|

Mike Richardson Member of The Society of Pension Professionals Public Sector Committee, and Head of LCP’s Social Housing Practice |

Defensification: going beyond diversification

Written By:

|

John Stopford |

|

Jason Borbora |

John Stopford and Jason Borbora of Investec Asset Management describe their approach to Defending investments by seeking to understand their true behaviour and relationship with the economic cycle

Reading the signs of financial markets is always difficult, and the market environment today makes for a particularly tough analysis. Buoyed by unorthodox central bank stimulus, many stock markets have risen to expensive levels while investors have been drawn into riskier and higher yielding bonds in their hunt for income.

Despite the absence of asset price volatility, investor concerns are rising. How should they protect against the risk of a market sell-off now that this bull market is one of the longest on record?

Investors are right to be wary as avoiding significant losses can materially impact performance. Over the last 20 years, for example, an investor in the FTSE All Share who missed just the worst five months of performance would have beaten the index by over 600%.1 We believe the key to good investment defence lies in looking beyond the traditional, simplistic topdown approach to portfolio construction that many investors adopt, instead aiming to provide a defensive return made up of an attractive level of income, as well as capital growth over the medium term. The best way to achieve this consistently, we believe, is through the proper implementation of what we have termed defensification.

Within equities, for example, the perception that a company’s high dividend yield is a guide to its likely returns is erroneous. Simply because a company is paying out a high proportion of its earnings does not mean this is sustainable. What if the company is in distress or investors are forcing down the share price in anticipation of a dividend cut?

Similarly, high yields on sub-investment grade corporate bonds or emerging market debt may simply be warning of the risk of default.

Chasing yield without taking account of the accompanying risks can lead to painful capital drawdowns that far outweigh the level of income offered; often an asset offers a high yield because of the proportionately higher risks it presents. A bottom-up approach seeks to understand the sustainability as well as the level of an investment’s income stream in addition to its potential for capital appreciation.

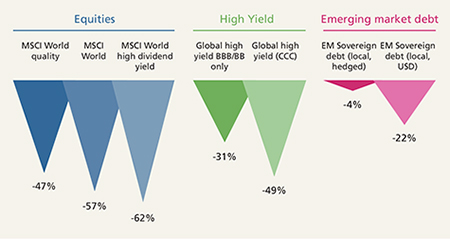

Take sub-investment grade corporate debt as an example. Those at the bottom of the credit rating spectrum, where the average yield over the past 10 years has been nearly double that of their more highly rated peers, suffered a drawdown in 2008/09 of nearly 20 percentage points more than less risky BBB/BB rated issues. Similarly, equities with the highest dividend yields underperformed the broader stock market during the financial crisis. A top-down approach may be able to achieve yield but it may come at the expense of resilience and capital.

Figure 1: Maximum drawdown over 10 years

Source: Bloomberg, Investec Asset Management, May 2017

A portfolio beyond diversification

A more defensive approach looks beyond simple diversification and the top-line yield offered by assets. Rather, it requires a genuine understanding of the resilience of the cash flows supporting the dividends and coupons paid by individual securities. This involves looking at measures such as profitability, the stability of cash generation, the debt burden and how much flexibility there is to deal with a changing economic environment.

What lies beneath true diversification?

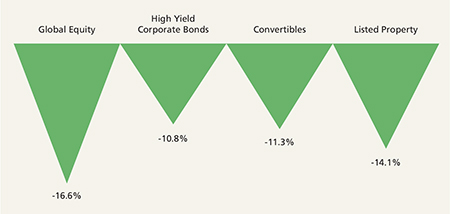

Holding assets which exhibit different return patterns provides the potential to build a portfolio that delivers a superior trade-off between risk and return. This is the concept of diversification. Problems occur, however, when diversification is improperly implemented (often when based on labels rather than behaviours) or when it is done just to reduce risk without also focusing on whether each additional position can also add to potential returns. For example, a portfolio invested in equities, high yield corporate bonds, convertible debt and real estate may appear on the surface to be diversified, with each asset sounding very different from the other. The reality however is very different because these securities may have different labels but they exhibit similar relationships to the economic cycle and therefore are susceptible to delivering negative performance at the same time, rather than providing the offsetting returns one would hope for from true diversification (see Figure 2).

Figure 2: Percentage return over equity drawdown across different labels (with similar characteristics)

Source: Morningstar, Bloomberg, BofA Merrill Lynch, Investec Asset Management. Drawdown from May 2015 to equity low of February 2016. Global Equity: MSCI World; High Yield Bonds: BofAML Original High Yield; Convertibles: BofA Merrill Lynch Global 300 Convertible; Listed Property: FTSE ERPA/NAREIT developed.

We divide assets into three groups: Growth, Defensive, and Uncorrelated according to how their returns are impacted by the economic cycle.

Determining any given asset’s classification relies on undertaking a quantitative and qualitative analysis of its behaviour relative to others. Above all though, to be used effectively, these classifications require an understanding beyond historical relationships and an anticipation of future trends. Below we give some commonly encountered examples of these.

Growth

These assets are positively correlated with the health of the global economy, being reliant on periods of economic expansion often for earnings potential or for spurring risk-seeking behaviour from investors. Consequently, we classify both shares and high yield corporate bonds as Growth assets rather than thinking of them as equities and fixed income. Other examples include property, and unhedged EM debt.

Defensive

By contrast, investments which have inverse relationships with the economic cycle offer Defensive properties, which can offset negative returns on Growth assets. These tend to deliver better returns in more difficult economic conditions. Currently we classify safe-haven currencies such as the yen as defensive, and whilst we still see high quality developed market sovereign bonds as offering such properties, an analysis of their return drivers has caused us to place less reliance on them as Defensive assets.

Uncorrelated

Certain asset classes are little affected by the economic cycle and therefore behave in an uncorrelated fashion compared with Growth and Defensive assets. These assets offer the potential to increase portfolio returns without adding to risk and so are very useful, particularly for defensively minded investors. Given the lure of yield for investors in recent times, finding genuinely uncorrelated assets with secure and attractive income streams are rare. Infrastructure investments, the cashflows of which are frequently backed by very longdated government funding, have traditionally represented such an investment; however, considerations of valuation and liquidity must be made when selecting such investments.

Beyond asset labels

How this helps defensification

Dividing assets in this way helps defend a portfolio in a number of ways.

Firstly, it allows for a smoother return profile as holding assets which exhibit truly diversified returns offsets the volatility of each individual holding in the portfolio.

Secondly, the process means there is less reliance on market timing: a characteristic-focused approach reduces the need for trading should high levels of market stress cause correlations in a superficially diversified portfolio to rise. This would need to be corrected by selling existing positions to guard against losses.

Finally, it allows the managers to prepare properly for the unexpected. Risky assets tend to experience their most significant losses in recessions which typically represent a small period of any economic cycle. This is not to say however that significant losses cannot occur outside of recessions.

A truly diversified portfolio keeps investors on guard for the significant drawdowns that can occur due to non-cyclical events while enabling investors to continue collecting income from their positions. Reducing the impact of drawdowns in this way can improve investors’ probability of meeting their goals over long-term periods.

For professional investors only.

Past performance should not be taken as a guide to future returns. Investments carry the risk of capital loss.

1. Investec Asset Management, Bloomberg, June 2017

2. Performance targets may not necessarily be achieved and are not guaranteed, losses may be made.

More Related Content...

|

|

|