Implementation shortfall – iceberg warning, or storm in a teacup?

Written By:

|

Steve Webster |

Steve Webster of MJ Hudson Allenbridge looks at implementation shortfall and what is needed when choosing a transition manager

I saw my first “iceberg” in 1998. Working for ITG Group in London, we were selling the concept of hidden trading costs and risks to asset owners at the launch of Europe’s first ever equity crossing network. It didn’t take long for the client to understand that the majority of their market expenses were hidden, or implied within the executed price. Crossing allowed investors to, for the first time, buy and sell directly from each other without giving away their intentions. The iceberg, as it was known, helped illustrate where these below-the-waterline expenses were accruing, and was quickly adopted by transition managers in their explanation of Implementation Shortfall (IS).

Today IS has become a catch-all measure of transition expense, having first been conceptualised by Andre Perold back in 1988. IS is simply as Andre Perold penned it, “Paper versus reality”, or to put it in a transition context, the difference between the returns of what you own versus the returns of what you want, over the time of the transition. The elegance of this measure is that it captures all the expense both implicit and explicit, but be wary of assuming that, on its own, it defines success or failure.

So, to the question, is IS an important warning of costs and risks, or is it irrelevant in the grand scheme of investing? The transition cost of changing investment exposures, versus the total performance of an investment during its life cycle is likely to be very small, given say a five-year time horizon. But let’s remember that IS is a paper (portfolio) versus reality benchmark, so how relevant are transition costs when you consider their impact to benchmark out-performance of an investment over the same time horizon. In this context things change a bit.

Let’s consider a change of active global equities, which nets an out-performance of 1.3% annualised for five years. A transition realising 50bps implementation shortfall, would impact the total period out-performance by some 10%.

But all this talk of missed performance is actually, well, the tip of the iceberg. The purpose of IS was originally to frame both expense and risk/opportunity cost. From the point at which a transition is benchmarked, risk between the current portfolio and the target investment will vary the outcome subject to any hedging implemented. Although market risk should average out over time, transitions tend to have a natural negative skew, given the propensity to buy popular high performing/high value investments and sell the opposite. Clearly the longer the period IS is measured, the higher the possible risks and variance of potential outcomes. The majority of decisions to change investments often occur months before any action is taken. If IS was used to estimate the risks related to a transition event from the point of this investment decision, most asset owners would find the resulting investment exposure risks unacceptable. It would be even more unpalatable if the decision to change was influenced by widely shared consensus or recommendations, leaving those late to act susceptible to a further negative skew in the market.

So what does IS tell us about the performance of those who use it to measure transition management events? A typical transition will be benchmarked from the last price available prior to any execution commencing. Using a benchmark in this way is designed to ensure the transition activity doesn’t influence the benchmark price and thus performance. This concept is nothing to do with IS, but related directly to the T-Charter, which is a guide to best practice, collectively agreed between transition managers over 10 years ago. Today whilst the broad scope of this charter is still followed, some have strayed from the original benchmarking principles.

IS, as both a measure and a discipline, is important in ensuring the transition solution proposed is focused on finding the optimal balance between reducing exposure risk and paying outright costs. But if the resulting IS in a transition event is close to what was estimated, does this imply a job well done? Well unfortunately, it may not. What matters are the component parts of the IS versus the estimate. As an example, a transition result may be impacted by poor trading, which is disguised by the market moving in favour of the transition event. Indeed, such a transition result may in fact be demonstrating poor risk management and poor execution, or as we like to say, more luck than judgement.

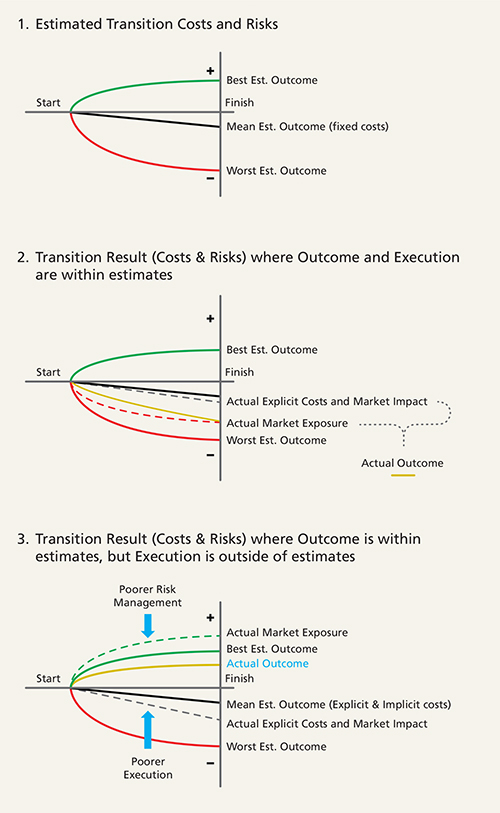

Figures 1, 2 and 3 show:

1. A typical estimate of costs and risks

2. The estimate verses result, where Outcome and Execution are within estimated boundaries

3. The same result, but where Outcome is within estimated boundaries, but Execution less so

The example above is for illustrative purposes only and is presented in such a way as to demonstrate that an overall positive (positive returns) implementation shortfall can include negative (higher cost) market impact.

At this point I hear an exhausted client, saying, “Well, does it really matter; result met estimate”. True, where an estimated outcome is delivered through successful implementation then there is nothing further to see. But, as we see from the example to the right, if the risk had been controlled as estimated, the transition would not have been as exposed to improving market conditions and the poorer execution realised could have resulted in greater net losses. The obvious conclusion is that selection of an investment or transition manager should always be based on skill and not luck. An investment manager typically has nowhere to hide as luck is only ever temporary and long-term out-performance can only ever reflect skill. But a clients’ experience of a transition manager is sporadic and where selection is based on a wide range of IS results, something could be missing from this picture.

Determining between luck and judgement requires more than a comparison of previous performance, it also requires an understanding of the way a provider operates, their capabilities and capacity and how solutions are delivered. Much of this is managed via a thorough due diligence assessment which will not be dissimilar to that typically required for an investment manager appointment. From this assessment, a client may appoint a panel of providers from which to select at short notice. However, like any assessment, due diligence of a provider or product will have a limited shelf life. Over time, the capability, people and reputation of a provider will likely change, which can’t be readily assessed by simply comparing cost estimates.

So, in conclusion, selection of a transition manager requires a relevant qualitative and quantitative understanding of what’s on offer. It’s fine to make a selection based on a quantitative estimate, so long as this is supported by qualitative evidence.

More Related Content...

|

|

|