How pension funds can use real assets to achieve an income

Written By:

|

Andrew Swan |

Andrew Swan of M&G Investments says that real assets, which offer inflation-linked, secure income streams, are proving attractive alternatives to long-term investors

Real assets come in a number of guises and have various attributes that long-term, income-seeking investors can benefit from. They are assets that have a physical existence and an investable value encapsulating real estate, infrastructure, land and forestry, plus agricultural and other commodities. The most popular for investors seeking income are usually real estate and infrastructure.

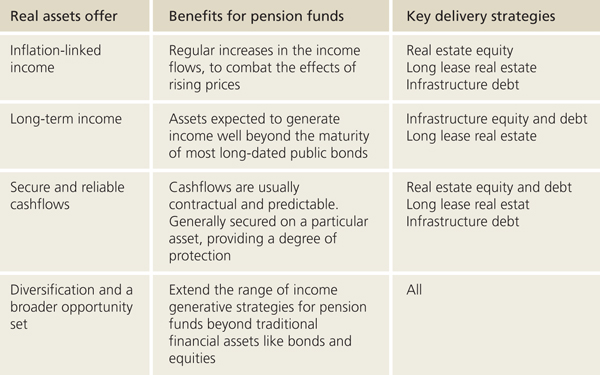

While most pension funds may have similar broad objectives they will also have their own specific requirements. The different approaches to real asset investing offer different benefits to investors, as Figure 1 below summarises.

Figure 1: Investor benefits from different approaches to real asset investing

Source: M&G Investments

Real estate ownership: In the UK market, rents can deliver regular, contractual income levels in excess of 4% p.a.1 Rents are typically received quarterly and paid to investors through quarterly or semi-annual distributions, if investing is through a real estate fund. Periodic rent reviews should provide the income stream with some protection against inflation. The income levels that are actually achievable will depend on various factors, such as the property type and location, the facilities it offers and the credit quality of the tenant.

Taking a pooled fund approach to investing in real estate can be efficient for pension schemes. Funds can achieve good diversification across industry sectors, tenants and geographies, which may be more difficult through direct ownership of individual properties. An alternative approach would be to hold stock in a listed real estate investment trust (REIT) and receive dividends. These property ownership approaches also provide scope for investors to benefit from capital appreciation of the underlying assets.

Long lease real estate: This approach can have three principal forms. A secured property income strategy, or sale and leaseback, focuses on achieving secured income from long-term leases to high-quality tenants, with rents subject to contractual uplifts, either at a fixed rate or linked to inflation. Historically, income achieved has significantly exceeded the yields on long-term UK government and corporate bonds. Security of income is the strategy’s primary consideration and rental income is typically the main driver of returns. In recent years, income yields have been in excess of 4% p.a.1

A secured lease income strategy, or income strip structure, has a profile similar to a repayment mortgage. Here the value is represented by the inflation-linked income it delivers since, at the end of the agreement, often contracted for over 40 years, the tenant has the option to buy back the freehold for a nominal sum. Pension funds can appreciate the clarity of income strips since all the cashflows can be anticipated and valued, to form part of a liability-matching strategy. Long-term returns of 1.5-2.5% p.a. above RPI (retail inflation) are possible.1

Ground rents offer pension funds another way to generate predictable, inflation-linked income secured by a real asset, with even longer-term cashflows, to help match the duration of their liabilities. With leases often over 100 years, to either commercial or residential tenants, cashflows constitute the majority of returns on each investment.

Real estate debt: Income can also be generated by investing in commercial real estate (CRE) debt. In this strategy, investors provide a loan to an owner of commercial property and receive regular coupons, similar to a bank providing an individual with a mortgage to buy a home. A key attraction of a CRE loan lies in the security that the underlying physical asset provides to the lender.

It typically has a shorter investment horizon, with three to five years being common. The income stream can be at either a fixed or a floating interest rate, with the actual rate being largely influenced by the seniority of the debt, the loan-to-value ratio and the credit rating of the loan. Unlike other real asset investments, the income stream is typically not linked to inflation but, given the shorter term of most deals, that may be less of a concern to investors.

In the European markets, where most debt is usually at a floating rate, a margin of 1.5-2.5% above a short-term reference rate (e.g. LIBOR or EURIBOR) is common for senior CRE debt.1 Margins, and hence income and total returns, on junior or subordinated debt will be higher than for senior debt.

Using investments in infrastructure to deliver income

Utilities, transport networks, renewable energy projects and communications networks are all examples of investable economic infrastructure assets. Some physical buildings, particularly those in the public sector such as social housing, hospitals, student accommodation and schools are considered as social infrastructure, though outside the public sector they can be closely related to real estate.

Some of the key features of infrastructure that appeal to pension funds include the expectation that income streams are usually stable and reliable, since assets typically provide services that are essential to the wider public. In most cases, the cashflows are linked in some way to inflation, either contractually or regulated, or simply through exposure to general economic drivers. Infrastructure assets are typically long lasting, so the cashflows they generate should be also.

Owning infrastructure: Pension funds, like most other investors, will normally achieve ownership participation in infrastructure through unlisted pooled fund vehicles. Income streams can originate from various sources. Those sources may be rents, access charges, fees or the receipt of subsidies, and income can be distributed, usually quarterly or semi-annually. The advent of pooling may make it easier for some local authority pension schemes to gain access to attractive infrastructure opportunities by increasing the scale of individual investments they can share participation in.

Brownfield opportunities (broadly, assets that are already in the operational stages of an asset’s lifecycle) can usually generate stable, long-term income, with target yield levels of 6-9% p.a. being typical.1 Returns from investing earlier in a project’s lifecycle, at the greenfield stage, where design planning, and construction are still being undertaken, may be as much as 15% p.a. The greater return potential reflects the additional risks associated with the initial project stages, and there may also be a period of time before income begins to come on stream.

Infrastructure participation through lending: Investors can provide infrastructure project finance. These loans are likely to be arranged privately and will typically be illiquid compared to publicly-traded bonds. Loans against specific assets are usually well-protected from adverse events through strong covenants and security of shares in the borrower, the assets and key contracts.

Alternatively, pension funds can also gain income from infrastructure by buying the public corporate bonds of companies that are involved in infrastructure in some way (for example, electricity providers). Whatever form it takes, infrastructure debt will usually pay a regular income stream over the long term, which can be at a fixed rate (including index-linked) or a floating rate.

The margins currently available for high quality (investment grade) private market assets are about 1.5-2.5% p.a. over government bonds of equivalent maturity.1 Higher margins, of up to 8%, may be achievable for lower quality (sub-investment grade) assets, depending on the various risks associated with the deal such as credit, market or regulatory risks.

It’s clear that real assets present appealing alternatives to long-term investors looking to generate reliable and secure income streams with links to inflation.

For Investment Professionals only.

This article reflects M&G’s present opinions reflecting current market conditions. They are subject to change without notice and involve a number of assumptions which may not prove valid. Past performance is not a guide to future performance. The distribution of this guide does not constitute an offer or solicitation. It has been written for informational and educational purposes only and should not be considered as investment advice or as a recommendation of any particular security, strategy or investment product. Information given in this document has been obtained from, or based upon, sources believed by us to be reliable and accurate although M&G does not accept liability for the accuracy of the contents.

The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook.

M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at Laurence Pountney Hill, London EC4R 0HH. M&G Investment Management Limited is authorised and regulated by the Financial Conduct Authority.

1. Source: M&G Investments

More Related Content...

|

|

|