure can be accessed through both private ownership and publicly listed securities. In our view, investing in publicly listed infrastructure provides advantages over private infrastructure investing, including the following:

- Scale: Total market capitalisation of the universe of “pure-play” infrastructure companies is approximately USD 2.5 trillion²

- Diversifying: Access to assets that might only be available in public markets and are not available for private purchase

- Liquid: Daily price transparency and liquidity

- Transparent and accountable: Publicly traded infrastructure firms have extensive financial reporting requirements, providing investors transparency

As with any investment, it is important to know the companies’ performance drivers and risks. Companies that exhibit consistent and rather predictable business models, and offer potential for high and sustainable profitability, solid capital appreciation, and robust dividend growth are in a good position to offer attractive returns.

Attractive prospects in a world of uncertainty

Communications: In the US, a re-acceleration of growth is expected to accommodate wireless usage and deploy new networks/spectrum. In Europe, the independent tower model has accelerated, as more telecommunications carriers have sold off their tower portfolios. Although acquisition opportunities have decreased, we are seeing growth thanks to the construction of new towers to meet organic demand. The 5G mobile buildout is just beginning and will be a process taking place over several years, meaning that tower companies’ runway for related growth is still quite long.

Utilities: Decarbonisation of the economy is benefiting utilities as they improve their environmental profile and increase earnings. The transition to renewable energy provides a visible growth path extending for more than a decade. Political initiatives in Europe and the US (including the EU’s REPower program and the US’s Inflation Reduction Act of 2022) reinforce our positive thesis. Strong earnings visibility and momentum from the global decarbonisation theme provide support for valuations relative to the broader market.

Transport: North American railroads enjoy strong pricing trends in an inflationary environment and are well equipped to offset rising costs. However, service levels and margins continued to lag due to insufficient progress in the hiring of personnel. Traffic trends for toll roads have improved, with only limited impact from higher gasoline prices on volume. While airports have experienced a strong recovery of passenger air travel, especially leisure travel, economic concerns have increased the uncertainty surrounding air travel.

Energy: For midstream energy, supply remains below demand levels, supporting the price of the underlying commodities. Inventories are also low globally, and we do not expect a quick solution that will increase supply. Company fundamentals are robust due to financial discipline and favourable industry dynamics. Investors can look for natural gas and natural gas liquids (NGLs) related names that will be favourably exposed to growing volumes and the need for energy security.

The coming months will undoubtedly present unforeseen challenges, but in our view there also are opportunities to be found. The market volatility experienced in recent months has created attractive valuations across the infrastructure universe, and we believe global infrastructure companies are well positioned to deliver attractive, diversifying returns.

Disclaimer

Investment risks – Companies engaged in the infrastructure industry, are exposed to the risk of the monopoly of the public sector which, as a rule, is the sponsor of the most infrastructure projects. This virtually monopolistic position of the public sector translates into a number of dependencies of the infrastructure companies from the public sector: fiscal (spending) policy of the government, openness and fairness of the tendering processes and protection of the infrastructure companies against unfair competition practices, market and price setting powers of the monopolist, to name some of them. A company’s stock price may be adversely affected by changes in the company, its industry or economic environment and prices can change quickly. Equities typically involve higher risks than bonds and money market instruments.

This marketing document was produced by one or more companies of the Vontobel Group (collectively “Vontobel”) for institutional clients.

This document is for information purposes only and nothing contained in this document should constitute a solicitation, or offer, or recommendation, to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever.

Although Vontobel believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this document. Except as permitted under applicable copyright laws, none of this information may be reproduced, adapted, uploaded to a third party, linked to, framed, performed in public, distributed or transmitted in any form by any process without the specific written consent of Vontobel. To the maximum extent permitted by law, Vontobel will not be liable in any way for any loss or damage suffered by you through use or access to this information, or Vontobels failure to provide this information. Our liability for negligence, breach of contract or contravention of any law as a result of our failure to provide this information or any part of it, or for any problems with this information, which cannot be lawfully excluded, is limited, at our option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you. Neither this document nor any copy of it may be distributed in any jurisdiction where its distribution may be restricted by law. Persons who receive this document should make themselves aware of and adhere to any such restrictions. In particular, this document must not be distributed or handed over to US persons and must not be distributed in the USA.

1. Vontobel

2. The Global Listed Infrastructure Organisation (GLIO). As of 31.12.2021

More Related Content...

|

|

|