Emerging markets – is the rebound sustainable?

Written By:

|

Peter Saacke |

|

Raheel Altaf |

Peter Saacke and Raheel Altaf, managers of the Artemis Global Emerging Markets strategy, discuss the outlook for emerging market equities and where they see opportunities arising

2016 was a good year for emerging market equities. The five preceding years were not. Indeed, at the start of 2016 sentiment towards emerging markets was particularly poor: commodity prices had been falling, currencies were weakening, the economic outlook appeared fragile and there was political uncertainty in a number of major developing economies. Accordingly, the consensus was to be underweight emerging markets. In their 2016 European Asset Allocation Survey, Mercer reports that 44% of the plans surveyed had a strategic allocation to emerging market equities. Of these, however, the average allocation to the asset class was 5%, relative to an index weight of over 10% (MSCI AC World).

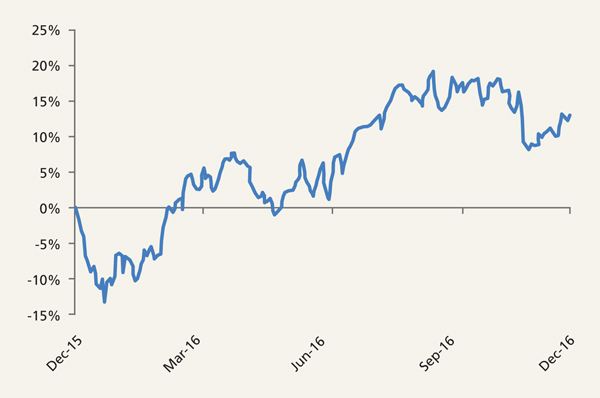

But 2016 proved to be a year when those willing to take risk and go against the trend were rewarded handsomely (Figure 1). There were a number of reasons for this. Commodity and oil prices first stabilised and then rebounded, prompting a sharp reversal in performance for the energy and resources sectors. Economic newsflow also improved: China’s predicted banking crisis failed to materialise; India maintained robust economic growth; and Russia and Brazil appeared to have passed through the worst of their recessions.

Figure 1: Emerging market performance

Source: Bloomberg as at 30 December 2016

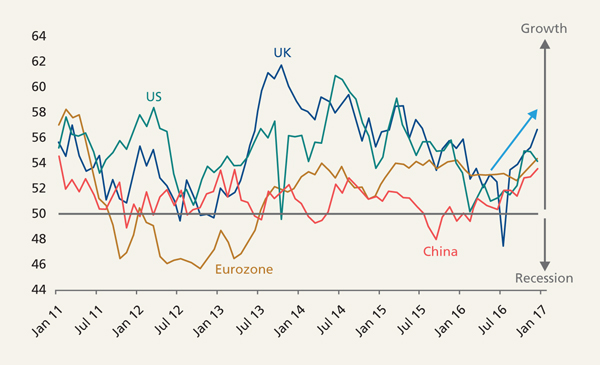

More broadly, there are signs of a synchronised global cyclical upswing. For the first time since 2014, purchasing managers’ indices (PMIs – indicators of the economic health of the manufacturing sector) in the US, Europe and China are signalling expansion at the same time (Figure 2).

Figure 2: Purchasing managers index

Source: Bloomberg as at 31 December 2016

The rally in emerging markets was initially confined to companies sensitive to commodity prices. But as economic data stabilised over the course of the year, the recovery broadened out to other cyclical areas of the market.

Risks to the recovery remain. The last months of 2016 were a stark reminder that sentiment towards emerging market stocks continues to have a close link with concerns of a faster normalisation of interest rates in the US via a stronger dollar. While political uncertainty has diminished in some areas, a new concern has arisen around agreements on global trade. The main threat on this front emanates from the US and its newly elected President. If Donald Trump manages to make his more protectionist proposals policy and thereby limiting free trade, this could have a serious impact on global equity markets in general and emerging markets in particular. Although Trump has already vowed to renegotiate several key agreements, the outcome is far from certain. While we remain vigilant, we are inclined to act on actual policy rather than rhetoric. However, it does highlight a wider issue: investors are often wary of the apparent political risk in emerging markets. Events of 2016 have demonstrated that these types of risk are not confined to the developing world.

We would also note that emerging markets are a very heterogeneous selection of countries. They are not necessarily fuelled by sales of commodities, nor overly exposed to the US dollar. Many of these countries are domestically focused, with growth driven by domestic consumers and growing middle classes. Their governments generally have lower debt levels than developed markets and many have current account surpluses.

A diverse and broad investment universe

In order to find the best opportunities within this diverse universe, we use a systematic, repeatable and fact-based investment process that has been operated and refined over more than 20 years. Given the breadth and depth of the opportunities within the emerging market universe, it is important for fund managers to spread their nets as wide as possible. The MSCI Emerging Markets index contains around 800 stocks over 23 countries. Our universe is much larger: we cover 2,200 stocks in 36 countries. Our systematic approach gives us more scope to find the best opportunities, particularly in mid-cap stocks. We frequently invest in companies outside the benchmark. Recent examples include stocks in Vietnam, Kenya and Peru and companies quoted on the China A-share market.

Attractive relative valuations

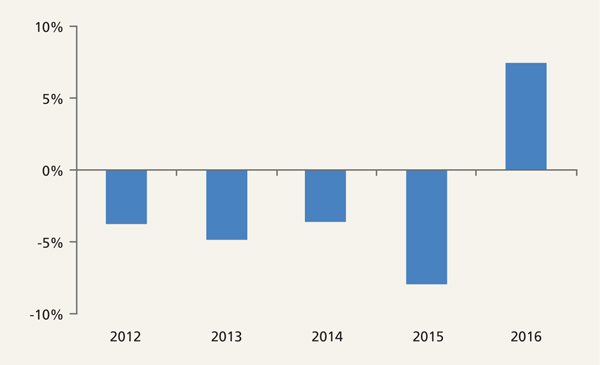

Despite enjoying strong gains last year, emerging market equities are still attractively valued relative to their developed market peers and investors remain underweight this asset class. As the outlook for economic growth has improved, the scarcity premium attached to growth stocks has diminished and value (cheap) stocks have come back into favour. While this has been the case across global equities, it is particularly apparent in emerging markets (Figure 3).

Figure 3: Value relative to growth performance in EM

Source: Bloomberg as at 30 December 2016

We currently see the most interesting opportunities in cyclical areas such as industrials, construction, resources and energy. We are underweight in more defensive sectors and have less exposure to “expensive growth” areas such as consumer discretionary, healthcare and staples than many of the market.

Moreover, there is evidence that the fundamentals of emerging market stocks are improving: a recovery in profit margins and improving returns on equity mean that earnings growth is forecast to be higher than in developed markets. Cheaper starting valuations and faster earnings growth can make for a powerful cocktail for stock returns. We are thus optimistic about the outlook.

This document is issued by Artemis Investment Management LLP which is authorised and regulated by the Financial Conduct Authority.

This document is intended solely for institutional investors and their professional advisers and should not be passed, either in whole or in part, to private investors who would be unable to place any reliance on the information contained. Nothing contained in this document constitutes investment, legal, tax or other advice and it is not to be relied on in making an investment or other decision. Any research or analysis contained in this document has been procured by Artemis for its own use and may be acted on in that connection. The contents of this document are based on sources of information believed to be reliable; however, save to the extent required by applicable law or regulations, no guarantee, warranty or representation is given as to its accuracy or completeness. This document may include forward-looking statements which are based on Artemis’s current opinions, expectations and projections. It is provided to you only incidentally, and any opinions expressed are subject to change without notice. Artemis, the Artemis Coin and SmartGARP are trademarks of Artemis Investment Management LLP.

More Related Content...

|

|

|