Factor investing: smarter than beta

Written By:

|

Alexander Davey |

|

Stephen Tong |

The interest in factor-based investing has been a key driver in the popularity of smart beta strategies. Alexander Davey and Stephen Tong of HSBC Global Asset Management look at their key benefits

Factor investing is not entirely new. Like active investing, Smart beta strategies are based on a premise that markets are inherently inefficient and that it is possible to generate excess returns by taking a particular stance in relation to a stock or an area of the market.

While the traditional, market cap-based index weights adjust according to market prices, alternative weighting approaches enable a systematic rebalancing discipline to add value by taking advantage of excess volatility. By removing the link with price, alternative weighting strategies help protect investors from behavioural biases and “irrational exuberances” that can lead markets to over-react in valuation terms.

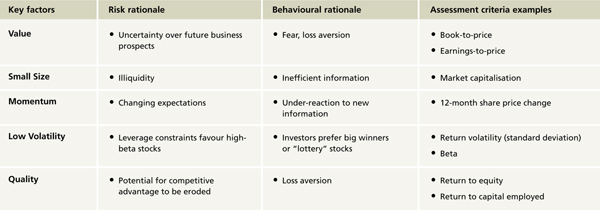

Alternative weighting strategies can be characterised in the context of factors. For example, equally-weighted indices would have larger exposure to smaller companies than their market cap peers, making them small size factor strategies. Similarly, low volatility strategies are based on the low volatility factor. Fundamental indexation – where stocks can be weighted by one or more fundamental criterion (e.g. value-added) – also focuses on a systematic rebalancing “factor” in an attempt to take advantage of excess volatility (Figure 1).

Figure 1: Key factors

Source: HSBC Global Asset Management. Illustrative purposes only.

The risks that pay off

Not all factors generate risk premiums that are persistent over meaningful periods of time. Among some of the factors with a consistent record of generating risk premiums are momentum, value, small cap, low volatility1 and quality. Interestingly, a bias to growth seems to lack consistency from the risk premium perspective.

In addition, there is little consensus on the criteria for creating exposure to a specific factor, nor is there a common portfolio construction methodology either for weighting or rebalancing. That would depend on a particular approach taken by a fund manager.

Constructing a multi-factor portfolio

Factors’ return cycles can encompass long periods of time, meaning that factor strategies’ periods of out- or under-performance against a market cap index can be substantial. In addition, while factors can have low correlations over the long term, more “basic” factors, such as value and momentum can be prone to far higher correlations, such as witnessed between 2006 and 2008.

It is possible to create single factors that are either uncorrelated or lowly correlated. This can bring diversification benefits to the portfolio, as when one factor experiences a period of underperformance, another factor may simultaneously outperform. While the link between factors may change over time, returns are generally uncorrelated, so it is unlikely that all factors outperform or underperform at the same time (Figure 2).

Figure 2: Factor correlations – Excess returns of HSBC Pure Factors relative to the MSCI World Index, from July 2001 to October 2015

Source: HSBC Global Asset Management, Quantitative Research – “Factor Investing: Pure and simple”, October 2015

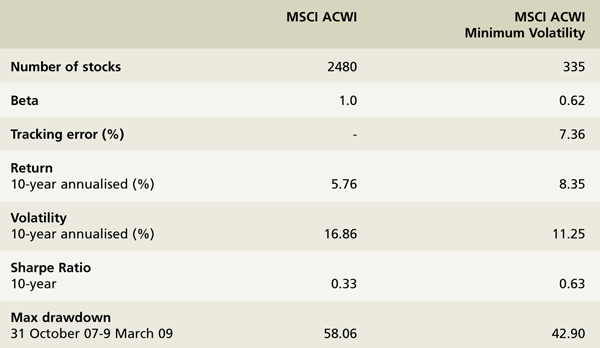

A low volatility case study

The low volatility anomaly was first documented academically by Haugen and Heins over forty years ago.2 They discovered that stocks with lower volatility can deliver better long-term returns than stocks with higher volatility (Figure 3).

Figure 3: Low volatility strategy delivered superior risk-adjusted returns

Source: MSCI, gross USD returns as of November 2015

With the global financial crisis still fresh in investors’ minds, the ability to avoid precipitous depreciation remains more important for many than a possibility of double-digit returns. Low volatility strategies can also offer valuable diversification benefits as they have a slightly negative correlation to quality and value, and a consistently low correlation to other factors. This means that a strategy based on a combination of low volatility, quality and value factors can have merit. Harnessing low volatility in combination with quality and value may reduce overall portfolio risk while maintaining return potential.

The way ahead

Factor strategies have attractive investment characteristics that will naturally drive adoption by asset owners. For asset managers, having conceptual clarity will be key in advancing beyond the current thinking, and in delivering even more robust factor strategies.

1. Low volatility is often referred to academically as an anomaly rather than a factor or risk premium, from a product perspective we address this in the paper as a factor

2. Haugen, R., Heins, A.J., On the Evidence Supporting the Existence of Risk Premiums in the Capital Market, 1972, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1783797

More Related Content...

|

|

|