Evolution of an asset class: secured credit

Written By:

|

Mark Fulwood |

A reduction in bank lending has contributed to new opportunities in credit. Mark Fulwood of Henderson tells us more

The challenges faced by the banking sector, particularly in Europe, and the opportunities being created for investors to broaden their fixed income portfolios has been a hot topic of discussion for some time. The principle asset classes include secured corporate loans, asset-backed securities (ABS), commercial property loans, infrastructure debt and secured high yield bonds.

Within Henderson we generically refer to these as “Secured Credit”. Whilst not all such opportunities will be secured against underlying assets, the majority will be, with investors benefiting from the type of security that would have previously been given to banks. Given that banks also tend to lend on a variable or floating rate basis, the majority of such opportunities pay interest at a variable rate (often linked to LIBOR) plus a spread. As market interest rates rise, so will the return on the investment.

The opportunities to invest in these markets may be either dedicated strategies focused on one area, such as commercial property loans or infrastructure debt, or those with broader mandates that are increasingly being referred to as Multi-Asset Credit or MAC funds. It should also be noted that many MAC funds may not exclusively focus on secured credit investment; for example, some may have the flexibility to invest in emerging market and convertible bonds, or take active currency and interest rate views.

Over the last several years, we have seen progressive bank recapitalisation and more stringent regulation of their activities, and we expect this to continue for some time. Recent analysis by Standard & Poor’s1 estimates that, in 2008, 69% of Eurozone corporate debt was provided by banks. By 2013 this had declined to 61% and they forecast it to fall to 55% by 2018. Other investors, such as pension funds and insurers, have been encouraged to step into the funding gap left by banks by a number of factors including:

- Regulatory and/or demographic forces encouraging allocations away from higher volatility asset classes such as equities, at a time when interest rates – and by implication fixed interest bond yields – are at historically low levels. Secured Credit strategies can deliver higher levels of income with moderate price volatility (similar to that of bonds), whilst also maintaining capital in a rising yield environment.

- Greater convergence between bond and loan financing markets, creating opportunities for investors to broaden portfolios and invest across the ratings spectrum and issuer capital structure.

- Improved understanding of the Secured Credit market, large parts of which following the global financial crisis had been viewed suspiciously and shunned due to a misconceived association with sub-prime US mortgage securities.

Secured Credit goes mainstream

We have already seen considerable activity in the various sub-sectors of the Secured Credit markets. In 2013, for example, European high yield (HY) markets saw record issuance of €90 billion and this is forecast to rise to €130 billion in 2014.2 A large number of companies that would previously have used bank loans for funding have turned to the bond market and as a result, we have seen an increasing number of first time HY issuers, a jump in the proportion of secured bonds and a material increase in floating rate issues.

In loans, the US market has seen substantial growth, with a surge in the popularity of loan mutual funds and exchange traded funds (ETFs). These vehicles have enabled US retail investors ready access to the asset class, adding $73 billion of flows in 2013 into a circa $800 billion secured loans market.3 In Europe, retail participation in the loans market continues to be restricted by UCITS regulations, with no obvious signs of change ahead. However, direct lending strategies by institutional investors have emerged, with estimates that 2013/14 will see €50 billion4 of new capacity available in real estate lending from non-bank institutions. A number of mid-market corporate direct lending funds have also launched, although institutional infrastructure debt has proved slower to develop, due to the time and complexity associated with each underlying project.

In ABS, securitisation issuance activity has been slowly rebuilding in Europe post the financial crisis, whilst in the US, ABS issuance has moved more quickly back to volumes similar to those seen in 2005. So far, Europe has been more constrained by uncertainties surrounding the regulatory environment as well as the cheap bank funding available from the European Central Bank (ECB) and the Bank of England (BoE), which reduces the need for banks to finance loans and mortgages through securitisation. Still, in Europe, there has been an increase in the types of assets being securitised, including the return of securities backed by corporate loans (collateralised loan obligations or “CLOs”) and commercial property. Increasingly, the ECB sees this as an important funding source for small and medium-sized enterprises (SMEs) within Europe.

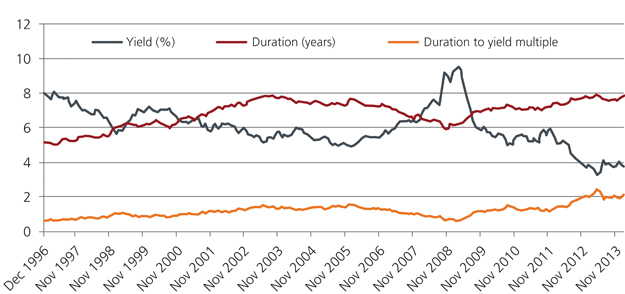

Figure 1. Interest rate risk embedded within corporate bonds

Source: Henderson Global Investors, Bloomberg, as at 30 April 2014. Data used is the BoA Merrill Lunch Sterling Corporate Index. Yield is to worst and duration is modified to worst

Whilst developed market interest rates and inflation remain low, increasing attention is being paid to the erosion of value that rising interest rates may eventually have on traditional fixed rate bond portfolios. Figure 1 highlights the interest rate risk that is embedded within a typical fixed rate bond portfolio. It can be seen that since 1996 as the yield on the portfolio has declined from around 8% to 4%, the interest rate duration sensitivity of the portfolio has increased from around five to eight years. Put simply, in 1996, market interest rates could have increased approximately 1.6% before the market value decline of the bond portfolio eroded a year’s worth of expected yield, today this would occur following a rise of around 0.5%.

In summary, Secured Credit can offer a number of attractive structural characteristics for investors:

- Floating rate coupons payable on many of the investments available, providing protection against the risk of rising interest rates and the impact this would have on the portfolio.

- Security, providing a priority claim on asset and cash flows and ability to direct any recovery or workout following default, thereby helping to mitigate capital losses.

- Illiquidity premiums that a long-term investor can capture and a range of strategies available with differing investment horizons/holding periods.

- Risk diversification benefits for portfolios, whilst noting the potential for higher correlation of price falls during periods of extreme stress/risk aversion.

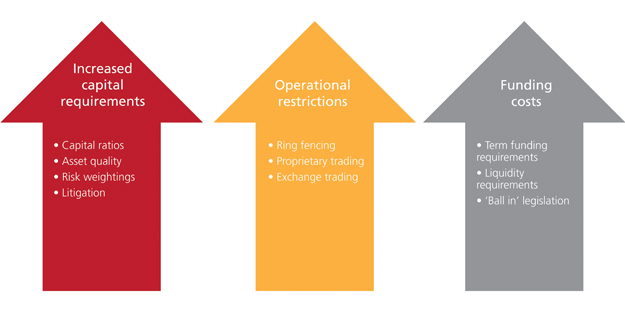

Figure 2. Banks under pressure from multiple forces

Source: Henderson Global Investors

A tactical or a structural opportunity?

Whilst banks have been significant beneficiaries of the unorthodox monetary policy measures of recent years through liquidity provision, higher net interest margins and consequently greater retained profits, we believe there remains a long-term political and regulatory desire for the further de-risking of banks. Figure 2 summarises the various forces that will continue, in our view, to put pressure on bank balance sheets and dampen their appetite to provide credit.

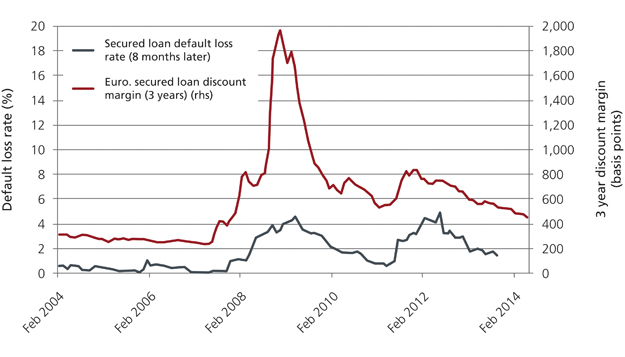

Figure 3. European loan default losses and spreads

Source: Credit Suisse, 6 June 2014

Given the easy money policies of central banks, low default rates and improving growth, the yield spreads for Secured Credit assets have fallen (prices risen) over the last two years, alongside many other risk asset markets. However, in our view, they still offer attractive risk-adjusted returns, although individual credit selection will become increasingly important as the credit cycle matures in the higher risk return segments such as HY corporate bonds and the universe of opportunities continues to grow. If we focus on the European secured loan market, for example, it can be seen from Figure 3 that credit spreads today remain materially above pre-crisis levels and continue to provide ample excess returns above historical default loss levels. What is more, an active manager will seek to materially outperform generic market default levels through fundamental stock selection – over the past five years, for example, the average default loss rate on Henderson’s secured loans fund has been less than 0.1% per annum over the last five years.

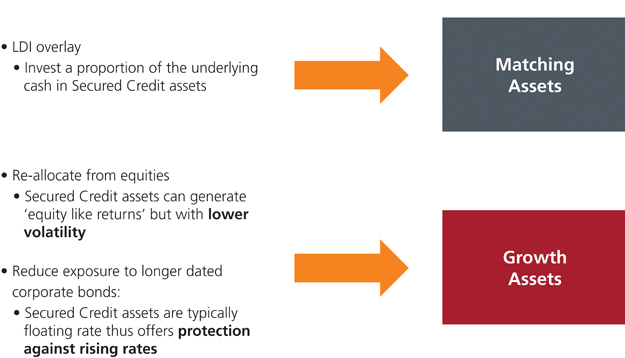

A broad range of applications within portfolios

We therefore believe that the opportunity in Secured Credit is not just tactical, but a structural one, with a broad range of investment applications. As summarised in Figure 4, we have seen a number of uses by clients for allocations to Secured Credit within their portfolios. These have included both “matching”, to generate a LIBOR plus return as part of a Liability Driven Investment (LDI) overlay, and also “growth” asset allocations.

Figure 4. Asset allocation potential for second credit

Source: Henderson Global Investors

Conclusion – the asset class evolves

Recent years have seen many investors take advantage of the opportunities in broader credit markets, with the catalyst for some being the thematic opportunity from bank deleveraging. Having invested the time to understand the asset class, we anticipate many will continue to appreciate the favourable characteristics that Secured Credit assets bring to a diversified fixed income portfolio. Consequently, we expect growing investor interest in Secured Credit either through focused individual asset class strategies or via broader MAC funds.

1. Standard & Poor’s, 16 June 2014

2. Credit Suisse, 6 June 2014

3. Thomson Reuters, May 2014

4. DTZ Insight, June 2013

More Related Content...

|

|

|