Finding attractive opportunities in distressed investments

Written By:

|

Marianna Fassinotti |

Marianna Fassinotti of Siguler Guff looks at opportunities for pension funds in distressed asset investing

For the first time in three decades, investors are entering a truly unfamiliar environment for investing: stocks and bonds are expensive and interest rates are about to start climbing from historic lows, threatening the value of fixed-income portfolios. For investors with fixed liabilities, delivering the necessary investment returns has become more challenging.

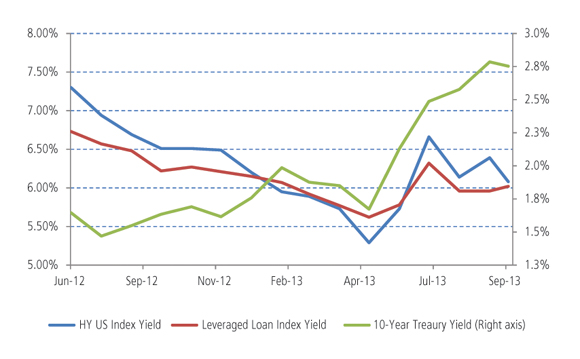

In 2013, US equities, as measured by the S&P 500 Index, have been up over 19%.1 Since the depths of the global financial crisis in March 2009, US equities are up over 150%.2 At the same time, yields of leveraged loans and high-yield bonds hover at all-time lows of 6.02% and 6.08%, respectively,3 see Figure 1 below.

Figure 1: Contrasting yields

Source: Bloomberg 23 September 2013: Past performance is not a guide to future performances

This spectacular equity market performance has been underpinned by the exceptionally accommodative interest-rate policies of central banks. However, global markets now face the prospect of a tighter monetary policy as the US Federal Reserve (Fed) begins to unwind its quantitative easing (QE) programme. On June 19, 2013, Ben Bernanke, Fed chairman, announced the bank’s intention to taper asset purchases, namely those of US Treasuries and agency mortgage-backed securities. Since then, interest rates have begun climbing. On September 18, 2013, the Fed surprised market participants by delaying the start of any tapering activity. However, the announcement only postpones the curtailment of asset purchases.

Despite a small rally following Bernanke’s announcement that policymakers would wait for more evidence of sustained growth before tapering bond purchases, the yields of the 10-year and 30-year Treasury notes are still 94 basis points (bp) and 78 bp above where they started the year, respectively.4

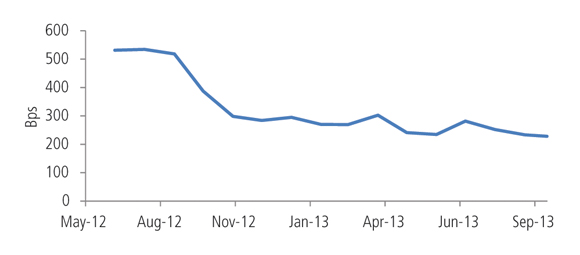

In Europe, the story is not too dissimilar. In 2013, European equities, as measured by the EURO Stoxx 50, the leading blue-chip index for the Eurozone, are up 10.3%.5 In the UK, equities, as measured by the FTSE 100 Index, are up 11.2%.6 On the fixed income side, yields sit at historic lows. For corporate debt, the capital markets are also robust. Even the PIIGS are getting fat: among sovereign issuances, the yield premium of Spanish over German 10-year bonds has halved in the past 12 months, see Figure 2.

Figure 2: Yield premium of Spanish over German 5-year bonds,bps

Source: Bloomberg 23 September 2013

The PIIGS grouping – Portugal, Italy, Ireland, Greece and Spain – refers to five Eurozone countries left with weakened economies following the financial crisis. All in all, not the stuff of a continent mired in a recession, with average unemployment rates hovering in the low teens and the tally in the most afflicted (Greece) approaching 30%.7

The tidal wave of massively accommodative monetary policy following the global financial crisis has depressed “risk-free” yields. The investor imperative to find yield – in both the equity and fixed-income markets – has dampened the risk premium to those “risk-free” yields, leaving investors with historically low absolute return expectations and expectations that are probably even worse relative to historical norms on a risk-adjusted basis.

So, on top of concerns about generating returns, investors need to worry about interest-rate risk and portfolio duration. It’s not just, “How do we get there from here?” but “Where are we really now?”

The possibilities for allocating capital

There is a temptation to observe today’s resurgent equity market, all-time low corporate bond yields and a benign environment for corporate defaults, and conclude that the financial crisis has passed. Siguler Guff believes that the investing environment has been manufactured and that market participants, confronted with rock-bottom risk-free rates, have been encouraged to chase returns without proper regard to risk. It is against such a backdrop that Siguler Guff expects to take advantage of mispriced opportunities across a broad base of asset classes and sectors.

The brief of Siguler Guff is not simply to hunt for yield but for attractive risk-adjusted yield*. In this market environment, distressed opportunistic investments offer a compelling alternative for investors. An opportunistic strategy that goes beyond the traditional asset allocation model of fixed income and equities, and takes advantage of both technical and fundamental dislocations stands to deliver not only higher returns but higher quality returns. Given the macroeconomic fissures, valuations, and interest-rate risk in conventional assets, Siguler Guff believes many conventional investors are taking the risk of investing in distressed assets without adequate compensation. Siguler Guff sees healthy returns and lower risk in unconventional niches – returns that can be unlocked by investors with a mandate to investigate and invest more broadly. Today, Siguler Guff finds areas, such as European non-performing loans, US and European distressed commercial real estate, private equity secondary portfolios and global shipping, attractive.

Siguler Guff has a long history of managing distressed opportunistic strategies. The objective of Siguler Guff’s Distressed Opportunities Funds is to generate top-tier, risk-adjusted performance for investors through a diversified portfolio of distressed and undervalued assets. Through deep fundamental research, Singuler Guff identifies market inefficiencies and seeks to exploit mispriced opportunities across a full range of corporate issuers and asset types that trade below their intrinsic value.

Today’s complex investment environment calls for a more careful and nuanced portfolio management. Siguler Guff believes that a passive asset allocation strategy will fail to deliver high absolute rates of return. The Siguler Guff Distressed Opportunities Funds, through an active and opportunistic approach, aims to deliver a broad-based and deep-value orientated portfolio that seeks to achieve high risk-adjusted returns.

* There can be no guarantee that targeted yields will be achieved.

1. Bloomberg. The S&P 500 Index is up 19.3% through the market close of 23 September 2013.

2. Bloomberg, Performance measured from 9 March 2009 to 23 September 2013.

3. JP Morgan, High Yield Daily Update. Data as of 19 September 2013.

4. Bloomberg. Yield differential calculated from 12/31/2012 to 9/23/2013.

5. Bloomberg. Market close as of 23 September 2013.

6. Bloomberg. Market close as of 23 September 2013.

7. Bloomberg. Market close as of 23 September 2013.

More Related Content...

|

|

|