Finding value in credit markets

Written By:

|

David Lloyd |

David Lloyd of M&G Investments recommends a less “siloed” approach to securities, which should provide a clearer view of potential risks

Debt markets are the world’s largest pools of capital by a considerable margin, with a scale and diversity of issuers and securities that can present a bewildering array of choices to the pension funds and other institutional investors that invest in them.

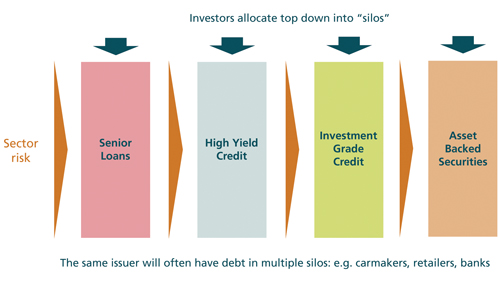

In response, participants usually segment the market into more manageable compartments – for example, investment grade bonds, leveraged loans and asset-backed securities.

These partitions encourage “silo thinking” – the tendency to view each segment in isolation. That can be unhelpful in fixed income, since investors tend to look only at assets that fall strictly within their parameters, leaving others ignored on the sidelines.

Assigning capital to a range of asset “buckets” like these intuitively makes sense, providing investors with a straightforward means to pursue the returns they target. But they are not always a perfect fit with the full range of securities debt markets contain – or the real-world activity the debt finance supports.

Companies raise funds across the various parts of the debt market, choosing, for each debt raising, that area of the market where terms are most favourable. But many investors do not mirror this flexibility, barring themselves from finding the best return for a given level of risk.

This is a clear inefficiency – decisions made, or avoided, for non-economic reasons. And where capital is allocated – or not allocated – for non-economic reasons there will always be opportunities to exploit the resulting “arbitrage”.

Take the example of company “A”. A large, well-established telecoms operator, it has an investment-grade credit rating, and its bonds have a home in many pension scheme portfolios. To investors who look only at other investment grade debt issuers, company A is a solid credit and benefits from having no major competitors that they can see.

Only an investor who analysed the world outside investment grade debt would notice that company “B”, a smaller and more agile rival with bonds that carry a high yield (sub-investment grade) rating, is aggressively pursuing company A’s customer base and poses an existential threat to its business.

Risk respects no boundaries; it overlaps asset class and other distinctions. Company A is not protected from this real-world threat by its investment-grade status. So Company A’s lenders should also look beyond that label to fully assess the real world challenges it faces.

As value investors, we find a broader, less siloed approach can provide a better view of the real risks to which an issuer is exposed. By looking through and beyond such compartments, we find many opportunities to select securities that are overlooked or unloved, and so are worth more than their current price.

Beyond the barriers

Investors deprived of a full view of debt market activity may find their approach is masking or misrepresenting the underlying risks being taken. The effect of these underlying risks is visible in the correlation between credit asset classes. Two assets may occupy different “buckets” in a typical pension fund portfolio – bonds and loans, for instance – but they typically move closely in tandem, particularly in times of stress.

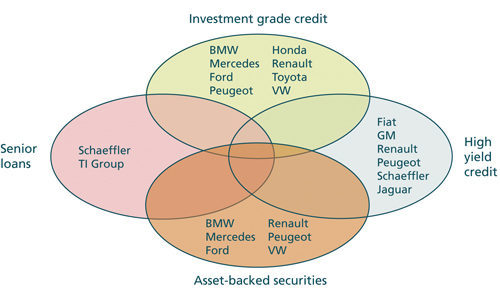

This is primarily because unlike equity, one company can issue debt in a myriad of structures in many different credit markets. These could be a secured loan, an unsecured bond, an asset-backed security created by securitising the issuer’s properties or even a “sale and operating lease” deal that replaces real estate ownership with a long-term lease; and all are exposed to the same sector, geographies and competitive pressures. Investors often therefore hold correlated assets.

Figure 1: Investors tend to allocate by silo

Source: M&G, illustrative

In our view, a more effective way to approach markets is by viewing them as a spectrum or terrain. Removing the partitions can allow investors to view asset classes as homogeneous rather than distinct from one another, and look through to the underlying risks, to assess them in a common framework that looks a little like Figure 2.

Figure 2: A homogeneous view of asset classes

Source: M&G, Bloomberg, Credit Suisse, as at 31 December 2014

Where risks overlap, an investor should be alert to the effect it can have on a portfolio.

A world without silos

Looking through fixed income silos and selecting assets based on their underlying risk exposures rather than the demands of asset allocation can have positive effects. This requires a more flexible investment style, to involve fewer boundaries or dividing lines. We believe that looking between and across boundaries, at as full a range of opportunities as possible, offers two main sources of investment opportunity.

Firstly, it can allow investors to acquire assets that are priced attractively because they do not fit neatly within the limits of a typical mandate, such as one restricted to a certain currency or set of credit ratings. Assets that are ignored or excluded from mainstream demand can end up mispriced, offering a higher return for their level of risk than others of comparable quality.

An example of this is the gulf between investment grade and high yield (sub-investment grade) credit. When a high yield debt issuer is upgraded to investment grade its bonds typically experience a favourable repricing due to the much larger investor base suddenly able to buy it. This is a coveted result for both the company and its existing bondholders, who see their investment rise in value.

An investor can take advantage of this trend by seeking out high yield issuers with strong enough credit quality to likely become investment grade. It requires rigorous analysis of a wide range of companies to understand which offer an attractive return for their credit risk, and the patience to wait for the misalignment between the price and risk level to correct.

Secondly, investors able to identify the common risks underlying assets in different silos can select those that offer greatest value for that risk. High yield bonds and leveraged loans, for instance, both offer similar underlying credit risk; indeed, the same companies often issue both instruments. Yet bonds and loans have different liquidity, seniority, covenant protection and recovery rates, so the relative pricing of the two asset classes can change quite significantly over time. An investor who can consider both is able to select a company’s loans or bonds depending on which offered the higher return at a given time.

Welcome flexibility

Debt markets throw up many opportunities like these. Some are found by looking across asset classes; others are found because they do not fit neatly into one compartment or another. Still others are found in niches where risk might be misunderstood, investors may have to give up liquidity, or where extra work is required.

True multi-asset (or mixed asset) credit strategies managed with a value focus are designed to capture just this kind of investment opportunity, in public or private markets (or a combination of the two). These have flexible parameters that enable investors to consider a broad range of fixed income assets, typically including government and corporate bonds, loans, asset-backed securities and other structured credit.

Innovative managers are even able to spot investment opportunities in gaps between silos such as fixed income and property. These can unlock value from their complexity through hard work and expertise, to ultimately provide institutional investors with the sort of secure, long term returns that can match liabilities.

This approach is resource-intensive, in order to cover a broader range of investment opportunities than those offered by any one asset class, and to assess the value offered by credits in niches where few other investors may look. In the case of the telecoms companies in our earlier example, that can mean potentially selecting company B’s bonds rather than those of company A; or waiting until company A’s bonds are priced at a level that reflects their true risk. Looking at the full spectrum of opportunities in this way and taking risk only where it is fully compensated offer investors a simple, yet repeatable source of attractive returns over the long term.

More Related Content...

|

|

|