Blending low risk with quality and value to offer higher risk-adjusted returns

Written By:

|

Stephen Hearle |

Stephen Hearle of Nordea Asset Management looks at the relative benefits of the low volatility factor compared with its peer factors of value, growth, momentum and quality

A quick Google search of the words “Low Volatility factor” returns more than 43.4 million results and yet it’s striking to see how relatively unknown this academically-backed systematic factor is when compared to its peers Value, Growth, Momentum, and Quality. Returning to the research results, most of the first links that pop up provide a fairly comprehensive definition, so the purpose of this piece is not to shed new light on the academic discussions around it. Instead, our purpose is to start with a relatively simple definition of the factor, as well as the reasons that could explain its existence. We then consider whether combining further factors to the Low Volatility factor improves risk-adjusted returns. Finally, we will highlight the potential benefits of adding this factor to an investor’s equity portfolio in the current market environment, as well as over the full investment cycle.

What is the Low Volatility factor and why does it exist?

According to MSCI’s Foundations of Factor Investing¹, the existence of the Low Volatility/Risk factor implies that low risk stocks – understood as those with lower than average volatility, beta, and/or idiosyncratic risk – offer higher returns vis-à-vis the overall equity market. This has puzzled academics and investors as it is clearly at odds with the Capital Asset Pricing Model, which asserts that riskier assets should earn higher returns. So, how can this be?

Again, our main objective is not to revise nor summarise decades of academic research in this space, but we will go as far as to say that there are some behavioral explanations, as well as some more related to the way markets and investments are structured. Some of them are:

- The lottery effect, or investors’ preference for bets with (more probable and) smaller expected losses to (less likely but) higher expected gains.

- Representative bias, or when a few successful and highly volatile stocks’ stories drive investors to ignore the speculative nature of high risk stocks in general.

- Overconfidence, understood as investors’ tendency to be over-reliant on their ability to forecast the future, often with an optimistic bias.

- Leverage, short selling and/or regulatory constraints, which limit investors’ ability to fully exploit the low risk/beta stocks Jensen’s Alpha capabilities (by levering their long books to reach the same risk as the market).

- Benchmark related factors and incentive misalignments, as low risk/beta stocks:

- Can generate higher tracking errors, lower information ratios and potential difficulties to consistently outperform over short time-periods (yearly measurement and performance fees).

- Can lead to unintended sector and/or valuation biases, if these are not properly controlled.

Are there any theoretical benefits in blending Low Risk with Quality and Value factors?

Now that we know what low risk stocks are in principle, it’s fair to ask the question of why shouldn’t investors just buy any Min Vol or Low Beta passive solution? As it’s often the case, the devil is in the details. Traditional low/min volatility/beta strategies are very often simple passive optimisations of traditional benchmarks that shift the asset allocation focus from a company’s market cap to the stock’s price volatility/beta. As mentioned before, this approach has some limitations in terms of portfolio construction as it can lead to unsustainably high levels of active risk (too low beta, too high sector/country over/under weights, etc.).

Hence, we would argue for a different approach towards low risk investments: one that tries to find stability (or lower volatility/beta) in the underlying fundamental factors that have explanatory power over a company’s relatively lower risk. By focusing on the stability of the earnings, free cash flows, EBITDAs, dividends, etc., we would be able to build an investment universe that has a Low Risk bias, but also clear high Quality characteristics.

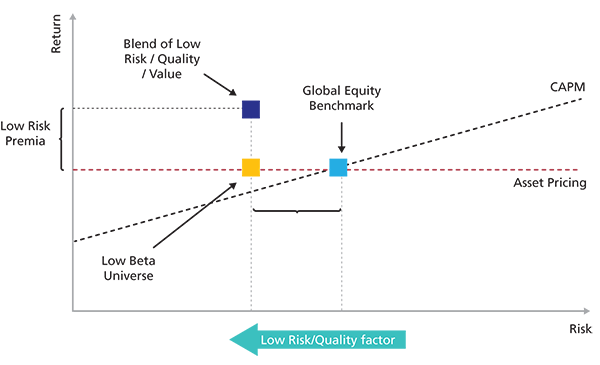

Lastly, by applying fundamental and valuation overlays to select companies that trade at reasonable valuations (relative to their stability, growth potential, risk, etc.), the portfolio will have lower valuations than the market. This would imply higher earnings yields and return expectations over the full investment cycle (as theoretically shown in Figure 1). Hence, in our view, while there are benefits to adding a Low Risk bias to a global equity portfolio, these are enhanced if we blend it with Quality and Value.

Figure 1: Value added vs Global Equity Benchmark and Low Beta Universe³

Sources: Nordea Investment Management AB and Datastream. For illustrative purposes only.

What have the actual results of a blend of Low Risk, Quality and Value been when compared to the market and the different styles?

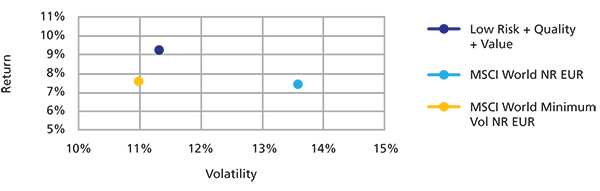

The theoretical risk-adjusted outperformance (shown in Figure 1) is confirmed by the actual historical results (Figure 2). The blended portfolio’s performance has been higher when compared to the overall equity market (understood as the MSCI World Index) and Low Risk stocks (MSCI World Min Vol Index), while also having significantly lower volatility than the former and only moderately higher than the latter. This translates into much higher risk-adjusted returns over the last 16 years.

Figure 2: Risk-Reward³

Sources: Nordea Investment Management AB and Datastream. Performance figures refer to Global Stable Equity Strategy (gross of fees) in EUR. MSCI World refers to MSCI World Index. Date: 31.12.2005 – 30.11.2022. The performance represented is historical; past performance is not a reliable indicator of future results and investors may not recover the full amount invested. The value of your investment can go up and down, and you could lose some or all of your invested money. Comparison with other financial products or benchmarks is only meant for indicative purposes.

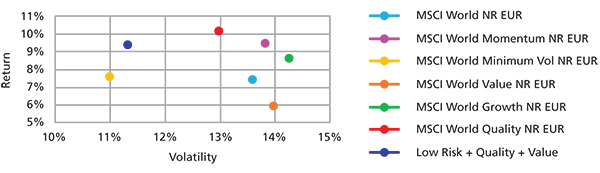

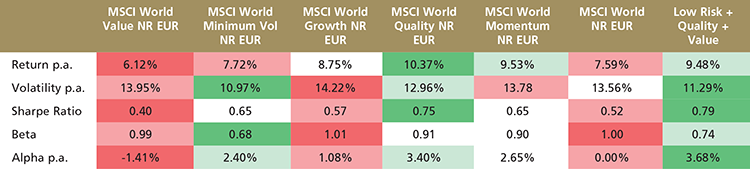

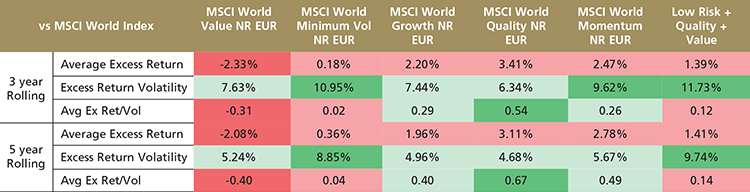

But what about other styles? Is this blend able to outperform Growth, Quality or Momentum? Looking at Figure 3 and Table 1, it seems very clear that Low Risk, Quality and Value are able to outperform all styles from a risk-adjusted perspective, while only lagging Quality and Momentum in pure performance terms. It has also done so with an equity beta only a little higher than the Low Risk factor, which translates into an annualised alpha² close to 370 bps, the highest one of the sample.

Figure 3: Risk-Reward³

Sources: Nordea Investment Management AB and Datastream. Performance figures refer to Global Stable Equity Strategy (gross of fees) in EUR. MSCI World refers to MSCI World Index. Date: 31.12.2005 – 30.11.2022. The performance represented is historical; past performance is not a reliable indicator of future results and investors may not recover the full amount invested. The value of your investment can go up and down, and you could lose some or all of your invested money. Comparison with other financial products or benchmarks is only meant for indicative purposes.

Table 1: Risk Returns, Beta and Alpha³

Sources: Nordea Investment Management AB and Datastream. Performance figures refer to Global Stable Equity Strategy (gross of fees) in EUR. MSCI World refers to MSCI World Index. Date: 31.12.2005 – 30.11.2022. The performance represented is historical; past performance is not a reliable indicator of future results and investors may not recover the full amount invested. The value of your investment can go up and down, and you could lose some or all of your invested money. Comparison with other financial products or benchmarks is only meant for indicative purposes.

Is this outperformance persistent/consistent over the different market environments seen during a full cycle?

There are two ways to answer this question. The first one disregards risk and focuses only on pure performance/excess returns relative to the market (the volatility of the excess returns and the relationship between these excess returns and the absolute performance). Using that lens, Growth, Quality and Momentum seem to be more consistent than our blended portfolio.

As it can be seen in Table 2, the 3 and 5-year rolling excess return of the Low Risk, Quality and Value blend vs the market has been on average stable, at around 1.4% p.a., with the volatility of those rolling excess returns hovering around 10%. The Value factor alone delivers an average negative excess returns (fairly consistently, given its low volatility), while the Low Risk factor alone lags our blend with only slightly lower dispersion of excess returns. This leaves us with single factor performance of Quality, Growth and Momentum showing higher average rolling excess returns over 3 and 5 years, with lower volatility too.

Table 2: 3 and 5-year rolling excess return of the Low Risk, Quality and Value blend vs the market³

Sources: Nordea Investment Management AB and Datastream. Performance figures refer to Global Stable Equity Strategy (gross of fees) in EUR. MSCI World refers to MSCI World Index. Date: 31.12.2005 – 30.11.2022. The performance represented is historical; past performance is not a reliable indicator of future results and investors may not recover the full amount invested. The value of your investment can go up and down, and you could lose some or all of your invested money. Comparison with other financial products or benchmarks is only meant for indicative purposes.

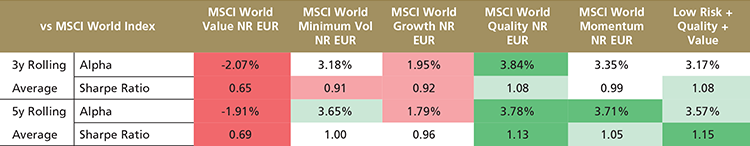

Having said this, we believe that the consistency should be measured not only from a pure performance perspective but should also be seen from a risk (free) adjusted perspective (i.e. beta adjusted alpha and Sharpe Ratio). Using this approach instead, as seen in Table 3, the blended portfolio has shown the most consistent/highest rolling Sharpe Ratios when compared to every other style using both 3 and 5 year rolling data, while its beta adjusted Alpha is second – but marginally – to Quality and Momentum factors.

Table 3: 3 and 5-year rolling average of the blended portfolio vs. other styles³

Sources: Nordea Investment Management AB and Datastream. Performance figures refer to Global Stable Equity Strategy (gross of fees) in EUR. MSCI World refers to MSCI World Index. Date: 31.12.2005 – 30.11.2022. The performance represented is historical; past performance is not a reliable indicator of future results and investors may not recover the full amount invested. The value of your investment can go up and down, and you could lose some or all of your invested money. Comparison with other financial products or benchmarks is only meant for indicative purposes.

In conclusion, looking at the more than 16 years of data we have gathered, it seems clear that an equity portfolio that combines Low Risk with Quality and Value factors, can generate higher risk adjusted returns over the cycle, when compared to markets and all equity styles. Moreover, while some of the single styles have higher average 3 and 5 years excess returns, the Low Risk + Quality + Value blend has very similar rolling average alphas and higher Sharpe Ratios.

Nordea Asset Management is the functional name of the asset management business conducted by the legal entities Nordea Investment Funds S.A. and Nordea Investment Management AB (“the Legal Entities”) and their branches and subsidiaries. This document is advertising material is intended to provide the reader with information on Nordea’s specific capabilities. This document (or any views or opinions expressed in this document) does not amount to an investment advice nor does it constitute a recommendation to invest in any financial product, investment structure or instrument, to enter into or unwind any transaction or to participate in any particular trading strategy. This document is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or instruments or to participate to any such trading strategy. Any such offering may be made only by an Offering Memorandum, or any similar contractual arrangement. Published and created by the Legal Entities adherent to Nordea Asset Management. This document is furnished on a confidential basis and may not be reproduced or circulated without prior permission and must not be passed to private investors. This document contains information only intended for professional investors and eligible investors and is not intended for general publication. © The Legal Entities adherent to Nordea Asset Management and any of the Legal Entities’ branches and/or subsidiaries.

1. Bender, Briand, Melas & Aylur, December 2013.

2. Alpha or Jensen’s alpha, is a risk-adjusted performance measure that represents the average return on a portfolio or investment, above or below that predicted by the capital asset pricing model (CAPM), given the portfolio’s or investment’s beta and the average market return.

3. Sources: Nordea Investment Management AB and Datastream. Performance figures refer to Global Stable Equity Strategy (gross of fees) in EUR. MSCI World refers to MSCI World Index. Date: 31.12.2005-30.11.2022. The performance represented is historical; past performance is not a reliable indicator of future results and investors may not recover the full amount invested. The value of your investment can go up and down, and you could lose some or all of your invested money. Comparison with other financial products or benchmarks is only meant for indicative purposes.

More Related Content...

|

|

|