Buy and maintain credit for local authority pension funds

Written By:

|

Shalin Shah |

Shalin Shah of Royal London Asset Management explains how inefficiencies in corporate credit can be used to the advantage of LGPS funds

In September, the Federal Reserve chose again to defer a rise in interest rates. While Chair, Janet Yellen, has suggested that interest rates may rise before the end of the year, such a move faces continual headwinds from economic uncertainty, both at home and globally. Therefore for the time being, government bond yields remain low and policymakers continue to force investors to take higher risks to achieve a real return.

This is a difficult backdrop for Local Government Pension Scheme (LGPS) funds, as they aim to improve funding levels. In addition they face a relentless focus on cost saving, and for some, difficulties in managing negative cashflows. There is no immediate solution to the central dilemma for many pension schemes; that their portfolios may not provide a sufficiently high return to meet their future liabilities.

Corporate credit is, in many ways, a natural choice to address some of the difficulties faced by LGPS funds: credit-based yields are often used to determine the value of the scheme liabilities, which means it is a good matching asset class. Yields are higher than those available on government bonds, which can help close the funding gap.

But perhaps more importantly, corporate credit markets also have a number of structural inefficiencies that investors can exploit to reduce risk and improve returns. It is a market that lends itself to stockpicking and proprietary research, meaning that an active approach to sector and stock selection can add significant value over and above that available from a typical benchmark index.

The liquidity premium

Liquidity in corporate credit markets has become widely discussed and may seduce investors into thinking that they need to be invested in highly liquid bonds. Indeed, in the market many investors are paying a premium – in terms of loss of yield – for bonds that are large and relatively more readily tradable. However, LGPS funds, as long-term investors, do not necessarily need this liquidity. Investors with a long-term horizon do not need to pay for secondary market liquidity that they are unlikely to use, and can therefore use the high premium placed on liquidity to their advantage, by investing in relatively less liquid bonds.

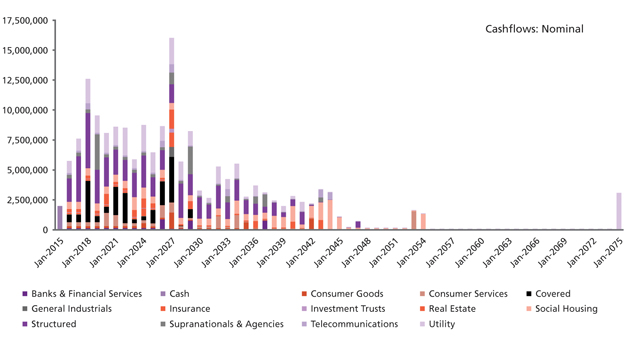

Pension funds should also consider that trading bonds in an illiquid market can add significant cost. In the current market bid-offer spreads are high and investors may lose 1% on the spread alone. For long-term investors, a better option may be to build a portfolio for which bonds are bought and held – the “maintain” part of a “buy and maintain” strategy. The maturity profile of the bonds can then be managed to meet a pension fund’s future liabilities. This also “frees” the fund manager to invest in smaller or relatively less liquid bonds, where yields may be higher, just because the bond may be outside of indices due to the size of the issue rather than the credit-worthiness of the issuer. This improves the local authority’s funding and cashflow position, without increasing the risk.

Figure 1: Importance of diversified cashflows to meet long-term liability

Source: UBS Delta, UBS and RLAM as at 4th June 2015

The inflexibility of ratings

Also, many corporate credit investors are dependent on the ratings providers for guidance on the creditworthiness of individual bond issuers and this creates some short-term mispricing within the market. They are used to construct benchmarks and in many cases as the starting point for portfolio construction (e.g. due to regulatory requirements on banks or insurance companies that increase capital requirements based on ratings). Investors, via the ratings, often place most emphasis on the probability of default and therefore fail to price in correctly the recovery value when making investment decisions. As such, the agencies treat asset rich and asset light companies the same.

In many cases, as senior secured lenders, if a company defaults on its bonds, the bondholders can expect to take control of assets or cashflows that will significantly enhance recovery prospects.

For example, within our portfolios we hold the bonds of the Grosvenor Estates. A desire for a higher perceived level of liquidity can blind investors to such an opportunity. At £200 million, the bond size is too small to enter credit indices, and is also too small to attract the interest of the largest funds, as it may be perceived as too illiquid. However, this is a bond secured on high quality West End properties, offering considerable protection for investors whilst providing an attractive yield. Furthermore, even though this company is highly asset rich, because of its lack of visibility, it is priced well below where an equivalent rated bond would be.

The distorting effect of benchmarks

The other problem with a benchmark approach is that it will not include bonds that are not rated by the rating agencies. There may be a number of reasons for a company not seeking a rating – none of which necessarily mean it is a poor investment. Grosvenor Estates debt is both unrated and falls below the £250 million benchmark size.

Equally, the rating agencies may ignore other genuinely protective features embedded in certain bonds such as seniority, security and strong covenants. A rating agency may treat the different tiers of debt within a company as holding the same risk, even if one type of bondholder gets paid first in the event of a default.

Key to exploiting these inefficiencies is to move away from a traditional benchmark-led approach. While investors are comfortable and familiar with stock market benchmarks built on the market capitalisation of companies (such as the FTSE 100 or S&P 500), in fixed income the same approach introduces a number of significant risks: credit benchmarks weight companies according to the size of their outstanding debt. Companies with the largest debt requirements will therefore form a larger proportion of indices over time. By their nature, companies with high debt may exhibit larger credit risk and, as such, this seems an illogical starting point for portfolio construction, which would result in greater investment in more indebted companies.

With this in mind, our buy and maintain approach looks to select a diversified portfolio of investment-grade corporate bonds (with an average rating falling within the A rating band). In building the portfolio, we will pay particular attention to covenants, structure and security, selecting a broad range of bonds with attractive credit enhancements. We will then aim to hold those bonds to maturity whilst monitoring the credit worthiness of the issuer throughout the period. This enables investors to capture the liquidity premium and to invest in higher yielding bonds without increasing the overall risk of the portfolio.

The exact portfolio will depend on the needs of individual LGPS funds, but it will look very different from the benchmark index. In this, the approach is low turnover, but it is very active from a structural perspective, reflecting the large differences between the constructed portfolio and the make-up of a typical sterling benchmark. The aim is to deliver robust long-term cashflows, allowing pension schemes to better match their liabilities but also to capture and “lock-in” excess return for the long term.

LGPS funds will use buy and maintain credit in a number of different ways, depending on their funding and cashflow requirements. Some will blend with an LDI solution, some will incorporate a gilt overlay to more accurately match future cashflows, whilst others will implement it as a “liability conscious” strategy. Buy and maintain is a flexible strategy that can be adapted to meet different requirements.

We are currently constructing and managing buy and maintain credit portfolios for several LGPS funds. We were recently appointed by South Yorkshire Pensions Authority to manage 5% of their scheme assets in a buy and maintain portfolio. They wanted to introduce a liability monitoring system and become less reliant on index-linked gilts as their sole protection assets. They were able to achieve this through a tailored, cost-effective and long-term buy and maintain credit solution.

“Buy and maintain” may be an unfamiliar concept for many LGPS funds but we believe it can address some of the key issues they face in the current market environment. We believe the approach exploits some of the anomalies in corporate bond markets, to achieve a higher return with lower overall credit risk from a well-diversified portfolio of corporate bonds.

More Related Content...

|

|

|