Emerging market equity returns to the spotlight

Written By:

|

Justin Preston |

As equity investors demonstrate a renewed appetite for emerging markets, Justin Preston of bfinance looks at the drivers behind the sentiment

The resurgence of investor appetite for emerging markets is proving to be the most significant manager selection trend of 2017, at least according to our data at bfinance. Emerging market equity and fixed income mandates comprised one third of all public market manager searches handled by the firm in the first half of the year, representing an increase of more than 100% against the same period last year.

The positive macro tailwinds witnessed in the aftermath of President Trump’s election have simultaneously sent emerging market equity to the top of the performance rankings – especially those with lower exposure to Brazil or more commodity-sensitive markets such as Russia.

Amid the revival we observe a number of noteworthy but perhaps less evident developments since the last great surge in investor appetite for emerging markets in 2009-10. These include the increasing relevance of Environmental, Social & Governance considerations (ESG), the greater feasibility of segregated accounts thanks to improved market liquidity and the deepening bench of specialist regional and country managers, to name but a few.

Below, we consider four key questions in light of recent implementation experience: ESG, country allocation, global versus regional focus, and fees.

How problematic is ESG integration in emerging market equities?

The ESG dimension has been an important aspect of emerging market equity manager selection work in 2017. Interest in this question is certainly far higher now among investors than it was 10 or even five years ago.

Before addressing the question of integration, it’s worth paying attention to recent data indicating connections between ESG and outperformance in emerging market equities. For example, there has been a great deal of publicity around the outperformance of the ESG-focused MSCI emerging markets index versus its non-ESG counterpart, although this finding should be treated with caution in view of the commodity price dynamic.

In bfinance’s own analysis of active equity managers in emerging markets, there does initially appear to be a positive correlation between manager governance scores and investment performance. This is a correlation that we do not observe as clearly among developed market active equity managers.

At present we would not view this conclusion as being sufficiently robust to suggest a connection, but it has certainly intrigued our team. To be frank, we were initially a little surprised by the fact that the managers scoring highly in our ESG analysis, particularly on the governance side, were all also performing very strongly in non-ESG EM equity selection processes. Not all of them, it should be noted, received good scores from PRI (Principles for Responsible Investment): this community is currently playing catch-up in terms of disclosure and communication.

So what of integration? For emerging market and Asian managers, the governance element (the “G”) has always been key, particularly given the crises of the 1990s. This does not just apply on a corporate level in emerging markets: it also applies on a country level. Indeed, we do see certain managers that will rule out entire countries, such as Russia, on a governance basis. The “E” and “S” are becoming progressively more influential. That being said, there still remain significant obstacles and investors should certainly not expect the ESG processes of emerging market ESG managers to compare with their developed market counterparts.

One of the greatest difficulties is that managers are simply wrestling with a lack of data. Companies in developed markets now thoroughly recognise that ESG-related issues are a major concern for shareholders: they report on relevant criteria in annual reports; they publish relevant numbers. There is simply far less ESG-related information available from emerging market companies.

Providers such as MSCI have sought to provide ESG ratings in this space but those scores are often based on less information. Furthermore, these supplier ratings are usually restricted to benchmark stocks – the ones in the index. Yet many emerging market managers invest a significant proportion of assets off-benchmark in order to add value.

The way in which managers deal with that data challenge represents a significant differentiator in terms of our ESG assessment. Those that are proactively dealing with these weaknesses, such as developing in-house ratings rather than relying on external suppliers, will tend to score more favourably (see recent white paper ESG Under Scrutiny: Lessons from Manager Selection).

This also ties back to overall manager strategy and style. Those with more concentrated, higher conviction, low turnover portfolios will find it more straightforward to assess ESG in emerging markets than those with a more diversified approach.

Bottom-up stock picking versus top-down macro analysis: has the balance changed?

Country allocation has always been the most influential driver of manager performance, but also the most difficult area in which to add value on a consistent basis.

In the past year, the most important “decision” was Brazil exposure and in the previous year it was China, but these are not intentional decisions for the most part. It is relatively straightforward to analyse a company; it is immensely difficult to predict the dynamics of a macroeconomy.

The universe of emerging market equity managers is, first and foremost, a universe of bottom-up stock-pickers. A formal review of countries resulting in a definitive asset allocation policy is far less likely to be found among this group. Instead, country exposures tend to be integrated into the stock selection decision-making process or as part of portfolio construction and risk control, or maybe considered as a currency management issue.

Yet we handle manager selection engagements in emerging market equities where the investors are deeply concerned by the managers’ country assessment models. In part, this has a broader relevance: institutions can be seeking country-level insight that will inform their wider portfolio decision-making, not just their emerging market equity strategy.

In one recent example – a project for a Middle Eastern insurance company – the investor was firmly committed to finding a manager with a clear analytical framework for top-down (country) assessment. This one factor eliminated roughly a quarter of the relevant managers from the search.

In some ways this is a topic du jour, thanks to the current political and macroeconomic environment. It is more and more challenging to treat emerging markets as a bloc. Weak commodity prices have led to significant divergence of returns between the commodity-exporting emerging economies and the rest. For years, emerging market performance has been linked to the strength of the US economy as an export market; that is now more variable. There is a greater consciousness of Russia versus Brazil versus India, for instance, than there has been historically.

On the other hand, investors have always been intrigued by “country” stories in emerging markets. There has always been a crisis in the headlines: the Mexican peso crisis, the Asian debt crisis, the Russian financial crisis. In reality, from the perspective of emerging market equity manager processes, we conclude that country analysis is actually less significant than it was 20 years ago.

Have fees changed?

Emerging market equity manager fees have shown surprising resilience, at least according to bfinance data from live manager selection engagements. Many managers have been suffering from outflows during 2015-16 but they haven’t, as a rule, been dropping their prices.

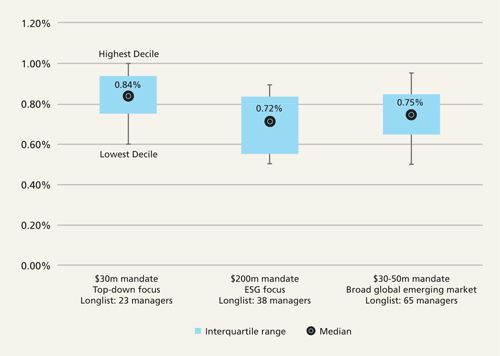

The median fee quoted for all global emerging market equity searches in 2017 was 69bps. Figure 1 shows quoted (pre-negotiation) fees for three of them, illustrating how differences in approach and size can alter costs.

Figure 1: Quoted management fees for three global emerging market equity searches is 2017

Source: bfinance

What is the current appetite for global versus regional emerging market searches?

While global emerging market equity strategies remain the most popular choice, as they have been for some time, there is certainly a conviction among the investment community that Asia is more solid than other regions. As a result, bfinance has seen a significant surge in Asia-specific activity, both in an emerging markets context (ex-Japan, ex-Australia) and for the whole region or its developed markets (Japan).

In comparison with South Africa, Russia and Brazil, Asia is undeniably attractive: companies tidied up their balance sheets after the Asian crisis; markets are broader and deeper; performance is less commodity-driven. It’s also worth noting that Asia itself has become more dominant within the broader emerging market picture, rising from 60% of the MSCI Emerging Markets index in 2011 to 73% in 2017. Today, the universe of managers for Asian equity offers almost as much depth as the universe for global emerging market equity. The most recent Asia ex-Japan manager search involved 70 viable strategies and many of them have 10, 15 or even 20-year track records.

In other words, the fact that Asia mandates have been in favour does not reflect a shift from global towards regional approaches but, rather, the recent strength of Asia relative to the rest of the emerging market universe. Looking broadly, “global” does still appear to be the strategy of choice for emerging market equities.

More Related Content...

|

|

|