Emerging market debt – the fundamental case remains

Written By:

|

Steven Nicholls |

Emerging market debt investors needed extremely thick skins in 2013. Not only did the “taper tantrum” send them into a spin, causing heightened volatility, but overall, returns from developed market assets made emerging debt returns look paltry. Despite this, Steven Nicholls of Aberdeen Asset Management outlines why EM debt should still be a key option for investors

After years of being rewarded for taking on extra risks, 2013 was a year where taking a more conservative approach paid dividends. The question for investors is, does the fundamental case for emerging markets still hold? And, do emerging markets still compare favourably to developed markets?

Well, simply put, in both cases yes. It is important to remember that given many emerging markets have been some of the main beneficiaries of loose major central bank policies, they were always likely to suffer in the short-term when the support measures were eventually withdrawn. We remain confident that emerging market debt will recover from any short-term negative stresses emanating from the US Federal Reserve’s decision to commence tapering, and will perform well over the medium to long term. Emerging markets continue to be supported by long-term structural factors in the form of low debt levels, good demographics and healthy growth prospects.

Sovereign debt levels are now, on average, just one third of that of developed markets, driven by prudent fiscal management policies and economic prosperity. The improved fiscal balances have resulted in greater stability, making emerging economies more resilient in the face of financial turbulence, and at the same time improving their standing in international financial markets. The healthier backdrop has been necessary for an improved political and business environment.

Emerging market economies boast growing, youthful populations and burgeoning workforces are enhancing earnings and spending power, driving domestic growth and lessening dependence on the developed world. In contrast, more than 25% of Japanese and in excess of 14% of American, UK and Eurozone citizens are over the age of 651 and these figures are likely to increase over time, which will limit economic growth.

High inflation in many emerging economies in the 1980s and 1990s has previously deterred investors from seriously considering emerging market investments, especially those denominated in local currency. However, improvements have been significant, structural and hugely supportive. With political reforms leading to widespread central bank independence, most emerging market economies have now successfully battled inflation, or are well on top of the situation. As a result, the credibility of emerging economies has improved among investors and, from a fixed income perspective, has enabled governments to focus new issuance on local currency denominated bonds with longer maturities. This progress has not been limited to sovereign issuers; corporates too have grown to be healthier than developed market counterparts, boasting lower leverage, higher quality of cash generation and a better ability to pay back their liabilities, fuelling increased corporate debt issuance.

Credit rating agencies have closely monitored and praised emerging economies’ improving fiscal balances, well demonstrated by Standard & Poor’s upgrading the Brazilian long-term foreign currency rating to BBB, and their local rating to A-, citing an expanding middle class, diverse economic structure, and potential for more exports.2

A strong fundamental backdrop is also helping emerging markets to develop and mature more in line with developed markets. Emerging markets currently account for 70% of global nominal GDP growth, and have outpaced developed market growth fourfold over the last five years since the financial crisis.3 At current growth rates, emerging markets are estimated to account for around half of global GDP by 2025.4 Admittedly, convergence is unlikely to be a smooth process and is probably going to be confronted by some obstacles, nevertheless over the medium to long term, the investment case for emerging markets is compelling.

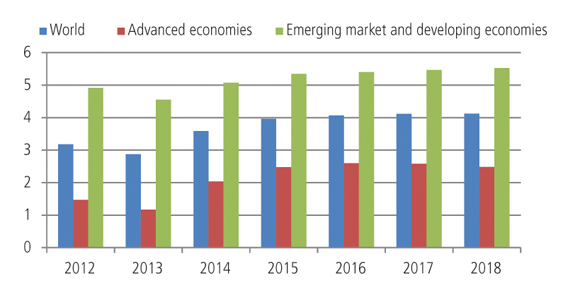

Figure 1: Projected global GDP growth

Source: IMF World Economic Outlook, October 2013. Note: Growth figures provided refer to IMF GDP growth at constant prices forecasts.

The emerging market debt investment universe is vast and has come a long way since the early 1990s, evidenced by the evolution of the JP Morgan EMBIG and CEMBI indices. In 1993, the emerging market debt universe comprised of just 14 countries and 206 companies, predominantly located in the Latin American region, and the entire emerging market debt universe was just US$422 billion. Today, total emerging market sovereign and corporate debt stands at US$9.8 trillion with the JP Morgan EMBIG index comprising 55 countries and the JP Morgan CEMBI index comprising more than 450 corporate issuers spread throughout the emerging market world.5

Over 140 countries make up the entire emerging market universe, and member countries continue to evolve as more mature emerging markets receive developed market status and frontier markets attain emerging market status. Frontier markets offer compelling opportunities in their own right with favourable growth outlooks, manageable fiscal and debt positions, and higher yield opportunities compared to mainstream emerging and developed markets.

Investors can access emerging market debt in a variety of ways. Traditionally, investors have concentrated on debt denominated in hard currency, usually the US dollar. However, stabilising economies have allowed emerging market governments to raise an increasing proportion of their financing by issuing debt in local currency, which is now more than twice the size of the US dollar market. Local currency denominated debt offers investors returns not only through coupon payments and capital appreciation but also currency movements. To date, emerging market local currency denominated debt has achieved almost twice the annual average return of global bonds over the last 10 years, while having just half of the volatility of emerging market equities over the same period.

Companies have also sought to capitalise on the increasing demand for emerging market debt, and in recent years, emerging market corporate debt has developed into a standalone asset class. Dedicated financial infrastructure such as investable market indices, dedicated research, and the rapid growth in market capitalisation from increasing corporate debt issuance has brought this expanding asset class into the spotlight.

Blending the three distinct asset classes together can provide further benefits to investors in the form of higher risk adjusted return, and diversification due to their low historical correlation to developed markets and emerging market equities.

Aberdeen has a wealth of experience in investing in emerging market debt, and offers separate investment in emerging hard currency, sovereign local currency and corporate debt. We also offer a blended approach which showcases our best ideas across the emerging debt universe against a hard currency benchmark. We believe that a fund manager with expertise at country and corporate levels, in addition to having the skill set necessary to make those asset allocation decisions in a dedicated fund, is a more suitable approach for most investors. We can certainly provide that expertise and have been successfully doing so for over ten years. As a result, the blended approach is proving very popular generally, but specifically with investors who have less experience of the emerging market debt asset class.

1. Source: Bloomberg, 31 December 2012

2. Source: The Herald, December 2012; Bloomberg, January 2012

3. Source: JP Morgan, 12 July 2013

4. Source: International Monetary Fund, 31 May 2013

5. Source: JP Morgan, 12 July 2013

More Related Content...

|

|

|