Income thinking: building resilient portfolios from the bottom up

Written By:

|

John Stopford |

As local government faces ever increasing budget constraints, John Stopford of Investec Asset Management looks at why the need to consider the most appropriate investment strategy is more important than ever

Since the global financial crisis, the extreme monetary policies of central banks around the world have distorted government bond markets. With interest rates at low levels, increasing numbers of treasurers are considering moving away from traditional deposits into a range of different income-producing asset classes that have been more commonly associated with pension funds and other longer-term investors.

The best offence is a good defence

In preparation for this, we believe it is important to recognise the effectiveness of a bottom-up approach to security selection and to understand how individual holdings perform in different market conditions. After years of low interest rates following the financial crisis, many assets may look expensive when viewed using traditional valuation metrics.

We think it best to avoid constructing portfolios based on simplistic, top-down ideas of value, and instead take a cautious and forensic approach to picking investments, with a focus on higher-quality securities held in a conservative fashion. By doing this, we believe, the severity of drawdowns can be reduced. The process requires investors take the time to thoroughly understand the true nature of their exposures by building their portfolio from the “bottom-up”.

Building a resilient portfolio from the bottom-up

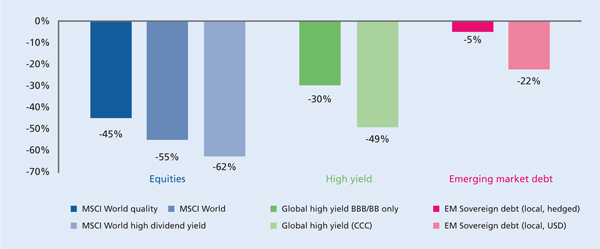

Figure 1 shows the maximum drawdowns experienced by different strategies which adopt a more or less conservative approach to security selection in some of the key growth asset classes. The results may be surprising to some, however, they validate our belief that by understanding asset class behaviours we are able to build a resilient portfolio which can achieve a desired outcome.

Figure 1: Maximum drawdown over 10 years

Source: Bloomberg, Investec Asset Management, May 2017

Within equities, the perception that a company’s high dividend yield conveys protection to its investors is erroneous. Simply because a company is paying out a high proportion of its earnings does not mean that there should be confidence in the sustainability of its business model or that its management is focused on maximising the interests of shareholders. It can, instead, mean that the company is in distress or that investors have forced its share price down in anticipation of a cut in the dividend.

Similarly, rather than looking at the immediate attractions of high yield, a more defensive approach aims to understand a company’s relative profitability, earnings stability and debt-burden. We define businesses which compare favourably on these grounds, whether considered from a debt or equity perspective, as “quality” corporations allowing us to judge the sustainability of the income they offer and properly compare their relative valuations.

As shown in Figure 1 with the high yield asset class, it can be seen that those at the bottom of the credit rating spectrum (and whose average yield over the last 10 years has been nearly double that of their more highly rated peers) suffered a drawdown nearly 20 percentage points worse than the less risky BBB/BB issues.

Finally, within emerging market debt, a thorough understanding of the risks posed by the nation’s debt also requires an intricate understanding of its currency markets. In many cases the volatility of an emerging economy’s exchange rate will far outweigh that of its bond market and so expose investors to risks that extend beyond a country’s ability to service its debts. It is therefore important to consider such investments on a currency hedged basis when comparing their relative valuations and to analyse their currency separately.

Avoid unnecessary diversification

By applying a bottom-up approach across the portfolio, investors gain a further advantage: the avoidance of “diworsification”. This is the situation in which investments are made in the hope of diversification but actually have the effect of doing little if anything to reduce overall risk and instead merely increase trading costs and erode the portfolio manager’s knowledge of and conviction in their investments.

Conclusion

Consistently applying a defensive orientated bottom-up approach to security selection, we believe, can help produce portfolios with structural integrity that are better equipped to handle episodes of market weakness. This requires an intense focus on bottom-up analysis and the consideration of positions on a holistic basis, rather than in isolation. By reducing the impact of drawdowns, investors are able to improve the probability of meeting their goals over the long run.

This communication is for institutional investors and financial advisors only. This communication is provided for general information only. It is not an invitation to make an investment nor does it constitute an offer for sale. The full documentation that should be considered before making an investment, including the Prospectus and Key Investor Information Documents, which set out the fund specific risks, is available from Investec Asset Management.

More Related Content...

|

|

|