Event shortfall: revealing the risks of investment change

Written By:

|

Steve Webster |

|

Paul Gallagher |

Steve Webster and Paul Gallagher from State Street Portfolio Solutions consider a new measure of the risks pension funds face while managing investment changes. Here they examine the recent experience of a UK Local Authority Pension Fund in adopting this new approach

Investors decide to reallocate portfolios for a wide array of reasons. They may be looking to generate alpha, meet funding levels, remove underperforming managers, or protect a portfolio from pending risks. These reallocation decisions are often critical in achieving long-term risk and return goals. Whatever the reason for the change in investment allocation, it is likely that significant analysis motivated the decision.

While portfolio analysis typically focuses on the return and risk of a new investment allocation vis-à-vis the current portfolio, the implementation costs will also be under the spotlight. If not carefully managed, these costs can erode or even eradicate the projected benefits of the target investment allocation. The potential “opportunity cost” incurred between the point when the investment decision is made and when trading begins – a period that can easily span several months – is often overlooked. Like trading-period costs, external market factors prior to trading can easily erode the benefits of the reallocation.

Focus on timely reallocation

While there has been some focus on implementation cost in the investment decision-making process, the delay cost between the investment decision point and implementation is often under-appreciated. This delay period can easily span two weeks to 18 months for some long-term investors, resulting in significant risk to the portfolio. For example, the delay can result in uncompensated risk when an underperforming active manager continues to fall short after the decision to change but prior to termination.

Likewise, for many pension plans, a timely reallocation may be necessary to maintain asset-liability matching or meet key ratios. If a pension plan decides to implement a tilt from its strategic asset allocation, the timing of this tilt will often be a key factor in its success. Any delay can significantly reduce the alpha potential.

A new study conducted by State Street¹ found that asset owners and pension funds may be running significant un-mandated and unrewarded risk through unintended delay in implementing changes to asset allocation and investment decisions.

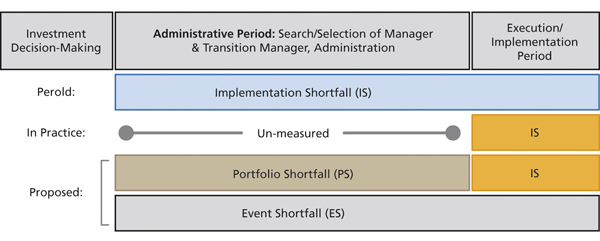

Calculating event shortfall

State Street took André Perold’s concept of implementation shortfall – intended to measure the cost of effecting investment decisions – and extended the way this is applied to focus on the costs incurred before the “execution benchmark” (i.e., trading-period costs). Event shortfall is a composite of implementation shortfall and portfolio shortfall – a measure of the opportunity cost incurred between the time the investment decision is made and the execution benchmark – see Figure 1. When these two measures are calculated separately and taken together, an asset owner can gain a better understanding of the total cost of a reallocation event – i.e., the total risk – from decision to settlement. That way, it can more effectively organise its decision-making.

State Street analysed almost 6,000 transition events over nine years, looking at the delay between first enquiry and agreed implementation. Although the average period was 23 days, one in six events was between three to six months. This period of appointing a transition manager may be only a small fraction of the total delay in organising the change of investments.

Figure 1: Elements of investment allocation change

Source: State Street Global Markets, Perold

Understanding tracking error

The bottom line is that there is risk in waiting to implement an investment decision. This risk – realised as portfolio shortfall – can diminish or even eliminate the perceived benefits of the reallocation decision. Furthermore, the delay costs may have an impact on risk and return assumptions as well as allocation requirements (especially in the case of pension plans).

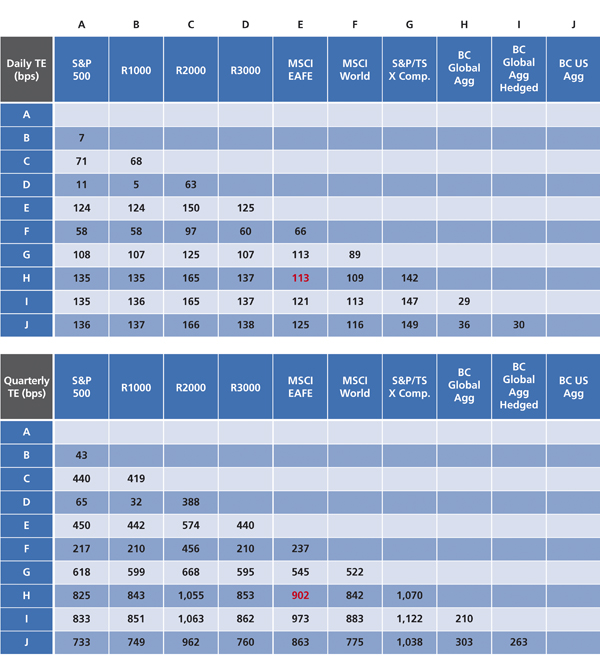

Unsurprisingly, asset classes tend to experience higher tracking over longer periods of time. The same can be said for active managers within the same asset class (assuming the strategy is active and unique). If we assume that a single day’s relative index return represents the implementation shortfall, we can get a sense of the relative magnitude of portfolio shortfall using a basic framework below.

For example, the daily tracking error between MSCI EAFE and the Barclays Global Aggregate is 113bps while the quarterly tracking error is more than 9%. A delay cost of three months could easily eliminate years of alpha expectations – see Figure 2.

Figure 2: Daily vs quarterly tracking error²

Source: State Street Global Markets, Bloomberg

Client application of event shortfall

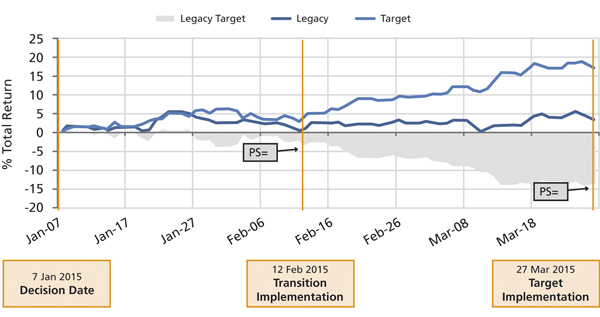

As a working example of Event Shortfall (and its components), here is a recent case study where a UK Local Authority pension fund worked with State Street Global Markets to transition plan assets. The fund initially planned to transition in three stages, staggered monthly for operational reasons. For example, it was decided on January 7 that the 3rd stage of the transition would commence on March 27.

When State Street completed its post-event analysis, they found compelling results. If the fund had held the legacy portfolio through the initial implementation date, the portfolio would have grown by approximately 3.3% while the target portfolio grew 17.3%. This would have resulted in nearly 14% in portfolio shortfall (17.3-3.3%) or approximately £13.8 million. However, State Street Portfolio Solutions and the fund worked together to transition the assets, beginning on the 12th of February, after which point State Street managed the portfolio on an interim basis until it was feasible to transfer the portfolio to the target manager. Doing so decreased the portfolio shortfall to £3.7 million, saving the plan more than £10 million in opportunity costs!

Figure 3 shows the legacy and target portfolio returns during the relevant periods for the restructure outlined above. For the purposes of this example, we do not consider the additional legacy manager fees that typically would have been paid during this period of transition and would have resulted in even greater shortfall.

Failing to measure and report benchmark risk from the point of decision may lead to inaccuracies in a funds statement of overall investment risks. State Street estimates that at present fewer than 10% of pension funds actively seek to address these risks from the point of decision.

Figure 3: Legacy and target portfolio returns

Source: State Street Global Markets, Bloomberg

Manager performance risk

Every year there are significant manager terminations due to the departure of key employees, negative press or unacceptable performance. In each of these cases, investors require a nimble, effective solution to manage exposure.

Empirical evidence suggests the protracted delay in terminating an active manager for poor performance may carry higher risks given current performance statistics. Figures show that 80% of actively managed European equity portfolios and 85% of US equities (large-cap) portfolios underperformed their benchmark in 2014, according to Le Temps and Lipper data respectively.

Assume a plan decides to terminate a manager as a result of continued underperformance. The plan can begin a manager search at the decision point and experience portfolio shortfall for several months until implementation can begin. Alternatively, the plan can terminate the manager, and hire an interim manager to de-risk the portfolio, while seeking a new active manager. This strategy eliminates much of the risk that the existing manager will continue to underperform the benchmark, allowing the plan to achieve market-like returns in the interim.

The plan has several options to de-risk the asset allocation, including a programme of managed futures, ETFs or physical exposure. In choosing an appropriate exposure management vehicle, an investor should consider both risk (tracking error) and costs (transaction costs, management fees and administration costs).

Managing interim exposure

Fortunately, there exists a wide array of interim exposure management strategies that can be tailored to a particular investor’s needs. The optimal exposure management strategy should consider the cost, tracking and operational features across multiple investment vehicles. A range of event-specific factors should also be considered such as holding period, legacy portfolio composition, settlement timing requirements and the level of certainty around the target allocation.

The most effective interim exposure management strategies will balance risk and cost to mitigate portfolio shortfall and ultimately the total cost of the reallocation event – the event shortfall. This enables pension funds not only to calculate the full scale of their risk exposure and the resulting potential costs – but also to access solutions to mitigate these risks.

1. “Event Shortfall – The often-unmeasured administrative opportunity costs,” State Street Global Markets, December 2014

2. Index returns from December 1999 – November 2014, Source: Bloomberg, S&P, Russell, MSCI, Barclays

More Related Content...

|

|

|