Don’t accept second best from your indirect property holdings

Written By:

|

Shaun McWilliam |

Shaun McWilliam of Kames Capital suggests that local authority pension funds should take an active approach to reviewing their indirect property investments

Most institutional investors accept the benefits of investing in property as part of a multi-asset portfolio. Specifically, property can offer:

- Attractive long-term returns with characteristics of both equities and bonds

- Relatively low volatility compared with other asset classes

- Diversification, through low correlations to other asset classes

- Stable and attractive income returns, with the potential for capital growth

- Inflation hedging characteristics

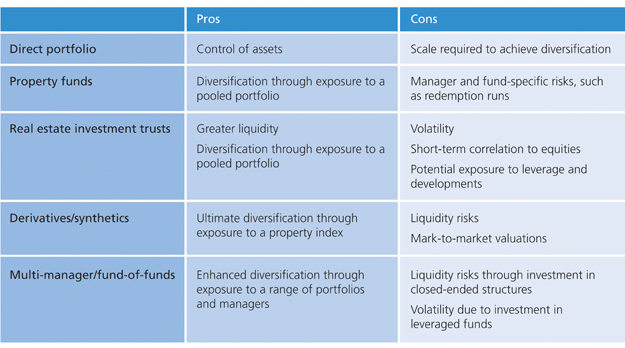

As Figure 1 illustrates below, there are various ways in which institutional investors can invest in property.

Despite so many options, there is no perfect solution. The choice of route will ultimately be determined by a range of considerations, not least an investor’s size, risk appetite and liquidity preferences.

Figure 1: Options for property investors

Source: Kames Capital

The multi-manager approach

A multi-manager or fund-of-funds approach can mitigate the risks of being exposed to a single fund. Instead of investing in a single property fund, a diversified multi-fund solution with exposure to different managers and styles can be attractive for local authority pension funds.

While this route undoubtedly spreads manager or fund risk, the typical multi-manager model of the past 10 years actually increased portfolio risk, through investing in closed-ended, leveraged specialist vehicles, in some cases outside the UK market. This resulted in multi-manager portfolios underperforming due to the employment of debt in poorly-performing, illiquid, closed-ended vehicles.

We know that many local authority pension funds have long-standing indirect property holdings which are inflexible and have underperformed. Yet they can be reluctant to review these, because of a misconception that few alternative options exist that would justify changing managers.

Demonstrating value from active multi-management

Warren Buffett famously observed that “Price is what you pay. Value is what you get.” This feels appropriate for the world of multi-manager property investment, where some investors focus purely on the additional layer of fees and so dismiss these approaches as offering poor value. We believe this view is naive and simplistic, failing to recognise the positive value that some multi-managers add.

In our view the ability to add value from active management is the most important benefit a multi-manager can offer. This includes identifying themes and sectors that will outperform. When is the right time to underweight the central London office sector? Is it better to tilt the portfolio towards prime or secondary assets? Should we view speculative developments positively at this point in the cycle or should we prefer long and secure income? These are just some of the questions that a good multi-manager should answer and then implement to add value for clients’ portfolios.

Active management is also about researching, selecting and reviewing managers and funds. High-quality multi-managers will add value by consistently picking outperforming managers and funds. At the same time they avoid those funds that have significant risks attached to them. This latter point is important as recent experience has shown that “passive” investors who do not actively manage their property holdings can suffer from poor performance. Any investor in a fund that has suffered a redemption run could testify to this.

Good indirect managers are active users of the secondary market. By reducing transaction costs, executing deals swiftly and implementing opportunistic and relative value trades, managers can add value to clients’ portfolios through judicious use of the secondary market.

A further benefit of the multi-manager approach is stronger governance. Multi-managers add value by working with underlying property managers to improve governance and fund terms for their clients. This can involve improved fee terms or negotiations over complex issues such as fund extensions, expiries or improved investor protection clauses.

The myth about fees-on-fees

Kames Capital’s typical management fee for a UK multi-manager portfolio is 0.25% per annum. This compares favourably to the fees charged by multi managers or fund-of-funds in other alternative asset classes. For example, the fees on hedge fund-of-funds and private equity fund-of-funds typically range from 0.5% to more than 1.0% per annum. Furthermore, it is common elsewhere to levy performance fees, which can be an additional 10% of profits on top of the base management fee.

Our relatively low fee for a typical UK multi-manager portfolio means that the value we can add by just a few active management decisions can easily offset the additional cost. For example, in a recent secondary market transaction Kames Capital’s Indirect Property Team saved a client costs equating to 25 years of our fees, compared to purchasing units on the primary market.

Summary

Many local authority pension funds have long-standing indirect property holdings which are inflexible and have underperformed. Their reluctance to review these is because they believe there are insufficient reasons to change.

We believe that high-quality multi-managers can successfully add value through truly active management and strong governance, with their fees more than offset by just a few successful decisions.

This article is not intended for retail distribution and is directed only at investment professionals. It should not be distributed to, or relied upon by, private investors. The information in this document is based on our understanding of the current and historical positions of the markets. The views expressed should not be interpreted as recommendations or advice. Past performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and is not guaranteed.

Where funds are invested in property, investors may not be able to switch or cash in their investment when they want because property in the fund may not always be readily realisable. If this is the case we may defer a request to switch or cash in units. Whilst property valuation is conducted by an independent expert, any such valuation is a matter of the valuer’s opinion. Property funds invest in a specialist sector, which may be less liquid and produce more volatile performance than an investment in broader investment sectors.

Kames Capital is an Aegon Asset Management company and includes Kames Capital plc (Company Number SC113505) and Kames Capital Management Limited (Company Number SC212159). Both are registered in Scotland and have their registered office at 3 Lochside Crescent, Edinburgh, EH12 9SA. Kames Capital plc is authorised and regulated by the Financial Conduct Authority (FCA reference no: 144267). Kames Capital plc provides segregated and retail funds and is the Authorised Corporate Director of Kames Capital ICVC, an Open Ended Investment Company. Kames Capital Management Limited provides investment management services to Aegon, which provides pooled funds, life and pension contracts. Kames Capital Management Limited is an appointed representative of Scottish Equitable plc (Company Number SC144517), an Aegon company, whose registered office is 1 Lochside Crescent, Edinburgh, EH12 9SE (FCA/PRA reference no: 165548).

More Related Content...

|

|

|