Beta’s brave new world

Written By:

|

Alex Carpenter |

Alex Carpenter of BlackRock examines how local authority pension funds can benefit from the indexing revolution

For many years, indexation or “beta” strategies have focused on market capitalisation-weighted benchmarks and on the large and medium cap sectors. However, recently there has been a surge in interest in alternative benchmarks, and new ways of gaining exposure to the investable universe. In an environment where high volatility looks set to persist for some time, these strategies are providing institutional investors with the creative latitude to build the portfolios they need.

Volatility strategies

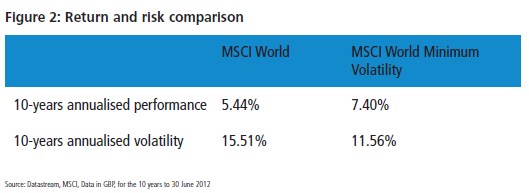

Approaches that offer a superior return-to-risk trade-off are garnering considerable attention. Minimum volatility indices aim to create similar exposures to a reference or “parent” index but with lower volatility. This is achieved through an optimisation process that filters the parent index, leaving only lower volatility stocks. This process is subject to a variety of constraints to ensure sufficient diversification and to maintain the broad characteristics of the parent index.

The results speak for themselves: Figure 1 shows that, over the past 10 years, the MSCI World Minimum Volatility Index has delivered approximately 25% less volatility than its parent MSCI World Index.

Although it has outperformed its parent index by nearly 2% per annum over the same period, we believe that, given the objective of the strategy, investors should consider this approach for ex-ante volatility reduction and not excess return generation.

Small-cap equity

Developed global and emerging market equities have long been used by institutional investors to gain broad equity market exposure. Yet, until recently, small-cap equities were largely ignored by the institutional community. This is changing. Since the financial crisis, institutional investors are increasingly conscious of the need to diversify their beta exposure more effectively. Small-cap investing has become an increasingly important part of these conversations because of the greater diversification and the risk premium it offers.

Small-cap indices include many more names than comparable large-cap indices. What’s more, small companies are likely to be locally oriented, with less exposure to the global business cycle than multinational companies with substantial foreign operations. As a result, returns on small-cap equities tend to be less correlated with global factors. This is especially true in emerging markets.

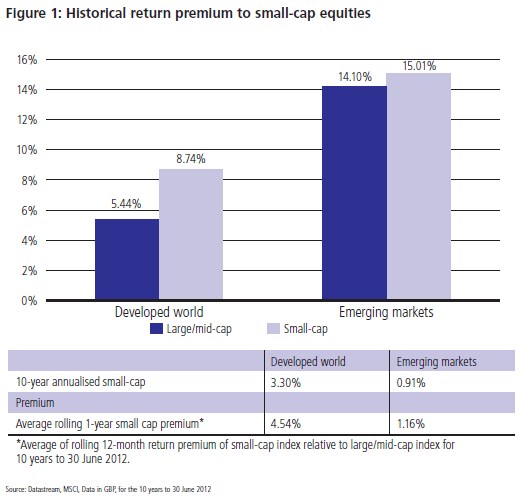

In addition to their diversification benefits, global small-cap indices have historically earned higher average returns than large- and mid-cap indices. Small companies have high potential for growth and have tended to perform well following market recessions when risk assets tend to be rewarded. The risk premium earned by small-cap securities has been well documented.

Figure 2 illustrates the average return premium earned by small-cap equities across developed and emerging markets. Over the last 10 years, developed global small-cap equities have delivered an average of 4.54% in incremental annualised return over that of the “standard” developed world benchmark covering large and mid-cap securities¹. The small-cap return premium has been less marked in emerging markets as the MSCI Emerging Markets Small Cap Index outperformed the standard Emerging Markets Index by an average of 1.16% over the last 10 years.

Screened fixed income index strategies

Screened fixed income strategies take a parent index and make adjustments to reduce downside risk arising from deteriorations in credit quality. Screening can be applied to any underlying benchmark or portfolio of assets. However, customising standard benchmarks to avoid overconcentration, improve diversification and increase liquidity can be an optimal application of the strategy.

Strategies such as these can take many forms, but generally achieve their objectives by making one or both of the following adjustments. First, they may customise the beta characteristics of the underlying index by increasing its diversification benefits. Some fixed income indices, for example, will contain inefficiencies such as a tilt to larger issuers that are more debt-laden. Capping issuers at, say, 1% lowers the concentration of each issuer to provide better diversification. The strategy might also exclude subordinated debt, which can behave like equities and is often the first to react in times of stress.

The second stage ranks the constituent companies using a quantitative process, and underweights the names considered to bear the most default risk. By down-weighting (or removing) name-specific risk (also known as idiosyncratic risk), while leaving the broad characteristics of the fund in line with the benchmark, the expectation is that the fund will outperform in down markets.

Multi-asset beta strategies

Another consequence of the broadening beta toolkit is the development of multi-asset strategies that predominantly use passive products to reflect broad asset allocation views. These strategies embody the belief that it is effective diversification across asset classes, rather than active building blocks in asset allocation, that achieves the best results for a strategic portfolio.

One version of this type of strategy focuses on rewarded risk factors, the drivers of return that underlie each asset class. Traditional portfolios, such as a 60/40 allocation between equities and bonds, can look diversified on the surface but, in reality, are predominantly exposed to equity risk and may be subject to infrequent but high-loss events. By contrast, risk factor-based allocation strategies aim to deliver attractive risk-adjusted returns by focusing on the drivers of return, as opposed to asset class views, to achieve more efficient diversification.

Examples of risk factors include real rates, inflation, credit, political, liquidity and economic risk. For example, an investor holding high‑yield debt will expect to be compensated for the all the risks to which they are exposed real rates, inflation, credit and liquidity risk, over the long term. To create a portfolio diversified by risk factors, the manager identifies which combination of asset classes gives the best exposure to each. Passive holdings are then combined to provide better balanced exposure allowing for capital growth with limited volatility.

ETFs

Institutional take-up of exchangetraded funds (ETFs) is growing as more investors become aware of how ETFs can be employed as a flexible and efficient tactical solution in a variety of situations.

Unlike other index funds, ETFs trade intra-day on secondary markets and the most liquid funds can often trade at spreads that fall within the aggregate spreads of their underlying assets. Although their management fees or total expense ratios (TERs) are typically larger than those of index funds, the level of trading efficiency, coupled with the tremendous depth of choice that ETFs offer, presents unmatched flexibility over the shorter term. ETFs are now widely used for a wide variety of purposes, ranging from implementing tactical or temporary exposures, to gaining access to niche markets such as certain commodities or emerging markets. Recently, we have also seen pension funds in the US seek to respond more effectively to the new environment of high volatility and correlated markets by using ETFs to create so-called liquidity overlays. These are small portfolio sleeves that represent 2-3% of the wider portfolio and replicate segments of it. This allows schemes to quickly remove and add risk in highly stressed, fastmoving markets. Once again, the strategy makes full use of the flexibility of ETFs to perform a function that would otherwise require significant resources to implement.

More generally, many funds are finding that the “buy and hold” investment thesis no longer applies given the prevailing market conditions. They need to manage their portfolios more dynamically to exploit market opportunities as they arise. Larger funds with greater resources are “insourcing” decisions to in-house investment teams that are increasingly leveraging ETFs’ flexibility and range of choice to make the desired tactical trades.

Questions to ask yourself:

1. Is my portfolio missing out on the added diversification and return benefits of greater exposure to a broader cross-section of global markets?

2. Could I make use of equity index strategies that offer similar returns to the referenced index but with lower volatility?

3. On the fixed income side, would my portfolio benefit from an approach that aims to reduce credit, name-specific and illiquidity risk as well as overconcentration in the benchmark?

4. Could I use passive strategies to create a more cost-effective, multi-asset return portfolio?

5. What are my short-term asset allocation needs and what is the most flexible and cost-efficient way of meeting those needs?

1. Based on the average rolling 12-month annualised return premium of MSCI World Small Cap Index over MSCI World Index for the 10 years to 30 June 2012.

More Related Content...

|

|

|