Creating resilient property income through responsible investment

Written By:

|

Paul Myles |

|

Guy Glover |

Paul Myles and Guy Glover of BMO Global Asset Management look at how including environmental, social and governance (ESG) property alongside a traditional property allocation can create longer-term and more resilient income whilst improving residual values

There are many uncertainties around how illiquid assets will fit into the new Local Government Pension Scheme (LGPS) structure after the pooling of 89 LGPS funds in England and Wales into the proposed eight new investment pools. What is not uncertain, however, is that the UK government has indicated it wants the current reforms to lead to improvements in the way local authority funds approach ESG considerations.

Against a backdrop of market volatility and economic uncertainty following the vote by the UK to leave the European Union coupled with low/negative interest rates, institutional investors are facing a challenging environment in which to find investment opportunities that will provide a meaningful income stream. Will property continue to perform and how is it positioned against other asset classes?

The continued income appeal of commercial property

In a world in search of income, real estate still has the ability to provide a sustainable attractive level of income combined with the possibility of growing that income and producing capital appreciation. Property features in most portfolios as a long-term stable allocation and for many local authorities and other pension funds, allocations have remained consistent recently not only as a result of an asset allocation call delivering outperformance, but also as a proxy for corporate bonds whilst providing a significantly higher income. With commercial property currently yielding over 5%, this is not an asset class which can be easily ignored and with income backed by long-term leases usually with excellent covenants, property is ideally positioned to continue to deliver going forward, despite the recent, arguably overdone, liquidity “scare”.

Providing an attractive and sustainable level of income is only one aspect of the total return; other important characteristics of property include the potential growth and protection of the residual value.

In this article, we discuss the benefits of:

- Including ESG credentials in property stock selection

- Successful asset and property management in order to deliver a stable income and protect capital values

- Reducing risk

- Satisfying the requirements of the all-important occupier

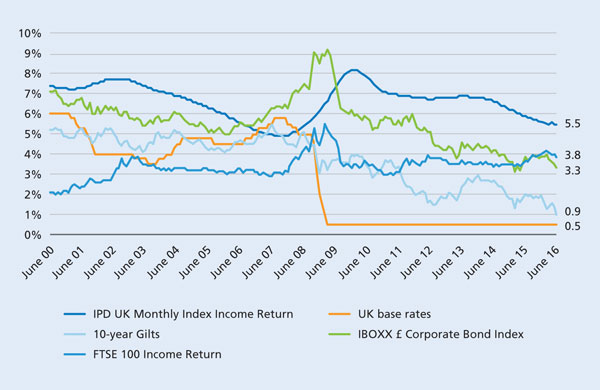

To begin with, let’s consider the income side and where this sits relative to other income-yielding asset classes. Typically, property delivers an income of between 5% and 7%. As shown in Figure 1, property is currently delivering an income return of 5.5%. This is more than 4.5% above that of Gilts and 2% above corporate bonds. Importantly in both cases, the income from property is significantly more than the income delivered from these asset classes.

Figure 1: Income spread as at end June 2016

Source: IPD monthly index, Datastream as at 31.07.2016. FTSE International Limited (“FTSE”) © FTSE 2016

Taking a longer-term look at the income return from property as shown above, with the exception of 2007 and early 2008, the persistently higher income is clearly demonstrated. Of particular note is the relationship between corporate bonds and property where the typical 1% margin between the two broke down in 2012 with the onset of quantitative easing (QE). Income is steady, contractually based and also significantly higher than the other asset classes.

Figure 2: Long-term income return asset class comparison

Source: IPD monthly index, Datastream as at 31.07.2016. FTSE International Limited (“FTSE”) © FTSE 2016

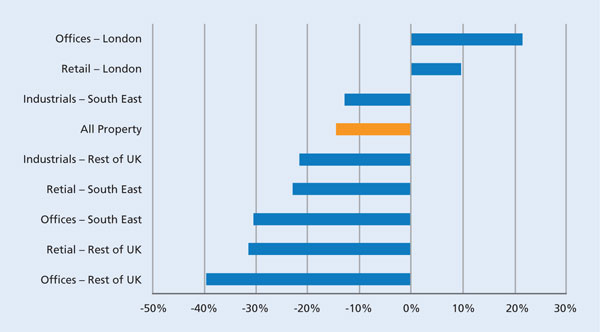

The concern therefore turns to capital values – how resilient are these and where are we in the cycle? Whilst Central London offices look overpriced on most valuation metrics once you look past the headlines, values outside core London remain some 15% below 2007 levels and for some sectors over 25% below their previous peak, see Figure 3. For example, an office building in a good quality, growth location such as Cambridge, let on a long-term lease to an excellent covenant at a yield of 6% plus, seems to be sensibly priced.

Figure 3: Capital values discount from 2007 as at end June 2016

Source: IPD Quarterly Digest, IPD Key Centres Report as at 31.07.2016

Pricing has been significantly tested by the recent referendum. The vote to leave would surely destabilise occupier demand, therefore causing the occupational market to decline feeding through into pricing by investors. In practice, since the referendum result, occupiers have remained resilient, confidence in pricing has quickly been re-established and the newspaper-headlined falls of 20% have not transpired, with a correction of around 3% being more typical – a frequent level of volatility in the equity markets!

Quite simply the “Brexit” referendum has not had the impact many of the headlines suggested. Indeed, with interest rates having now fallen further the income attraction from property has, for some investors, been enhanced. But the pause in the market post the referendum has meant a reassessment of the asset class, current pricing and its income attraction. All of which remain as valid now as they were before the referendum, albeit with an increased uncertainty in relation to the occupier market.

Why apply responsible investment to property?

Regulation has a huge impact on property markets. The continuing evolution of Environmental, Social and Governance (ESG) practices, driven by international agreements to reduce our impact on climate change, such as COP21, puts pressure on the property industry to improve. In the UK, whilst recently the UK government has not been driving the agenda, legislation is coming to the fore and therefore it is important that property investors are aware of the challenges this presents for property owners and occupiers. Such regulation now touches property at all stages – design, development, construction, letting, operation, lease agreements and refurbishment. Investors should not only consider current regulation but also future possible legislation in order to remain ahead of the ever-changing landscape.

As an example, Energy Performance Certificates (EPC’s) which rate a building’s energy efficiency, whilst a blunt instrument, have the potential to undermine value. Regulation, coming into force on 1st April 2018, requires that buildings rated as “F” or “G” are upgraded, otherwise they will simply not be able to be let or sold in the future. Retrofitting buildings and refurbishment is expensive and screening properties and portfolios in this regard remains essential. A similar move to include “E”-rated buildings within this legislation would result in capital expenditure being required of around 30% of the UK stock.

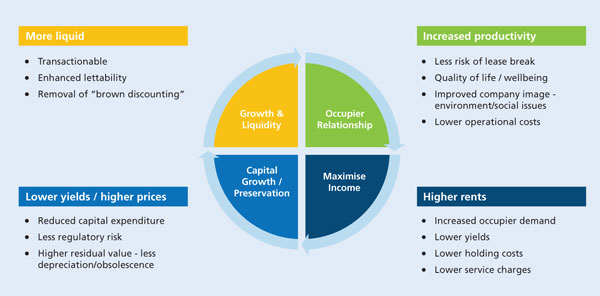

A stronger rationale for applying ESG credentials to property is simply that it makes financial sense. There is a “virtuous circle” which can be achieved by creating a building which incorporates strong sustainability credentials. Such a building will have lower operational costs, and meaningfully incorporating ESG values is likely to significantly increase the appeal to potential occupiers. This translates into a quicker letting of an asset, and therefore earlier income generation and arguably a higher income return through increased occupier demand.

Importantly it also has a significant impact on the investment side – a better building commands a lower yield and therefore a higher price. In the case of an asset with ESG credentials it will tend to have lower regulatory risk and therefore lower future capital expenditure requirements, lower tenant turnover leading to less depreciation/obsolescence creating a higher residual value. This improves liquidity and removes any potential brown discounting. This virtuous circle is demonstrated in Figure 4.

Figure 4: Financial benefits of ESG incorporation into asset management

Source: BMO Real Estate Partners (BMO REP)

Holding an asset with good ESG credentials makes sense, but it is important the building operates in the manner it is designed; having a strong relationship with occupiers is essential. The inclusion of “green” lease clauses enabling the disclosure of both the occupier and owner’s utility usage is a key component. This goes further with a joint contract between occupier and owner to deliver on potential savings through cooperation even if it results in capital investment. For particular clients we are now including these lease clauses as standard instructions to our lawyers for all new leases and renewals.

Advances in technology are making recording an organisation’s ESG impact easier, and the expected levels of transparency make not embracing a Responsible Investment agenda a risk in itself. A desirable asset that meets today’s and tomorrow’s expectations will reduce risk within a portfolio by creating resilient and longer-term income whilst protecting residual values.

Mainstream or specific ESG agenda?

The investment case for including ESG credentials is well documented. The investment case applies regardless of the intended holding timescale for an asset as improved returns can quickly be obtained by reducing costs which impact on the net income. Therefore, should ESG criteria be applied to all types of property funds as a mainstream investment approach?

The fiduciary answer is that there is a compelling case for all investors to adopt ESG criteria in all aspects of property investing, from stock selection through to day-to-day management. In time, this will come as the investment case becomes more explicit in the pricing of assets and also as expertise develops.

But if ESG criteria is adopted as standard for property funds, does this diminish the case for specific ESG-targeted property strategies? At BMO REP, Responsible Investing encompasses not only generic ESG criteria but also the idea that ESG application should be taken further to set a standard in the industry.

We define this positive step as the implementation of our “3i’s”:

- Targeted investing

- Improving stock

- Impact investing

We see this evolution in much the same way as a Responsible Investment equity fund manager who previously looked at only negative screening, but over time developed the portfolio construction to include best practice of positive engagement with companies. More recently this is evident in targeted investing where there is the ability to address an ESG agenda by investing in firms which lead by example.

Figure 5: Responsible Investment Approach

Source: BMO Real Estate Partners (BMO REP)

1. Targeted Investing

We consider this in the context of commercial stock with market leading ESG credentials, such as Figure 6 – The Leonardo Building, which we believe will reduce portfolio risk and improve the resilience of the income and residual values. This tends to be in new stock let on long-term leases with excellent covenants. The initial marginally tighter yield will be more than offset by enhanced growth and improved residual values. This can be applied to standard commercial real estate – offices, logistics and retail, which can also include alternatives sectors.

Figure 6: Leonardo House, Crawley

Let to Virgin Atlantic on a 16-year lease with a Building Research Institute Environmental Assessment Method BREEAM Excellent rating – Held in the F&C UK Commercial property Trust. Source: BMO Real Estate Partners

2. Improving stock

We implement this by actively tackling the ESG agenda – taking failing buildings from an ESG and investment perspective and targeting the capital expenditure to create resilient capital growth. Targeted returns will typically be double digit as the building becomes significantly more appealing to occupiers. Importantly a reduced yield/higher price combination can be commanded not only because of the improved income stream but also as the asset has been protected from the need to incur future capital expenditure from a regulatory perspective.

3. Impact investing

For example, this could be targeted investment in primary or secondary healthcare, bridging the gap for funding social housing or working with charitable organisations. As a specific case study, we have a relationship with a charity where there is the possibility of creating assets for vulnerable individuals that specifically meets their care needs. As studies have shown this not only provides benefits to the health and wellbeing of the individual but also lowers their support costs and eases funding requirements for the charity. The social impact can be immense. This type of investment can also create long-term government-backed income streams often with inflation hedging. This is ideal for an investor seeking a stable long-term income with growth, or for liability matching.

Working with enlightened investors, there is the opportunity to go beyond the standard ESG criteria applied to property portfolios to make a positive impact by targeted investing producing a market-leading solution. This approach also facilitates the creation of portfolios with targeted CO2 emissions. By working with our partners, there is also the opportunity to create a portfolio with COP21 (climate change) ambitions with regard to matching, or even beating, the two degree centigrade threshold.

Conclusion

COP22 and beyond will follow. Each successive COP (Conference of the Parties) meeting has and will continue to bring further progress, further commitment, and further sophistication. At times it may be marginal, but occasionally transformational.

The same philosophy can be applied to real estate investment and management. When the issue of climate change and greenhouse gas emissions are distilled down to relevance on an individual asset level, it’s mainly about the key impact areas of energy, water, and waste with transport not far behind. It’s about seeking out efficiencies, about careful resource use, about eliminating waste. It’s about the location of buildings, their adaptability and flexibility, desirability and amenity. There have been similar considerations for many years, but as with the evolution of COPs, the development of engagement with buildings has become more sophisticated over the years.

The property investor is now faced with greater and more demanding legislation, sometimes transformational as with minimum energy performance standards. With this comes greater scrutiny from potential occupiers and from third party assessors providing independent verification of credentials.

As more countries join and ratify the outputs of COP, so more organisations are looking for the reputational benefits of pursuing responsible property practices. The direction of travel for the responsible agenda is clear and investors in the UK are making significant headway at a time when much of the industry is standing still.

More Related Content...

|

|

|