Forging new ground

Written By:

|

Catherine Darlington |

|

James Sparshott |

Catherine Darlington and James Sparshott of Legal & General suggest strategies for successful transition management during the pooling process

It continues to be a busy time for the Local Government Pension Scheme (LGPS). The project of pooling has moved beyond the initiation phase and is well into the planning and implementation phase. As each pool formalises its appointments and the structure is finalised, attention is focused on how assets will move into the new structures.

Pools and their member funds are increasingly engaging with transition managers on both an exploratory and implementation basis, and the National LGPS Framework for Transition Management is now in place. Each pool and its partner funds are likely to use transition management through a series of engagements as the pooling implementation progresses.

We recognise that the circumstances for each pool will be unique depending on its individual requirements. Regardless of the exact nature of the pool structures, one thing they will each have in common is that they will be creating new processes, new structures and new teams as assets are consolidated into the pool.

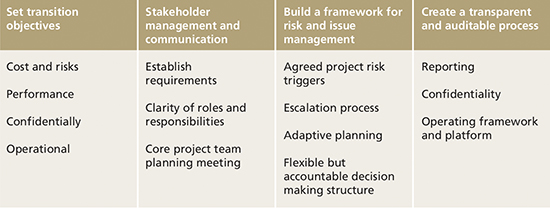

To help ensure the success of the implementation stages, stakeholders may wish to work with their transition partners on a robust project management framework, giving consideration to four key areas, as shown in Figure 1.

Figure 1: Key stages in drawing up a transition management framework

Source: LGIM

Set transition objectives

The collective objective of realising savings and enhancing the value of assets delivered to the pools can be translated into some key collective transition objectives:

- Implementing change in a measured fashion

- Protecting value for the member funds whilst retaining some elements of flexibility

- Seeking to reduce the risks and costs that the pool and its member funds are exposed to when implementing these changes

- Ensuring that the process is transparent and auditable without compromising the commercially sensitive nature of the transactions

- Aiming to reduce market distortion and protecting confidentiality

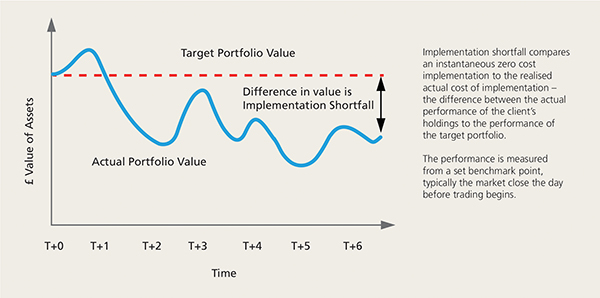

Furthermore, appropriate performance metrics will need to be defined and agreed. Typically transition management uses implementation shortfall (Figure 2) but in some instances, for example selling down a run-off portfolio, other alternatives may be more appropriate (such as a trading VWAP benchmark). It is critical that your transition manager provides clear, transparent and auditable performance reporting.

Figure 2: Performance metrics: understanding implementation shortfall

Source: LGIM

Stakeholder management and communication

Each transition management event can display different levels of investment and operational risk. A successful transition plan will address both components of risk.

A critical aspect to ensuring these risks are fully understood and appropriately captured in the transition plan is a robust framework for stakeholder engagement. The framework should include systematic identification, analysis and planning of actions, with clarity over the roles and responsibilities of all stakeholders.

Given the number of inter-dependencies across the work streams for the implementation of pooling, it will be necessary to have clear go/no-go criteria for various milestones.

Build a framework for risk and issue management

As with all aspects of pooling, having a strong governance framework in place will be an important part of the transition journey. Every project has risks, they cannot be totally avoided but they can be managed. The tools, such as an issues and risks log, that are being used across the pooling work streams can be leveraged for transition management.

Clear, accountable decision and communication channels are important. It would be prudent to have agreed escalation triggers and processes in place. This could involve a working group, identified points of reference and oversight with escalation processes that will enable transition managers to be responsive to evolving information or changing environments. The implementation of these changes is unlikely to be a static process. Therefore designing in some flexibility to the process and timing may be beneficial.

Create a transparent and auditable process

Critically, funds are not proposing dramatic changes to their overall asset allocation through this process. The order in which asset classes and managers move into the new structures will therefore ultimately be driven by each pool’s collective objectives and priorities, and the required operational process and infrastructure.

Transparency and auditability of process and cost will be an essential governance consideration. Working with your transition partners, advisors and stakeholders to establish a robust framework as you go through implementation will help reinforce the achievement of set objectives.

In summary

The LGPS is forging new ground; the project of pooling is creating new processes, in new structures, with new teams. At its core, this activity is a significant asset management exercise and there is a lot of project management involved. Working with a transition manager with a depth of project management expertise can not only help in the planning and implementation but also lift the operational burden from the pool – which have a wealth of demands on their resources.

Important Notice

Derivatives may have greater volatility than the securities or markets they relate to. A change in value of a derivative may not correlate to a change in value of the underlying instruments. This may result in losses greater than the direct investment in those securities or markets.

The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested.

The Information in this document (a) is for information purposes only and we are not soliciting any action based on it, and (b) is not a recommendation to buy or sell securities or pursue a particular investment strategy; and (c) is not legal, regulatory or tax advice. Any trading or investment decisions taken by you should be based on your own analysis and judgment (and/or that of your professional advisors) and not in reliance on us or the Information.

Issued by Legal & General Investment Management Limited which is authorised and regulated by the Financial Conduct Authority. Legal & General Investment Management Limited, One Coleman Street, London EC2R 5AA.

1. VWAP is the Volume Weighted Average Price. It is the ratio of the value traded to total volume traded over a particular time horizon

More Related Content...

|

|

|