Breaking new ground in LDI: towards an outcome-oriented approach to investing

Written By:

|

Mark Versey |

It’s time for consultants and trustees to consider the benefits of an outcome-oriented approach to LDI, says Mark Versey of Aviva Investors, who provides an overview of the relevant asset classes and investment strategies

As individuals, we’re all working towards meeting different financial goals. In the same way, pension schemes have their own goals, namely meeting their liabilities. These represent the aggregation of the financial goals of thousands of individual scheme members. As such, we begin to see the development of an outcome-oriented approach designed to meet these collective goals as the natural “next step” for liability-driven investment.

Until recently, LDI has focused mainly on reducing the mismatch between interest rate and inflation exposure which exists between scheme assets and liabilities. Because liabilities are measured using a present value calculation of future liability cash flows, the substantial fall in nominal and real interest rates that has occurred over the last decade has significantly increased the size of scheme liabilities.

Although falling interest rates have boosted the value of scheme assets and especially LDI assets, the net effect has been a painful increase in deficits. As at the end of November 2015, the aggregate deficit of the 5,945 schemes whose funding position is tracked by the PPF (Pensions Protection Fund) 7800 Index was just under £250 billion. This has forced many sponsors to dig deep and agree additional contributions.

Tough choices

At last count, there were over 1,000 LDI mandates in the UK¹ with schemes of all sizes making use of segregated or pooled LDI solutions. Those that have done so have been well rewarded so far, thanks to a continuing decline in bond yields. However, we estimate that only around a third of UK scheme risks are currently hedged.² Although many UK schemes may wish to increase their hedge ratio, they face a quandary in forming a supportive market view.

The Bank of England base rate has now been at a record low of 0.5% since March 2009; with scheme advisers and investment managers alike predicting that it would rise throughout this period. With inflation having touched a record low of 0.0% in the first quarter of 2015, interest rates look set to remain low.

With rates at historic lows, it seems difficult to contemplate them falling further. It could be argued that the current value of scheme liabilities already reflects rates staying low for the long term, which suggests that the “pain” has already been taken to some degree through larger market-valued deficits and increased sponsor contributions. Unfortunately, the risk to schemes of meeting liabilities if rates stay even lower than predicted outweighs the sponsor’s opportunity if rates go up. Trustees face the challenge of needing to balance the relative benefits of the remaining unhedged scheme assets versus taking on other market risks.

Fresh thinking

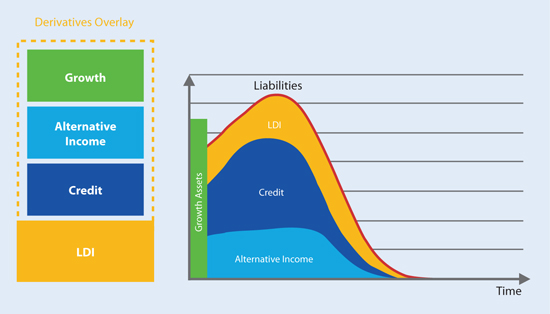

Rather than looking at LDI independently from “growth” portfolios, we think it’s time for consultants and trustees to consider an outcome-oriented approach to their investment needs.

At its core, this replaces a “two portfolio” model (where one is a growth portfolio and the other an LDI portfolio) and the extensive use of individual indices to measure performance that this entails. It uses a holistic investment strategy with a single portfolio model utilising a much more meaningful benchmark: the scheme’s actual liabilities. This enables trustees to consider risks taken on interest rates and inflation in the same context as risks taken on equities, real estate, alternatives and all other market risks in meeting future liabilities.

Key drivers when designing such a strategy include:

- Liability cash flows: How much a scheme needs to pay out in future will dictate both the maturity profile of a strategy and the inflation risks to manage, but it’s just as important to ensure that a scheme’s short-term cash flow and liability needs are met.

- Agreed contributions: Take account of future contributions when modelling portfolios.

- Level of funding: The current value of assets in a portfolio will naturally affect target returns and therefore the investment risk required.

- Risk budget: This is ultimately decided by trustees based on the existing level of funding, sponsor covenant and return required on assets.

Figure 1: An outcome-orientated approach: LDI is only part of the bigger picture

Source: Aviva Investors

Creating better benchmarks

An outcome-oriented approach takes a holistic view of all risks that may impact a scheme’s ability to meet its future liabilities; from interest rates and inflation to reinvestment, equity, real estate, credit and currency risk. Inherent in this is the opportunity to take a more meaningful approach to diversification. It allows schemes to move away from a model where the managers of individual asset class components diversify their parts of the portfolio relative to market benchmarks and towards managing the whole portfolio’s aggregate exposure. This can greatly reduce the prevalence of unrewarded risks, helping schemes get more “bang for their buck” from their risk budgets.

It subtly changes LDI from an exercise in interest rate and inflation hedging to an outcome-focused exercise, ensuring that all cash flows generated by a scheme’s assets are appropriately risk managed relative to liabilities. Therefore, unrewarded risks are kept out.

It also allows decisions on hedging to be taken strategically across expected rates curves and enables such hedges to be implemented in an intelligent, cost effective way which is matched to cash flows generated by the scheme’s existing assets and any new assets it might acquire. Because hedging can be implemented either where there are strong convictions or where liability and asset cash flows are most mismatched, any specific hedge ratio target can be delivered.

New LDI – new labels

Another key strength of an outcome-oriented approach is that it enables schemes to consider a far wider range of assets than most LDI portfolios currently encompass. Although income-generating assets naturally tend to dominate the mix, because the cash flow from assets can be matched to liability cash flows, outcome-oriented strategies aren’t constrained solely to income-producing assets.

It helps to discard labels such as “income”, “growth” or “matching”. After all, the ability to meet liabilities is based on total returns and the liquidity of assets when they need to be realised. Even traditional “growth assets” can offer attractive levels of long-term income and varying degrees of inflation proofing as part of an outcome-orientated solution.

Outcome-focused asset classes and investment strategies

- Unconstrained equities: An unconstrained approach targeting companies with highly liquid and sustainable dividend streams can avoid the natural pitfalls of following a market-cap weighted benchmark and maximise the certainty of income.

- Long-lease real estate: Focusing on properties with leases that offer long-term and frequently pre-agreed inflation-linked rental income streams from a wide variety of tenants can help diversify risk, even if the “growth” element of the return is often quite limited compared to the purchase price.

- Absolute-return funds: Funds that seek to maintain low volatility but can deliver a steady return above the rate of cash offer both a valuable source of future cash flows and high levels of liquidity.

- Alternative income assets: Real estate finance, infrastructure and other structured finance assets can offer a significant yield enhancement over bonds thanks to the healthy illiquidity premiums on offer as well as good diversification of credit risk and valuable additional collateral when compared to traditional corporate debt.

- “Buy and maintain” credit: This approach is especially useful for schemes with long-duration liabilities. It focuses on corporate credit but is unconstrained by market index benchmarks. The focus is on maintaining a defensive strategy which is invested in a diverse range of companies and avoids those businesses with significant unknowns in their long-term business plan.

Ready to implement?

Adopting an outcome-oriented approach requires a new mind set and the ability to size and manage market risks relative both to a scheme’s future liability stream and to one another, all in a single portfolio. The ability to do this means changes can be implemented across portfolios far more quickly and meaningfully than in a portfolio where assets are invested across a range of different alpha-chasing strategies, each of which might be managing against a different market index.

A number of pension consultants and schemes have already expressed support for this approach, and, like us, they see the benefit of making a scheme’s liabilities the most appropriate benchmark. They understand the need to provide pension schemes with support and advice when deciding on the most appropriate split between hedged and unhedged assets and implementing the oversight that must go hand in hand with this sort of outcome-orientated approach.

1. 2015 KPMG LDI Survey Navigating the UK LDI Market

2. Based on Aviva Investors analysis of the Pension Protection Fund (PPF) Purple Book 2014 data which indicates approximate UK scheme risk hedging of around 30 per cent

More Related Content...

|

|

|