Fixed income is no longer exempt from the digital age

Written By:

|

John Taylor |

John Taylor from AllianceBernstein looks at the new digital tools, artificial intelligence and digital platforms which are helping investment teams to become smarter and faster

Technology is finally catching up with the enormous changes that have taken place in fixed income markets since the global financial crisis. New digital tools are helping bond managers take advantage of increasingly scarce pockets of liquidity, break down information silos and find new investment opportunities.

Institutional investors will benefit in many ways as their asset managers gain the capability to make faster, smarter investment decisions. The right technologies will help managers find the opportunities others miss, get their best ideas to market faster and spend more time on high-level strategy questions.

The liquidity challenge

Liquidity has risen to the top of the list of challenges facing fixed income investors. Stricter capital requirements and bans on proprietary trading passed in the wake of the global financial crisis have discouraged broker-dealers from holding illiquid assets, such as credit, high-yield bonds and emerging-market debt.

With fewer banks and other market makers willing to take the other side of a trade, asset managers have a harder time than they once did buying and selling large blocks of bonds quickly and efficiently. Traders must monitor dozens of trading venues to find opportunities. And since pockets of liquidity can open and close very quickly, it’s easy for traders paying divided attention to miss them.

Cobbling together an order of sufficient size can also be a time-consuming process when liquidity exists in drops instead of lakes. Asset prices can move dramatically while traders are trying to source willing buyers and sellers, and not always in an investor’s favour.

Software that aggregates pockets of existing market data into a single user interface helps investment teams get an overview of which bonds are available and at what price. Being able to survey the market at a glance makes it less likely that traders will miss opportunities to execute the trades their clients need at a desirable price.

Breaking down information silos

Traders aren’t the only ones benefiting from digitalised, centralised information. Digital platforms help portfolio managers and analysts disseminate among their peers their fundamental views on particular credits.

In the analogue world that existed until very recently, portfolio managers and analysts might go back and forth on the merits of buying or selling certain bonds for hours or even days before making an investment decision. By that point, the price might have moved in an undesirable direction, particularly during times of market stress.

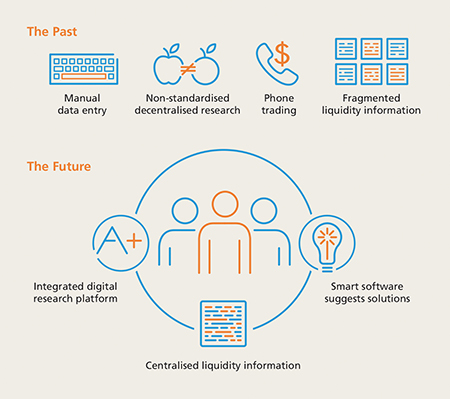

The solution? Scoring bonds across a number of dimensions using a standard, numerical scale and making those scores available on a centralised digital platform. Standardised scoring makes it easier for members of an investment team to compare and contrast bonds in different industries and regions, while centralising the information can eliminate some of the time-consuming preliminary discussions about particular credits.

Encoding sustainability into investment decisions

A standardised scoring mechanism can help firms integrate environmental, social and governance (ESG) considerations into their investment processes. Just as analysts can score credits on various financial measures, they can also rank them on their ESG practices. By incorporating this data into a credit’s overall score, fixed income teams automatically factor sustainability into every investment decision.

There’s good reason to use digital platforms to share ESG information among, as well as within, asset classes. For one thing, such information can benefit many different kinds of investors. Companies that ignore their obligations to the environment, their workers, their customers and their shareholders risk scandal and worse. That can affect shareholders just as much as bondholders.

Yet, firms don’t have to publish comprehensive, detailed ESG information in the same way they must regularly disclose their financial performance. That leaves professional investors to learn from engagement with executives, outside groups and other proprietary channels. When investment teams share insights from those meetings, their peers gain the opportunity to learn from a trustworthy source – his or her co-worker.

Figure 1: Going digital – bringing fixed income into the 21st century

Source: AB

Smart machines make investment teams faster and smarter

New digital platforms are certainly helpful today, but they may be even more helpful tomorrow. Software can easily read numerical information, like credit scores, and machines are getting increasingly skilled at interpreting natural language. Soon, investment teams may be using machine learning and artificial intelligence (AI) to trawl a firm’s entire digital library to come up with insights humans might never have put together.

Already, bond managers are using virtual assistants to automate tedious, mundane tasks, such as building trade orders. But, as these assistants get more intelligent, they will be able to do even more. Already, some fixed income investment AIs can whittle the thousands of bonds in circulation down to a few that meet specific parameters that investment teams specify.

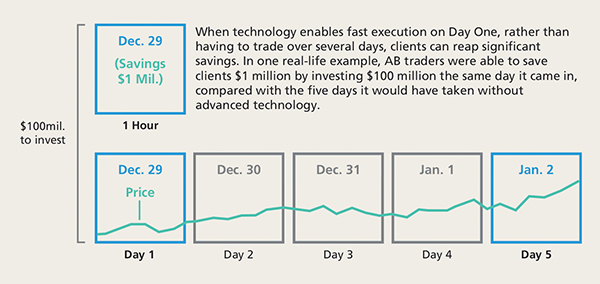

Institutional investors will save precious time, and likely money, as their managers adopt these tools. For example, an institutional investor with US$500 million to invest in a credit portfolio would need to purchase between 100 and 200 bonds. In a traditional investment process, portfolio managers and analysts would spend several hours or even days discussing which bonds to buy, while traders would have to make dozens of phone calls to check the availability of potential investments. Using digital tools that communicate with one another, the US$500 million could all be invested in a single day – reducing the odds of a major price move.

Figure 2: Putting US$100 million into the market – five days versus an hour

Past performance is no guarantee of future returns.

Source: AB

Freed from debating fundamental research into the ground or typing in trade orders by hand, skilled bond managers can spend their time on activities that create far more value – activities only humans can do. Those include looking for unique or proprietary sources of data, interviewing management teams and other stakeholders, testing novel hypotheses and discussing strategy with clients.

In the future, AIs will learn to proactively monitor markets and suggest opportunities on their own. Since software doesn’t have to sleep, eat or answer emails, the chances of missing a trade that suddenly becomes available drops dramatically. And since they can ingest and analyse oceans of data in less than a second, smart machines may very well start to see opportunities and patterns that humans cannot. Human decision-makers will always set strategy and make final investment decisions, but machines will unquestionably become a valuable complement to human investment teams sooner rather than later.

The analogue days are over: technology is part of the investment strategy.

More Related Content...

|

|

|