Co-investments: intelligent portfolio construction over market cycles

Written By:

|

Oliver Schumann |

|

David Smith |

Oliver Schumann and David Smith of Capital Dynamics discuss how a global, well-diversified and actively managed co-investment fund can help generate outperformance and mitigate risk

Private equity investment decisions can be challenging in the current market due to high valuations caused by an abundance of capital, high levels of leverage and concerns about a potential economic downturn.

Despite this, the alpha generated by well-performing private equity firms remains an attractive prospect for investors considering medium- to long-term investments. However, greater returns are often allied with increased risk. Investors should therefore pay close attention to risk mitigation when constructing a private equity portfolio.

This article explores how an actively managed mid-market co-investment fund1 properly diversified by region, sector, vintage and lead investor can generate outperformance while mitigating risk when compared to conventional private equity funds (or funds-of-funds). This balanced investment approach is known as intelligent portfolio construction.

Co-investment funds and their diversification

Co-investment funds have developed and professionalised over the last 10-15 years as an early ad-hoc approach to making individual co-investments often led to unsatisfactory returns.

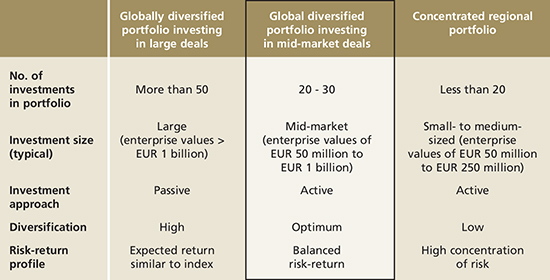

The market for co-investment funds comprises three principal approaches to portfolio construction and diversification:

- Globally diversified portfolio investing in large cap. transactions

- Globally diversified portfolio investing exclusively in mid-market companies

- Concentrated regional portfolio

As illustrated in the column highlighted in Figure 1, a global mid-market portfolio that is actively managed and well diversified should provide the best returns with optimum diversification, particularly for investments with an enterprise value of less than EUR 500 million.

Figure 1: Illustrative co-investment fund diversification models

Source: Capital Dynamics

Criteria for selecting attractive co-investments

As with other investment strategies, co-investment fund managers must possess the skillset to identify attractive investments and achieve strong performance.

It is really only a dedicated primaries platform, with a broad and deep network of top-performing private equity managers focused on smaller companies (i.e. less than EUR 500 million), that possesses the capabilities to adopt intelligent portfolio construction. Ideally, the co-investment fund manager should have a global network of several hundred lead investors spread across the key geographies, sectors and investment strategies. Independent academic research has endorsed the importance of deal flow derived from a broad network2.

In addition to having a broad network of lead sponsors from whom to source opportunities, the co-investment manager needs to be able to assess the characteristics of the target companies, including:

- Quality and experience of the target company’s management team

- The target company’s market position and barriers to entry for potential competitors

- Growth opportunities (e.g. regional, new product introductions and acquisitions)

- Target company valuation, capital structure and cash flow

- Responsible investment criteria (including ESG3 matters)

Finally, the credentials of the lead investor and their relevance to the contemplated investment must be assessed – a much easier task if the asset management firm has been invested in the lead investor’s fund for some time and knows the firm and its principals well.

Not surprisingly, the best co-investment opportunities are accessed by co-investment funds which have the relevant experience to perform due diligence, and negotiate attractive entry prices and capital structures, alongside a lead investor.

Co-investment outperformance

While some private equity investors have held the view that co-investment suffered from adverse selection (i.e., selection bias), recent comprehensive academic research has shown this to be a myth. In their study, Braun, Schemmerl and Jenkinson analysed over 1,000 co-investments from among over 13,000 private equity transactions between 1981 and 20114.

Their results showed that “the like-for-like comparison between co-investments and other deals [not offered for co-investment] found no evidence of selection bias, either positive or negative.” They also concluded that portfolios of co-investments could achieve better returns due to their lower costs5: “…We show that relatively small portfolios of 10 buy-out [co-investment] deals on average outperform [conventional] fund returns, net of fees and costs.”

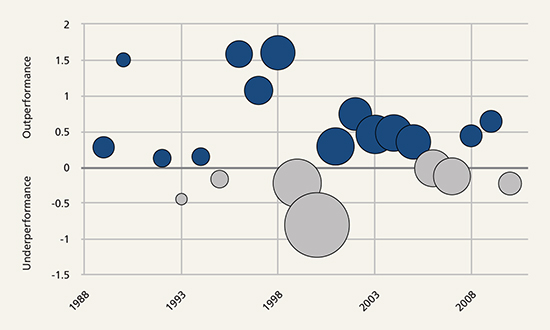

Figure 2 illustrates the performance of co-investments versus investments not offered for co-investment (i.e., conventional private equity fund performance). The blue bubbles show outperformance of co-investments while the grey bubbles show their underperformance. The bubble size indicates the amount of capital invested in specific years. What is striking is that the outperformance of co-investment funds (relative to conventional PE funds) appears more frequently, and on occasion, can be substantial. Conversely, relative underperformance occurs less frequently, principally around the time of the dotcom crash and global financial crisis when a lot of capital was chasing deals (so-called pro-cyclicality).

Figure 2: Performance of co-investment versus investments not offered for co-investment6

Source: Adverse Selection and the Performance of Private Equity Co-Investments. Braun/Jenkinson/Schemmerl, October 2018.

Note: Bubble size indicates the amount of capital invested in specific years.

Co-investment risk mitigation

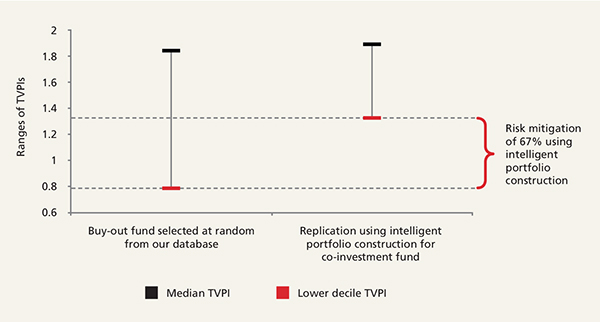

One approach to the mitigation of risk is to ensure that co-investment fund portfolios are constructed based on the four principal diversification pillars of geography, sector, vintage year and lead investor. To explore the impact of intelligent portfolio construction on risk, simulations were carried out using proprietary data on 268 actual private equity funds with vintage years between 1995 and 2010 and their 4,739 underlying portfolio companies7.

The results showed that a co-investment fund implementing intelligent portfolio construction (i.e., properly diversified and actively managed) has far greater downside protection than that of a randomly selected buy-out fund constructed by a single manager. This is illustrated in Figure 3 using the spread between the median and lower-decile ratio of Total Value to Paid-in Capital (TVPI) as a measure of risk. The aforementioned co-investment fund significantly mitigates risk versus that of a buy-out fund selected at random from our database; by 67% when comparing each of their lower-decile TVPI figures. These results are further supported by evidence from a sample based on Preqin data8.

Figure 3: Risk mitigation through intelligent portfolio construction8

Source: Capital Dynamics, January 2017 and 2019.

Note: The investment multiple is also known as the total value to paid-in (TVPI) multiple.

Impact of market cycles on co-investment selection

A balanced and attractive portfolio is one where a co-investor deliberately over- or under-weights individual regions, sectors, transaction sizes and/or transaction structures depending on the stage of the market cycle. Figure 4 provides examples of investment trends that have led to very successful private equity transactions. As a co-investor with privileged access to the corresponding lead investors, one can benefit from the value creation potential of these transactions.

Emerging from the global financial crisis (2009-10), there were good opportunities for medium-sized companies in the portfolios of private equity firms to expand their market positions in various regions (particularly in Asia), either organically or through add-on acquisitions. Access to agile capital provided by private equity firms was crucial in this period. Since the entry prices at the time of the purchase of the companies were often moderate and increased significantly over the course of the cycle, some very successful transactions were consummated.

Later in the economic cycle (2014-16), the co-investor was offered the opportunity to invest in transactions with high-value creation potential, especially in the software and services sector, as the growth momentum remained high in those sectors and entry prices were still very attractive compared to current valuations.

More recently (2016 onwards), thoughtful co-investors have looked for transactions that provide a higher degree of downside protection to safeguard against the uptick in market volatility. In addition, investments with specialist sponsors – typically completed outside auctions at attractive entry valuations – increased in popularity.

These reflect some of the trends that co-investment managers were following throughout the market cycle.

Figure 4: Examples of attractive co-investments at various stages of the market cycle

Source: Capital Dynamics

Conclusion

Academic research confirms that investing in a global, well-diversified and actively managed co-investment fund can be an attractive way of generating outperformance (and mitigating risk) versus a lead investor’s fund, particularly in the mid-market. Outperformance is attributable to the lower overall costs of a co-investment fund for an investor compared to those of a conventional private equity fund. Risk mitigation is derived from the diversification achieved through intelligent portfolio construction.

A capable co-investment team can add value by capturing trends that take account of market cycles (e.g. with higher value creation potential and/or more downside protection) and should either deliberately over- or under-weight individual regions, sectors, transaction sizes and/or transaction structures depending on the stage of the market cycle. This approach is particularly important late in the cycle.

1. Co-investments are defined as investments in the equity of individual companies made alongside third-party private equity firms (“lead investors”), generally involving a controlling consortium.

2. Adverse Selection and the Performance of Private Equity Co-Investments, Braun/Jenkinson/Schemmerl, October 2018.

3. Acronym for environmental, social and governance aspects of investment.

4. Adverse Selection and the Performance of Private Equity Co-Investments, Braun/Jenkinson/Schemmerl, October 2018.

5. The annual management fees and carried interests of a private equity co-investment fund are generally set at a level which is approximately half that applicable to a typical private equity fund active in the mid-market.

6. Net performance shown in terms of Public Market Equivalent (PME).

7. Capital Dynamics. Andrew Beaton, Andrew Bernstein and Philippe Jost, “Commingled co-investment funds: an attractive way to gain exposure to private equity”, Capital Dynamics, January 2017. The analysis was refreshed in January 2019, leading to a similar conclusion. Further information is available upon request.

8. Capital Dynamics’ calculation and analysis based on Preqin data using a sample of 64 multi-manager co-investment funds as of June 30, 2018.

Disclaimer

This document is provided for informational and/or educational purposes. The opinions expressed are as of June 2019 and may change as subsequent conditions vary. The information herein is not to be considered investment advice and is not intended to substitute for the exercise of professional judgment. Recipients are responsible for determining whether any investment, security or strategy is appropriate or suitable and acknowledge by receipt hereof that neither Capital Dynamics AG nor its affiliates (collectively, “Capital Dynamics”) has made any determination that any recommendation, investment, or strategy is suit-able or appropriate for the Recipient’s investment objectives and financial situation. A reference to a particular investment or security by Capital Dynamics is not a recommendation to buy, sell or hold such investment or security, nor is it an offer to sell or a solicitation of an offer to buy such investment or security. Capital Dynamics may have a financial interest in investments or securities discussed herein or similar investments or securities sponsored by an asset management firm discussed herein. Certain information and opinions herein have been provided by a number of sources that Capital Dynamics considers to be reliable, but Capital Dynamics has not separately verified such information. Nothing contained herein shall constitute any representation or warranty and no responsibility or liability is accepted by Capital Dynamics as to the accuracy or completeness of any information supplied herein. Before relying on this information, Capital Dynamics advises the Recipient to perform independent verification of the data and conduct his own analysis hereto with appropriate advisors. Analyses contained herein are based on assumptions which if altered can change the conclusions reached herein. Capital Dynamics reserves the right to change its opinions or assumptions without notice. This document has been prepared and issued by Capital Dynamics and/or one of its affiliates. In the United Kingdom, this document is issued by Capital Dynamics Ltd., which is authorized and regulated by the Financial Conduct Authority. For residents of the UK, this report is only directed at persons who have professional experience in matters relating to investments or who are high net worth persons, as those terms are defined in the Financial Services and Markets Act 2000. In the EU, this document is issued to investors qualifying as professional investors (as that term is defined in the Alternative Investment Fund Managers Directive) by Capital Dynamics Limited (authorized and regulated by the Financial Conduct Authority). Registered office: Whitfield Court, 2nd Floor 30-32 Whitfield Street, London W1T 2RQ, Company No. 02215798. In the United States, this document has been issued by Capital Dynamics Inc., an SEC-registered investment advisor. Redistribution or reproduction of this document is prohibited without written permission. Past or hypothetical performance is not a guarantee of future results and returns may increase of decrease as a result of currency fluctuations.

More Related Content...

|

|

|