Cyclicals to regain market leadership?

Written By:

|

Ritu Vohora |

Ritu Vohora of M&G Investments looks at the relative positions of defensive “bond proxies” and more cyclical sectors, and proposes a stance that may be appropriate in the current economic climate

Since bond yields bottomed a year ago, the leadership of the equity rally has continued to fluctuate. In the second half of 2016, as bond yields began to rise on reflation expectations, investors became more risk tolerant and there was a significant rotation away from the defensive “bond proxies” into more cyclical sectors. In the first half of this year, bonds rallied as reflation expectations subsided and equity leadership switched back to defensives. That was until the end of June, when central banks began to head for the QE (quantitative easing) exit in a move towards a more normal policy environment. Defensives then handed the baton back to cyclicals.

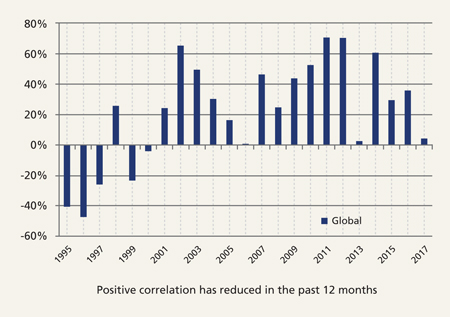

Yet while the rally’s leadership may have fluctuated, equities overall have continued to move higher with some indices boasting historical highs. Interestingly, the positive correlation between equities and bond yields (higher bond yields / higher equities, lower bond yields / lower equities) that held for much of this century appears to have broken down. This could be due to the deleveraging forces and extreme policies of the recent economic cycle distorting many past relationships.

Figure 1: Equity and bond yield correlation

Source: Citi Research, Datastream, July 2017

If that is true and equities have risen on the cumulative effect of years of cheap money, is the prospect of an end to QE the elephant in the room? Possibly. There is a chance that the end to asset purchases could impact liquidity adversely and lead to the repricing of risky assets. However, the somewhat stuttering inflation trend suggests that bond yields could stay sticky for a while and that central banks are more likely to act with caution.

Although bond yields no longer seem to cast such a spell over global equities, they nonetheless remain important in driving the leadership of the equity rally. There were clear winners and losers from QE: high quality, high yield and growth stocks have strongly outperformed since 2009, while value, low quality and low yield stocks have lagged. Since the market trough in March 2009, the MSCI World Growth index has outperformed Value by 45%, with the relative performance of the two styles closely following the expansion in central banks’ balance sheets.

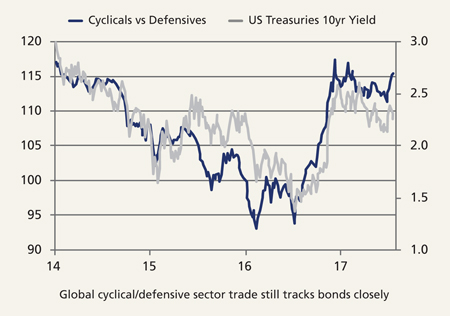

This trend is demonstrated in Figure 2, which shows how closely the cyclicals versus defensives relationship continues to track bond yields. Cyclicals outperformed strongly when bond yields rose following the US election last November, given the prospect of a more optimistic macro outlook with stronger growth and higher inflation. And more recently, hawkish central bank speak spurred their resurgence in June. Investor sentiment and preference for safety over the past few years has pushed many defensive stocks and so-called “bond proxies” to trade on expensive multiples with their valuations now looking stretched. On the flipside, cyclical areas of the market broadly remain attractively valued and look to provide the best opportunities, especially as we move to a more normal rate environment.

Figure 2: Global cyclical vs defensives and US treasuries

Source: Citi Research, Datastream, July 2017

A normalising global economy, with growth picking up and interest rates rising slowly, should be good news for risky assets such as equities and specifically for cyclical and value stocks. Importantly, robust economic data across the world supports the global reflation trade and with interest rates rising from such a low base, it could take some years before they reach restrictive levels.

A key driver to sustain the rally in equities will be earnings growth. Corporate earnings, largely stagnant over the last seven years, appear to be strengthening over recent quarters with many companies seeing upgrades to their 2017 earnings estimates. It is interesting to observe that relative earnings per share (EPS) momentum has been improving for cyclical stocks in absolute terms and against typically more defensive quality stocks. Currently, global sectors with above-average earnings and price momentum are all cyclical, including banks, industrials, tech and materials. In contrast, the more traditionally defensive sectors all have below-average earnings and price momentum, including consumer staples, utilities, and telecoms. History suggests stocks with relatively strong earnings and price momentum tend to outperform.

With the global economy on a relatively stable growth path, earnings improving and a high level of available capital for corporate investment spending, cyclical and value stocks look to offer the most potential. Improving fundamentals indicate the long-running bull market for stocks remains intact and a modestly pro-cyclical stance seems appropriate in the current environment.

For Investment Professionals only.

This article reflects M&G’s present opinions reflecting current market conditions. They are subject to change without notice and involve a number of assumptions which may not prove valid. Past performance is not a guide to future performance The distribution of this guide does not constitute an offer or solicitation. It has been written for informational and educational purposes only and should not be considered as investment advice or as a recommendation of any particular security, strategy or investment product. Reference in this document to individual companies is included solely for the purpose of illustration and should not be construed as a recommendation to buy or sell the same. Information given in this article has been obtained from, or based upon, sources believed by us to be reliable and accurate although M&G does not accept liability for the accuracy of the contents.

The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook.

M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at Laurence Pountney Hill, London EC4R 0HH. M&G Investment Management Limited is authorised and regulated by the Financial Conduct Authority. IM-604 08/17

More Related Content...

|

|

|