Capitalising on the complexity premium in CLOs

Written By:

|

Dónal Kinsella |

Dónal Kinsella of Eaton Vance Management examines the risks inherent in CLOs, arguing that they offer attractive return potential and other risk-mitigating factors, and can perform a useful role in a well-managed investment strategy

Within the credit universe, collateralised loan obligations (CLOs) have garnered increased attention in recent years from investors and the financial press. In part, the growing interest reflects the significant role that CLOs play as investors in the loan market: CLOs accounted for 71.4% of primary loan demand as at 31 December 2019, up from 50% 10 years earlier.¹

Although they have piqued interest, CLOs’ complex securitisation structure has left the asset class poorly understood, as misconceptions related to CLO riskiness persist. In our view, the CLO securitisation structure is durable not in spite of its complexity, but precisely because of it. CLOs are often more niche, bespoke and intricately-designed investment products than typical structured credit assets. Thus, there is a complexity premium that can be earned by managers who possess the right skillset, experience and investment resource.

Securitisation boosts credit support

CLO securitisation, which is key to the asset class risk and return profile, is one area that is often most misunderstood. Simply, CLO assets, which include a diversified pool of senior secured loans (typically B-rated average quality), provide cash flows that fund CLO liabilities – those being tranches of debt issued at differing priority levels for repayment and loss. Residual income accrues to an equity tranche, with its investors sitting in the first loss position.

The equity pool plays a critical role in fortifying the CLO capital structure; the structure is essentially overcollateralised, holding more assets than liabilities. Transparency on the holdings of secured collateral and regular performance tests also strengthen the structures. Specifically, tests on asset credit quality, par value and interest coverage are embedded into CLO covenants and act to alert the CLO manager and investors to any deterioration in the quality of collateral.

Minimal impairments historically

Unlike collateralised debt obligations (CDO), with which CLOs are so often confused, CLOs have enjoyed high levels of credit support and an overall low level of impairment historically. According to Moody’s analysis of 7,265 debt tranches over 1993-2016, there were just 53 principal and zero interest impairments. Almost 80% of these impairments came from pre-2003 CLOs, which had lower levels of credit support than later vintages, particularly post-crisis structures.

Our own analysis shows that in the past, a loss rate of 8% on a CLO’s underlying collateral would have been required before a typical BB-rated tranche became impaired – a level roughly twice that of today’s rate. Lastly, it is worth noting that CLO tranches rated AAA and AA have never experienced a default, while default rates for lower-rated tranches compare favourably to corporate equivalents.

An attractive investment option

CLOs derive a number of benefits from their underlying loans, such as the potential to hedge against inflation and interest-rate risk. The benefits of CLOs do not stop there, however, as several other attractive features remain.

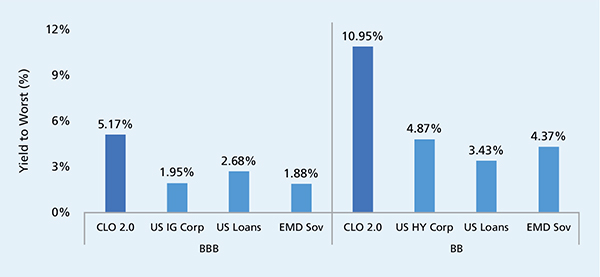

For starters, CLOs provide a superior yield in comparison with similarly rated credit assets. See, for example, the yield of 10.95% available on BB-rated CLO tranches, which compares favourably with the 4.87% for US high yield and 4.37% for emerging market sovereign bonds (see Figure 1).

In addition to securitisation, CLOs have other risk-mitigating features. Concentration limits on an issuer, credit rating, deal size and industry basis help to ensure that the collateral pool is well diversified, with a skew toward more liquid and broadly-syndicated, senior-secured and first-lien loans. In times of acute volatility, the absence of mark-to-market tests can act as another stabiliser, as CLOs would be unlikely to face forced collateral sales.

CLOs also offer extra protection from prepayment risk. Unlike bank loans, which have light call protections, CLO bonds typically have non-call periods lasting 1-2 years. That is an advantage for investors in CLO tranches, but implies that CLO managers must be prepared to manage prepayments and cash flows.

Lastly, CLO products are actively managed, unlike some other securitised products. During the vehicle’s reinvestment period, usually a 4-5 year window, CLO managers can alter the collateral allocation mix to manage risk, realise capital gains and take advantage of spread and relative value opportunities.

Figure 1: Comparative five-year credit yields

Source: Eaton Vance, ICE Data Indices, LLC, LCD, an offering of S&P Global Market Intelligence, as at 30 September 2020. Past performance is not a reliable indicator of future results. Data provided is for informational use only. CLO tranches are USD 2.0 CLOs. Loans represent the S&P/LSTA Leveraged Loan Index. CLOs represent the JPMorgan CLOIE Post-Crisis. US IG Corps represent the ICE BofA US Corporate Index 1-10 Year. US HY Corp represent the ICE BofA US High Yield Index. EMD Sov represent the J.P. Morgan EM Bond Index (EMBI) Global Diversified.

Potential risks

While the yield advantage over similarly-rated areas of fixed income is readily apparent, the extra yield compensates for some additional risks, of which investors need to be mindful.

Firstly, as leveraged products, CLOs derive many benefits from their underlying bank loans, but also share some credit risks, which can be higher for sub-investment grade securities. Unlike mutual funds, however, CLOs reapportion the risk-and-reward profile across the capital structure: equity holders and investors in lower-rated tranches assume greater risk, albeit with the potential for earning higher returns.

As less liquid products, price volatility is another area to monitor. Navigating potential liquidity risks, particularly for lower tranches, requires careful analysis. While we believe that credit risks are typically lower than for corporate credit, we accept that the price volatility may be greater. Importantly, liquidity generally decreases as you move down the capital structure with smaller tranches of debt issued and thinner trading liquidity.

Lastly, a final risk related to the performance variability between CLO managers merits close attention from prospective investors. With an outlook for continued market volatility ahead, the capabilities and investment approach of CLO managers and tranche investors will remain key.

Complexity can make CLOs a challenging investment area, having characteristics that lend themselves to skilled investment expertise. It is not always easy, however, to find managers having the capability and breadth of investment experience across CLOs and floating rate loans. True, the complex design grants the assets a certain level of durability, but for the uninitiated that complexity can obscure the analysis of risk and relative value between assets and across the capital structure of individual CLOs.

Notwithstanding potential risks, we see compelling value in the asset class and believe that risks, where they exist, can be managed and mitigated through a careful and judicious approach to security selection. Moreover, for investors with long-term time horizons (eg, pension funds), the compensation available for the liquidity and volatility risks in this asset class is, in our view, very attractive.

Conclusion

In summary, the securitisation structure of CLOs provides investors support and security that is unique in the leveraged credit space. While the structures are complex and are best accessed by managers with the requisite skillset, they are not to be confused with collateralised debt obligations, which had inherent design flaws. In fact, credit enhancement for CLO vintages has only improved over the past decade and systemic risk appears low, in our view. Within the leveraged credit space, CLOs offer attractive return potential as well as other risk-mitigating advantages. Considering these factors, we believe that a properly-executed CLO investment strategy can be attractive as a stand-alone proposition, complement a loan allocation or play a particularly constructive role for investors in a multi-asset credit strategy.

Important Additional Information and Disclosures

Sources of data: Eaton Vance, ICE Data Indices, LLC, LCD, an offering of S&P Global Market Intelligence. Data is as at 30 September 2020, unless otherwise specified.

This material is presented for informational and illustrative purposes only. It should not be construed as investment advice, or to adopt any particular investment strategy Investment views, opinions, and/or analysis expressed constitute judgments as of the date of this material and are subject to change at any time without notice.

This material is for the benefit of persons whom Eaton Vance reasonably believes it is permitted to communicate to and should not be forwarded to any other person without the consent of Eaton Vance.

In the United Kingdom, this material is issued by Eaton Vance Management (International) Limited (“EVMI”), 125 Old Broad Street, London, EC2N 1AR, UK, and is authorised and regulated by the Financial Conduct Authority. for Professional Clients/Accredited Investors only.

1. Source: S&P/LCD. As at 31 December 2019.

More Related Content...

|

|

|