ESG in a time of crisis

Written By:

|

Jeremy Richardson |

Jeremy Richardson of RBC Global Asset Management investigates the assumption that firms with strong ESG credentials have been less negatively affected than others during the pandemic

The coronavirus pandemic that spread around the world in 2020 had a profound effect on societies and caused significant economic disruption. It represented a discontinuity for equity markets, forcing share prices to quickly adjust to lower profit expectations and caused global equity markets to lose nearly a third of their value from the peak to their low on 23rd March 2020.

Investors quickly grasped the gravity of the situation and a sense began to emerge that it was perhaps a moment when firms with strong ESG credentials would be less negatively affected than others; that their healthy extra-financial forms of capital would provide them with some protection and greater resiliency. A headline in the Financial Times of 3rd April 2020 which proclaimed that “ESG funds continue to outperform wider market” typified the prevailing sentiment.

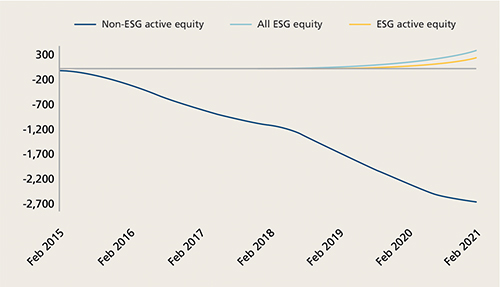

This sense that ESG strategies offered a better investment approach and were somehow more appropriate at that particular time, provided further support to an investment trend that had been gathering momentum several years prior to the pandemic. Although active equity funds have been under pressure from other investment opportunities, especially passive indexation and ETFs, inflows to active ESG funds have remained undiminished, despite the pandemic. Sanford Bernstein estimates that non-ESG active equity has seen outflows of USD 2.6 trillion since 2015 while ESG equity has seen inflows of approximately USD 379 billion (Figure 1).

Figure 1: Cumulative flow in non-ESG active equity and ESG equity funds ($billion)

Source: EPFR, Bernstein analysis. Data as at February, 2021.

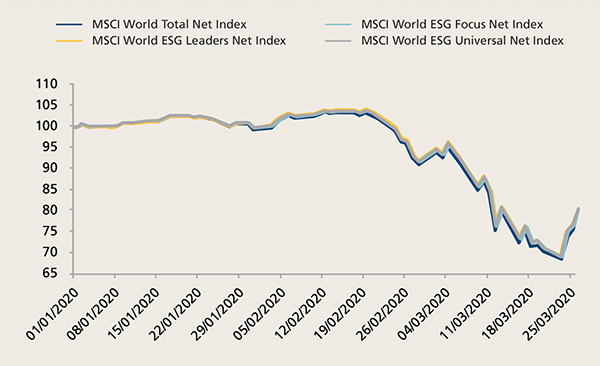

Yet over the course of the initial stages of the pandemic when equity markets fell, the established ESG indexes didn’t appear to capture the outperformance of ESG that many believed to be there. Over the whole of the first quarter of 2020 the difference in performance between a number of ESG indexes and the MSCI World Net Index was less than 1%. This was astonishingly small given the seriousness of the crisis and the perception that ESG was able to offer an element of downside protection amidst falling equity markets (Figure 2).

Figure 2: Index performance for Q1 2020

Source: Bloomberg, RBC Global Equity team. Data as at March, 2020.

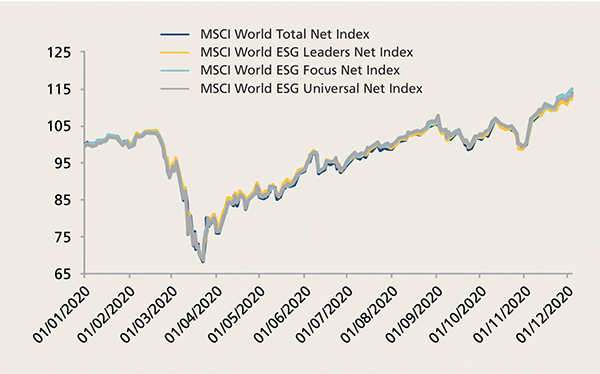

Extending the period to the whole of 2020 reveals a very similar pattern of performance with the spread of performance relative to the MSCI World Net Index being less than 2% (Figure 3).

Figure 3: Index performance for Q1-Q4 2020

Source: Bloomberg, RBC Global Equity team. Data as at December, 2020.

So does the result that ESG-themed benchmarks didn’t perform significantly better than the conventional alternative and, in particular, didn’t seem to preserve capital on the downside during the peak of the crisis, mean that “ESG” was less relevant than consensus opinion thought? Like a magician’s trick, did ESG-believers want to see something that wasn’t really there?

Two recent academic papers have tried to explore the performance of ESG during this episode in more detail. Both apply novel approaches and succeed in uncovering new evidence of the power and limits of ESG data to explain 2020 stock performance.

The first paper was published in February 2021 and at the time of writing has yet to be peer reviewed. Although the authors, Demers, Hendrikse, Joos & Lev (Demers et al), present their conclusion in the title: “ESG Didn’t Immunise Stocks During the Covid-19 Crisis, But Investments in Intangible Assets Did”, there is much in the paper to occupy the reader. The authors note that academic papers on the subject of the global financial crisis showed that ESG appeared to act as a risk mitigator and lowered downside exposure but that this did not appear to be the case during the Covid-19 crisis.

Their analysis demonstrated that a firm’s Covid-19 stock returns could be explained by its accounting-based measures of liquidity and leverage, its financial performance, supply chain management, industry affiliation and traditional market-based measures of equity risk. However, they also showed that a firm’s internally developed intangible assets were also relevant. These were defined as a firm’s expenditure on research and development plus half of its annual sales, general and administration expenses over the preceding five years.

They went on to test whether ESG scores had any additional explanatory power, using data from MSCI and Refinitiv. Such quantitative scores are based on aggregated underlying ESG data. The authors found that ESG scores were not significantly associated with stock market performance for Q1 2020 once the full array of determinants had been controlled for. In contrast, returns were positively associated with a firm’s internally developed intangible assets, even after industry controls were applied. The authors concluded that investments in innovation-related intangibles rather than measures of a firm’s ESG investments offer greatest immunity.

The approach of using “intangibles” is noteworthy. The term itself has received greater usage over the last few years – a good example being “Capitalism Without Capital: The Rise of the Intangible Economy” by Jonathan Haskel and Stian Westlake. The term recognises that traditional balance sheet accounting which focuses on historical cost accounting of assets and liabilities fails to capture important elements of a firm’s extra-financial value. The approach used in the paper attempts to create a proxy for this by assuming that a proportion of a firm’s annual expenses has future value and so instead of being written off against profits, capitalises them as “intangible” assets.

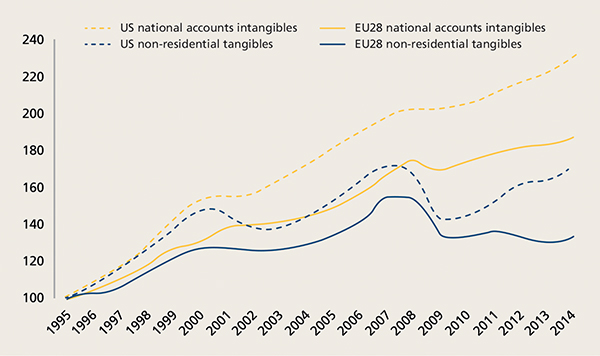

The use of intangibles has appeal for those who advocate a more inclusive approach to assessing balance sheet value. This, they suggest, not only better captures more of a firm’s intrinsic value but also reflects how in the real world firms’ intangible investments have been growing over time. Moreover, it is argued that correcting for the omission of intangibles explains why the Value style of investing has been shown to be less effective over recent periods (Figure 4).

Figure 4: Non-residential intangible and tangible investment in the EU-28 and the US total economy

Source: Eurostat national accounts for EU-28, BEA for U.S. ‘Unlocking Investment in Intangible Assets, Anna Thum-Thysen, Peter Voigt, Benat Bilbao-Osorio, Chrisoph Maier and Diana Ognyanova, Discussion Paper 047 I May 2017. Total Economy chain linked volumes, index 1995 = 100. Data as at May, 2017.

We believe that it’s important to avoid businesses that draw down on their intrinsic value through weak ESG practices that create contingent liabilities, and instead identify those that use strong ESG practices to create contingent assets. These “assets” are often qualitative in nature and defy quantitative measurement, but nevertheless can be powerful at informing firms’ fundamentals. We would argue that such an approach is better positioned to capture a greater proportion of a particular firm’s intrinsic value. For fundamental active investors, it is this company-specific assessment that is key to identifying and capturing value within a portfolio. If done correctly, it should allow the investor to select more attractive opportunities and therefore capture more value than is implied by the simple expense-derived definition of intangibles used in the paper.

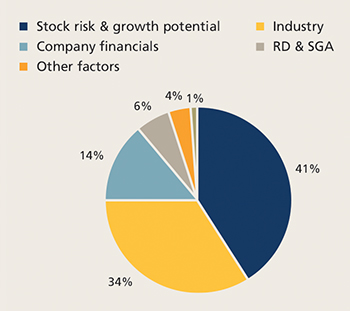

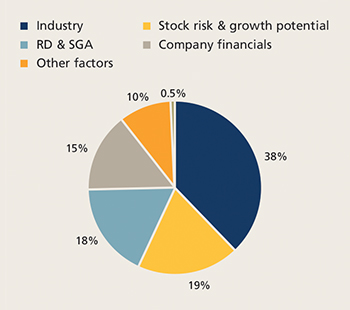

Demers et al. find that both over the initial stages of the pandemic and for 2020 as a whole, their measure of intangibles had a meaningful explanatory effect. Importantly though, adding ESG scores (Refinitiv and MSCI) did not change the result. Indeed, they found that ESG scores explained less than 1% of the cross-sectional variation in the Q1 2020 Covid-19 returns – far less than intangibles (Figure 5).

Figure 5: Relative contribution to identified factors to explaining Q1 2020 Covid stock performance

Source: ‘Corporate Resilience and Response During Covid-19’, Harvard Business School, 2020. ‘ESG Didn’t Immunise Stocks During Covid-19 Crisis, But Investments in Intangibles Assets Did’, Demers, Hendrikse, Joos and Lev, 2021. RBC Global Equity team. Data as at March, 2020.

It was the same when extending the time period to the whole of 2020. Again, ESG scores were insignificant but intangibles remained important. It was noted that cash and debt also became insignificant for the full year once governments’ policies extended emergency funding to firms (Figure 6).

Figure 6: Relative contribution to identified factors to explaining full 2020 Covid stock performance

Source: ‘Corporate Resilience and Response During COVID-19’, Harvard Business School, 2020. ‘ESG Didn’t Immunise Stocks During COVID-19Crisis, But Investments in Intangibles Assets Did’, Demers, Hendrikse, Joos and Lev, 2021. RBC Global Equity team. Data as at December, 2020.

The results were unaffected by repeating the analysis just for top-scoring ESG firms in order to minimise the potential impact of greenwashing. The authors suggest that it wasn’t ESG scores that helped stock return during the crisis but the flexibility that derives from a large stock of innovative intangible assets.

This is an important contribution as it highlights that “intangibles” and “ESG” are not identical. Demers et al suggest that intangibles are a proxy for “innovation capital” that is rewarded in periods of change. Note that this is very different from traditional definitions of ESG that tend to focus on the preparedness and management of extrafinancial risks. Indeed, critics of ESG sometimes suggest that its weakness is that too often it just focuses on risk factors, such as governance, rather than on opportunities, such as stewardship. One of the key contributions of the paper might, therefore, be to propose a relevant proxy for intangibles that gets closer to this forward-looking element of stewardship than traditional ESG scores can.

Before concluding on the paper, it is also important to note that the authors equate ESG with ESG scores. This is a common short-cut but, as we often argue, there is no such thing as ESG fact, just ESG opinion and it is rarely the case that complex contextual ESG issues can be adequately summarised in one simple overall ESG score. As we have written previously, ESG scores do not appear to have any significant ability to predict stock returns and one could argue that this paper provides further evidence of this.

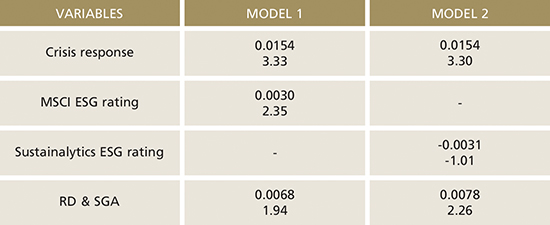

A second paper by Cheema-Fox, LaPerla, Serafeim and Wang (Cheema-Fox et al) covers similar ground but takes an alternative approach to determine “intangibles”. Like Demers et al, they do not rely on ESG scores, which are heavily weighted to self-reporting and self-disclosure by companies, but instead use natural language processing and data from external sources, such as news reports and social media provided by Truvalue Labs to assess a firm’s relationship with the key stakeholder groups of employees, suppliers and customers. Each group was independently assessed, scored and then combined to determine an overall measure of “crisis response” (CR).

The authors suggest that for CR to matter, it has to be perceived by stakeholders as being credible. The pandemic was just such a moment when credibility was likely to be tested.

The paper demonstrated that this CR score was very powerful at explaining stock returns, with higher scoring firms preserving value into the pandemic downturn, even after controlling for a number of relevant factors, such as debt, size, industry and valuation.

The authors went further and tested the results using the definition of intangibles used by Demers et al and found that although these did have a positive explanatory effect, they did not significantly diminish the importance of a firm’s CR.

The authors conclude that investments in stakeholder relations (CR) could be valued as strategic resources where they present a credible and costly commitment to those stakeholders (Figure 7).

Figure 7: Firm level stock coefficients

Source: ‘Corporate Reilience and Response During Covid-19, Alex Cheema-Fox, Bridget R. LaPerla, George Serafeim and Hui (Stacie) Wang. The table presents estimated coefficients, and below those, t-statistics (calculated from the test result of a hypothesis). Dependent variable is the firm level stock returns minus the country level market returns cumulated between 20th February 2020 and 23rd March, 2020. Data as at 23rd September, 2020.

Overall, both papers contribute to a growing body of evidence that simple ESG scores do not have a powerful explanatory effect when considering individual stock returns. It should perhaps be of little surprise then that ESG investment indexes compiled using ESG scores have performed similarly to their traditional cousins during the global pandemic. This was in contrast to popular opinion, suggesting investors’ faith in ESG scores to adequately capture ESG outweighs the reality.

The papers frame what ESG scores are missing. They allude to important aspects of firms which appear credible with stakeholders and seem to have a positive explanatory power. Both sets of authors suggest different ways of framing these “intangibles” which they argue support innovation, flexibility and resiliency. We would call these “contingent assets” and argue that focusing fundamental research efforts on understanding the qualitative nature of these “intangibles” is more productive than relying on quantitative ESG scores. This research appears to substantiate such an approach and provides further evidence that resilient businesses with strong contingent assets may help an investor achieve resilient investment returns.

More Related Content...

|

|

|