Dynamism and selectivity is key

Written By:

|

Jeff Boswell |

|

Garland Hansmann |

Jeff Boswell and Garland Hansmann of Investec Asset Management look at the investment drivers for the coming year, arguing that market price behaviour and selectivity will both be key factors in 2019

2019: What are the drivers?

As we progress further into an era of reduced central bank support and tightening liquidity, we believe that while fundamentals and valuation will play a role, market price behaviour will remain the key driver in 2019. We still see good opportunities for investment in some credit markets, but increased bouts of volatility are likely to become the norm. The stage is set in the year ahead for the nimble, and well-positioned investor, to take advantage of the move from quantitative easing to quantitative tightening (QE to QT).

Fundamentals: sound but not perfect

Going into 2019, the general fundamental backdrop remains sound. The auto sector aside, the robust growth experienced through much of 2018 is slowing rather than turning negative. As such, we think the threat of a very near-term recession is small. This macroeconomic strength has largely fed through to corporate earnings, particularly in the US. This has also translated into a continuing moderation in corporate leverage levels, which currently stand at elevated, but not overly aggressive levels. However, this varies somewhat by market.

It is notable, however, that certain subsets of the economy have recently shown signs of weakness. We have started to see a moderation of momentum in several of the traditionally more cyclical sectors, such as autos, industrials and homebuilders.

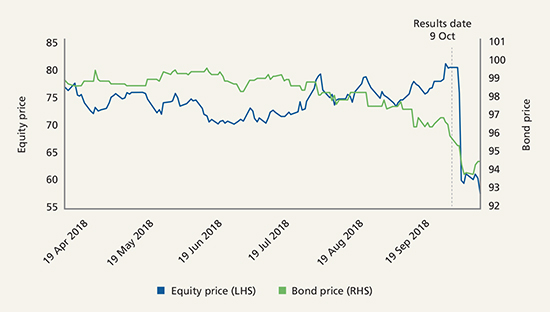

As individual issuers within these sectors have reported weaker financial performance, we have typically seen aggressive repricing of their equity or credit spreads, as illustrated below by the equity and bond prices of global chemicals manufacturer Trinseo (Figure 1). This asymmetric price reaction on any earnings miss clearly illustrates the increased value of selectivity.

Figure 1: Trinseo – equity and bond prices compared

Source: Bloomberg, 30.09.18

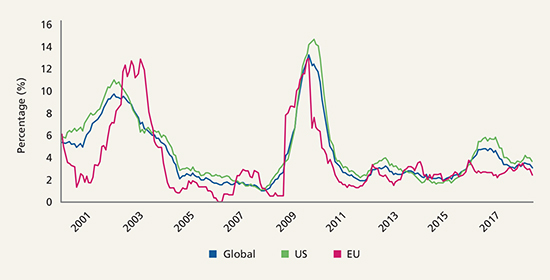

However, this localised stress has yet to filter through into broader measures of market health. As such, default rates have continued to moderate, alongside continued positive ratings drift (more upgrades than downgrades) momentum.

Figure 2: Default rates are moderating

Source: Moodys. As at 31.10.18

Valuations: a mixed bag

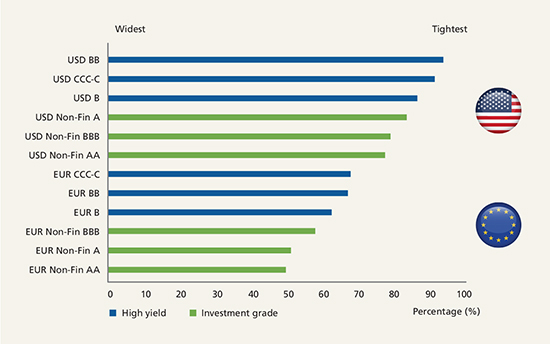

In a year of more divergent performance across the credit market subsets, the relative attractiveness of different credit markets is currently quite variable. Certain subsets, such as US high yield, are trading close to post-crisis lows. Other segments, such as European high yield, have repriced wider since the start of the year. Figure 3 provides a snapshot of the large developed market bond markets, illustrating the variability of these valuations in the context of each asset classes’ history.

Figure 3: Current corporate bond spreads, percentile against history

Source: Deutsche Bank, FactSet (ICE BAML). 20.09.18

The reasons for this valuation divergence differ from case to case. They can be idiosyncratic in nature (e.g. Italian political risk) or down to particularly supportive market technical factors (e.g. US high yield). We believe it is too difficult to generalise in terms of the attractiveness of valuations given the multitude of factors which need to be considered when assessing each market subset.

While we still see potentially attractive risk-adjusted returns across various subsets of the market, we think the year ahead is less about reaching for returns and more about preservation of capital. In this vein, dynamism and selectivity are going to be key to avoiding the more susceptible areas of the credit market.

Market price behaviour: a fine balance

In our view, market price behaviour will continue to be the main driver of markets in 2019. The “safe havens” may not necessarily be where investors expect them, given the impact of extreme monetary policy over the last decade.

Credit markets, along with most financial markets, have benefited significantly in recent years from a wave of central bank liquidity. Easy money has rippled through all credit market subsets, providing a strong tailwind for tighter valuations, supported by improving underlying fundamentals. However, the recent shift from QE to QT, in our mind, is likely to have a material impact on market momentum. The retrenchment of tourist investors (tactical allocators), who don’t consider credit a mainstay of their investing, leaves some areas of the market susceptible.

As such, understanding the behavioural dynamics of individual market subsets is a key theme for us and further illustrates the need for selectivity. We believe this dynamic, along with issuance levels and fund flows, will likely have a meaningful impact on market direction in the year ahead.

Conclusion: be selective and dynamic

We believe there are still attractive risk-adjusted returns on offer among the different subsets of the credit market. However, we believe selectivity is going to be key in the year ahead, not only in terms of individual credit selection, but also in selection of subsets of the credit market. We also believe dynamism in both these regards is going to be critical in 2019.

Investments carry the risk of capital loss.

This communication is for institutional investors and financial advisors only. It is not to be distributed to the public or within a country where such distribution would be contrary to applicable law or regulations. The information may discuss general market activity or industry trends and is not intended to be relied upon as a forecast, research or investment advice. The economic and market views presented herein reflect Investec Asset Management’s (‘Investec’) judgment as at the date shown and are subject to change without notice.

There is no guarantee that views and opinions expressed will be correct, and Investec’s intentions to buy or sell particular securities in the future may change. The investment views, analysis and market opinions expressed may not reflect those of Investec as a whole, and different views may be expressed based on different investment objectives. Investec has prepared this communication based on internally developed data, public and third party sources. Although we believe the information obtained from public and third party sources to be reliable, we have not independently verified it, and we cannot guarantee its accuracy or completeness. Investec’s internal data may not be audited. Except as otherwise authorised, this information may not be shown, copied, transmitted, or otherwise given to any third party without Investec’s prior written consent. © 2019 Investec Asset Management. All rights reserved. Issued January 2019.

More Related Content...

|

|

|