Income thinking: structurally diversifying sources of risk

Written By:

|

John Stopford |

John Stopford of Investec Asset Management explores why and how to structurally diversify sources of risk. By looking beyond asset class labels, considering income sources and using a dynamic approach, investors could protect their portfolios from drawdowns and compound gains in order to meet their desired outcome

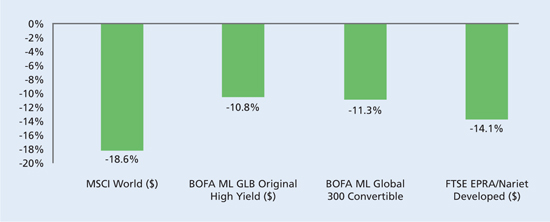

Traditionally, an investor’s portfolio has been allotted to different asset classes in the hope of achieving desired returns while diversifying risk. Investec’s Multi-Asset Income team place greater emphasis on an investment’s relationship with the economic cycle in determining its place in a portfolio than we do on its simple label. An asset’s label usually provides little insight, or worse still can be misleading with regards to its risk-reward characteristics. Figure 1 below, shows the percentage return on different asset classes over a recent equity drawdown. As can be seen, securities with very different classifications but comparable characteristics produce similar returns.

To achieve true, or structural diversification, we prefer to divide assets into “Growth”, “Defensive”, and “Uncorrelated” (G/D/U) buckets. Equities or lower grade company debt are highly correlated with the health of the global economy, being reliant on periods of economic expansion for earnings potential. Consequently, we classify both shares and high yield corporate bonds as Growth assets rather than thinking of them as equities and fixed income.

By contrast, investments such as high quality bonds typically have inverse relationships with the economic cycle, offering more defensive properties. These have tended to deliver better returns in more difficult economic conditions.

Certain asset classes are little affected by the economic cycle. Asset classes such as infrastructure, the cashflows of which are frequently backed by very long-dated government funding, behave in an uncorrelated fashion with Growth and Defensive assets. Crucially, to be used effectively, these classifications require an understanding beyond historical relationships and an anticipation of future trends.

There are important implications for a defensive return strategy. Firstly, a characteristic-focused approach avoids the need for market timing or overtrading when high levels of market stress cause asset class correlations in parts of the portfolio to rise. This allows investors to consistently collect the coupon or dividend payments from their positions. Secondly, it focuses attention on position conviction – investors have a broad opportunity set and should avoid inadvertently duplicating risks.

Figure 1: Percentage return over equity drawdown across different labels (with similar characteristics)

Source: Morningstar, Bloomberg, BofA Merrill Lynch, Investec Asset Management. Drawdown from May 2015 to equity low of February 2016. Global Equity: MSCI World; High Yield Bonds: BofAML Original High Yield; Convertibles: BofA Merrill Lynch Global 300 Convertible; Listed Property: FTSE ERPA/NAREIT developed.

Diversifying sources of income

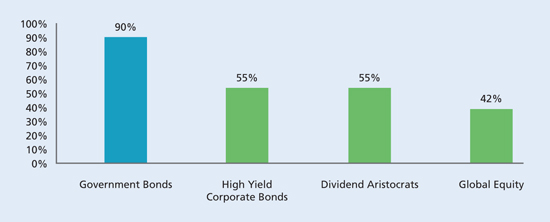

Another aspect of risk for a defensive strategy to consider is how concentrated its sources of income are and whether they are unintentionally exposed to similar sources of risk. A consequence of the hunt for yield, instigated by post-crisis monetary stimulus, has been increasingly concentrated sources of yield and a shift towards higher-risk origins. To ensure a smoother and more sustainable flow of income, the Multi-Asset Income team look to diversify risk from a yield perspective also. In Figure 2, we show the percentage of various asset class yields which can be explained by the top three yielding sectors within that asset class (in the case of government bonds we look at countries). Clearly investors are highly beholden to certain concentrated sectoral and regional factors for yield.

Figure 2: Proportion of index yield attributable to the top three yielding sectors or issuers

Source: Morningstar, Bloomberg, Markit, Citigroup, Investec Asset Management, in USD, 31.07.17. Global Equity: MSCI World; Dividend Aristocrats: S&P Global Dividend Aristocrats (S&P 500 constituents that have paid dividends for 25 years or more); High Yield Corporate Bonds: Markit iBoxx Global Developed Liquid High Yield; Government Bonds: Citigroup Group-of-Seven (G7) Index.

Be dynamic, consider skew

Investors increasingly look to certain correlations to inform their portfolio construction process. Simple correlation figures can provide a “quick and dirty” appraisal of an asset’s characteristics; however, it is important to remember that they are effectively average figures and say nothing of its upside or downside relationship. If one were to create an investment strategy which, over the last 10 years captured the upside return of every single month in equities and none of the down months, one would assume that this would have perfect risk characteristics. Yet the strategy would actually have an 82% correlation with equities, because the simple correlation coefficient fails to reflect the skew of upside and downside capture.

Conclusion

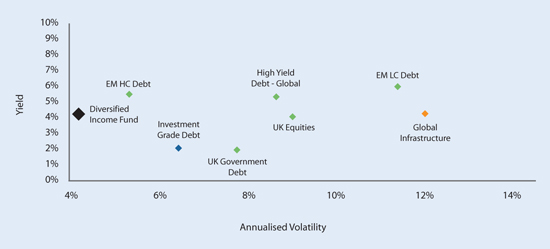

We believe that by looking beyond asset class labels, diversifying income sources, and using a dynamic approach, a portfolio can be protected from drawdowns and be allowed to compound gains. Doing so requires taking the time to understand asset class behaviours and risk. This means that investors can strike a better risk-reward balance than investing in a single asset class (as shown in Figure 3).

Figure 3: Yield vs. volatility: risk/reward characteristics of individual asset classes

Source: Morningstar, Bloomberg, BofA Merrill Lynch, Investec Asset Management, in GBP, 31.07.17. Annualised standard deviation of monthly returns over 3 years. Investment Grade Debt: BofAML Global Broad Market Corp TR USD; DM Gov’t Debt: BofAML Global Governments Bond II TR USD; EM HC Debt: J.P. Morgan EMBI Global Divers; EM LC Debt: JPMorgan GBI-EM Global Diversi; Global Infrastructure: S&P Global Infrastructure TR USD; Global High Yield: BofAML Global High Yield TR USD; UK Equities: FTSE All-Share TR; Diversified Income Fund: Distribution Yield and volatility of I Inc Net share-class.

More Related Content...

|

|

|