Globalisation still underway

Written By:

|

Kevin McCreadie |

As institutions become larger and more global, Kevin McCreadie of AGF Investments outlines how a deep understanding of global markets can benefit investors

The pension fund industry is becoming increasingly more global in nature. Although North American pension funds accounted for the largest slice of assets under management¹ in 2013 (41.4% of the US$14.9 trillion global market) other international pension fund assets such as those in China, South Korea, and Singapore are growing at double-digit rates, far ahead of the 6% growth seen in the US.² This is not surprising as populations in many countries are expanding at a far more rapid pace and often have higher savings rates compared to developed nations such as Canada or the United States.

Demographic profiles across countries also differ widely, and those with faster-aging populations are either planning or implementing much-needed pension plan reform. As reforms in countries such as India and China take hold, increased liberalisation of these markets should support further globalisation of investments as well as the promotion of deeper and more liquid financial markets.

Globalisation of pensions

Globalisation of pensions has been developing over the last number of years. For example, in 2013, the majority of the top 300 global pension funds were non-US institutions, and they are gaining ground. Since 2009, 12 new non-US entrants have displaced US pension funds in the top 300, for a total of 174 non-US pension funds. Additionally, eight of the top 10 pension funds in terms of total assets were domiciled outside of the United States.1 These non-US plan sponsors tend to invest more outside their home markets in order to access additional opportunities.

However, in the UK, home country bias remains strong as pension schemes still maintain a material overweight to UK-based equities. This home bias is true for other markets as well, including the United States, Australia, and Canada. As the investment landscape becomes more global in nature, institutions will need to increase their international allocations or potentially miss out on opportunities.

For plan sponsors, this inherent home bias is due to a number of reasons, including an adherence to the status quo, currency mismatches between plan assets and liabilities, and tax considerations. Over time, as globalisation continues, these institutions will increasingly realise the significant benefits of investing outside their home country. These benefits include a superior opportunity set, enhanced diversification benefits, better sector and security representation, and greater depth and liquidity.

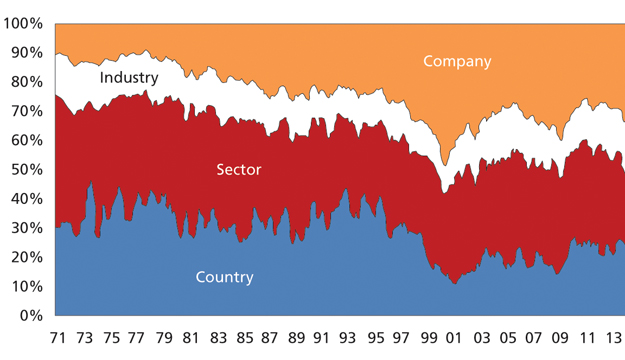

Figure 1: Importance of country, sector and industry in explaining company returns. Through end-December, 2013

Source: AllianceBernstein, September 30, 2014

Market inefficiencies

Asset managers face many challenges investing globally, such as differing accounting treatments, inflation rates, and political environments. At AGF, we believe inefficiencies, such as investor home-country bias, can result in periods of over- or under-valuationas well as mispricing, creating opportunities for global investors. Further, we believe that an important driver of returns in a global portfolio is country allocation. As shown in Figure 1, when attributing performance for the MSCI ACWI, country allocation explained approximately 34% of the variance in returns, on average, from December 31, 1970, to December 31, 1998, before the adoption of the euro. This declined to an average of about 20% of returns to the end of December 31, 2013.2 Even though the importance of country allocation has experienced a modest decline since the Eurozone region’s adoption of a common currency, it is important to note that country allocation still explained a significant 25% of the variance in returns at the end of December 2013.

The secular trend of global investing is likely to continue as institutions become larger and more global, thereby increasing the need for diversification and liquidity. An increased allocation to global equities is a trend that is likely to persist as investors continue to diversify away from their home markets. In order to meet pension requirements and access the breadth and depth of global equity opportunities, plan sponsors must look to asset managers who have strong in-house global research capabilities and disciplined, consistent, and time-tested investment processes and philosophies.

1. Towers Watson, Pension & Investments / Towers Watson 300 analysis of the world’s largest pension funds

2. Based on rolling 12 month average returns

More Related Content...

|

|

|