Building flexible credit portfolios for better risk-adjusted returns

Written By:

|

Andrew Swan |

Andrew Swan of M&G Investments looks at the advantages of private credit assets, which can perform a variety of different investment roles in the portfolios of long-term institutional investors

Local government pension schemes (LGPS) will usually have extensive holdings of public market securities, typically conventional and index-linked government bonds, as well as investment grade corporate bonds. Public debt assets can offer excellent value opportunities and are generally liquid; however, pension schemes’ need for income sources above government debt rates, which are extremely low, has prompted many to turn to private debt assets in order to generate higher risk-adjusted returns.

Together, both publically quoted and privately sourced credit instruments can form the building blocks of portfolios that can be tailored to schemes’ requirements to achieve their desired outcomes.

Investing for cashflows

UK pension schemes are now seeking to structure their asset portfolios to generate cashflows that more closely reflect the profile of their liabilities, while at the same time diversifying away from the volatility and uncertainty of more traditional asset classes.

Specifically, private assets can help schemes gain exposure to long-dated, contractual cashflows – whether fixed, floating or inflation-linked – that are well suited for longer-term liability matching purposes as well as delivering pension payouts as they fall due.

Private debt: a premium for illiquidity and better protection for investors

As the yields available in public markets have continued to compress, investment consultants in the UK have steadily looked to private debt in search of higher returns – recommending their clients consider an allocation to private debt as part of a diversified portfolio. As many schemes are still below target allocations, there is still more to be done to facilitate greater investment in private and illiquid debt.

Part of this may be due to the fact that private and illiquid assets are typically less well-known and can be esoteric in nature, so investors may be less comfortable investing in them. While most private loans are illiquid, meaning they will normally be held by investors to maturity, the exception is European leveraged loans, where an active secondary market exists.

Short-term liquidity may not be a primary concern for pension schemes, given the long-term nature of the liabilities they face, but LGPS trustees need to be aware of how private and illiquid assets will fit in their portfolios as individual holdings have different liquidity profiles.

Reassuringly, private debt assets will ordinarily pay a premium over similarly-rated public bonds to compensate investors for their lack of secondary trading and ability to sell at a good price at any time. This is often referred to as an “illiquidity premium”.

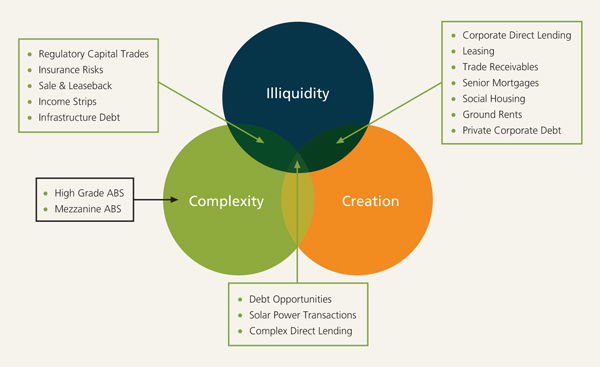

The opportunities in the private debt universe span a diverse range of maturities and risk/return profiles. As such, an investor will often need the resources and expertise in place to identify and source potential investments, conduct due diligence and analysis to understand the credit risk upfront, and perform ongoing credit monitoring. Consequently, these assets may justifiably command a return premium reflecting the additional complexity involved. Complexity can arise in situations where a borrower is distressed, or where the size, type or geography of an asset makes it harder for investors to understand or value.

Figure 1 illustrates how particular strategies derive their excess returns relative to traditional market returns.

Figure 1: Where do returns come from?

Source: M&G Investments, June 2017

Private debt asset classes are secured (private placements are unsecured but rank alongside with banks) and mostly senior in the capital structure. This means that if an investment does not perform as expected, then the owners of these assets are first in line to be repaid, ahead of unsecured debt holders, thereby affording more downside protection compared to other similarly-rated fixed income instruments.

Structural protections are as important as sound security selection. Private debt assets can often provide security over assets and typically incorporate attractive features, such as strong covenants that can offer added downside protection and enhance potential recovery values in the case of default. This often relies on the strength of the negotiation between the lender and borrower when structuring a deal or creating an asset, to ensure investors are adequately protected.

Key points to remember:

- Illiquid and private credit assets can perform a variety of different investment roles in the portfolios of long-term institutional investors. Considerations for building portfolios extend beyond returns, and include seniority in the capital structure, security and the type of coupon – fixed, floating or inflation-linked.

- Potential outcomes can include growth, steady contractual income, diversification from bond portfolios, and greater structural protections to mitigate the risk of losses in case of default or credit deterioration

- Markets are constantly evolving and the best opportunities are often found in non-standard, complex and underserved markets, which require a high degree of expertise and experience to navigate

- Discipline, patience and flexibility are crucial in the development of credit portfolios. Investors must avoid being a forced buyer to ensure that value is prioritised over asset availability

- Access to assets is vital in order to provide sufficient choice to be able to be highly selective, and requires well-developed networks of issuers and market intermediaries from which to source new investment opportunities.

Building flexible portfolios

Fixed income investment strategies are evolving in response to structural changes in the industry, offering hold-to-maturity investments managed for their coupon income that can use income-generating assets from both public and private markets to help local authority pension schemes deliver the predictable, scheduled and secure cashflows they require.

There are a range of assets available that pension schemes can access on a standalone basis, or as a multi-asset approach. Trustees want robust strategies in an uncertain environment, but also high returns that will improve their funding levels. In M&G’s view, a multi-asset credit approach is best to ensure sufficient diversification and a wide opportunity set to maximise returns. This way, portfolios can be adapted to specific risk / return needs, and assets can be added over time to diversify the portfolio further.

Private debt has been growing in size and relevance, and competition for opportunities has intensified in certain sectors. As markets continue to evolve and provide new opportunities, it is important to invest where risk is best rewarded i.e. in areas of the market where you can still find excess returns.

To illustrate, we have summarised two instances where we have provided bank replacement finance to privately-owned UK companies to support their long-term objectives. In both cases, we managed to secure favourable terms and security on behalf of our underlying investors.

Investment example 1: Family-owned regional brewing company

We provided a £20 million ten-year loan to Hall & Woodhouse, an independent regional brewer and owner of over 200 public houses.

The family-owned company, which was founded in 1777, had a long track record of stable cashflow and operating margins, and the deal was intended to help them align their debt to the long-term nature of their business. As well as replacing the existing bank loan facility, the cash will allow the brewer of Tanglefoot and Badger branded beers to invest for the long term in its freehold asset base.

Investment example 2: Trust and corporate services provider

We also participated in a £22.7 million debt financing deal to a leading international fiduciary, management and administration service provider. The company also benefits from recurring, long-term revenue streams, low customer attrition as well as a diverse client base, product offering and geographical presence. The deal followed a period of sustained growth for the business and is intended to support management efforts to deliver its growth ambitions in the years to come.

Furthermore, with the investment paying a floating interest rate in excess of a short-term reference rate – in this case Libor – investors are able to capture an additional return premium above similarly-rated public bonds, simply by going private side.

Ability to source investment opportunities across the full credit spectrum

For an investment manager, having the ability to source a variety of assets across the full credit spectrum can enable long-term institutional investors, including local government pension schemes, to realise the benefits from a wider range of opportunities.

At M&G, we believe it is our strengths in credit research and transaction structuring that provide us with a high degree of flexibility so we can be selective on credit quality, maintain discipline on structures and covenants and, crucially, avoid becoming a forced buyer of assets.

For Investment Professionals only

This article reflects M&G’s present opinions reflecting current market conditions. They are subject to change without notice and involve a number of assumptions which may not prove valid. Past performance is not a guide to future performance. The distribution of this guide does not constitute an offer or solicitation. It has been written for informational and educational purposes only and should not be considered as investment advice or as a recommendation of any particular security, strategy or investment product. Information given in this document has been obtained from, or based upon, sources believed by us to be reliable and accurate although M&G does not accept liability for the accuracy of the contents.

The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook.

M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at Laurence Pountney Hill, London EC4R 0HH. M&G Investment Management Limited is authorised and regulated by the Financial Conduct Authority. IM361 06/17

More Related Content...

|

|

|