Asset allocation challenges and the role farmland investing can play

Written By:

Joe McDonnell, CFA, Head of EMEA, Morgan Stanley Investment Management Diversified Alternatives Group.

Steven Turner, CFA, Vice President, Morgan Stanley Investment Management Diversified Alternatives Group.

Joe McDonnell and Steven Turner of Morgan Stanley examine the key challenges faced by investors today and discuss how farmland investing could help deliver much-needed portfolio diversification alongside income and capital growth

Today’s market conditions present significant challenges for investors. In this article we discuss how pension funds could respond to these challenges and we consider the merits of investing in farmland as part of the solution.

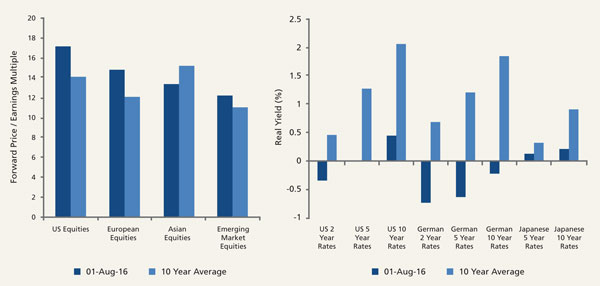

Investor confidence in achieving their desired returns is fading. Global growth forecasts are being reduced and numerous upcoming events, both economic and political, represent potential triggers for further volatility. In addition, investors are observing relatively high asset valuations across traditional asset classes, which could also constrain returns in the medium term. Figures 1 and 2 below illustrate this by showing equity values relative to earnings, and real bond yields in key regions, comparing levels at 1 August 2016 to 10-year averages.

Figure 1: Equity values relative to earnings & Figure 2: Bond yields in key regions

Source: Morgan Stanley Research and Bloomberg

In addition to target return, pension fund allocations highlight three other important portfolio characteristics:

- Investment income, either to support cash flow requirements or to blend portfolio gains from yield and capital appreciation

- Returns that are sensitive to inflation, often with reference to explicit inflation-linked liabilities, combined with the desire to preserve the real value of an investment portfolio

- Participation in sustainable investments that make positive contributions to corporate governance, society and the environment

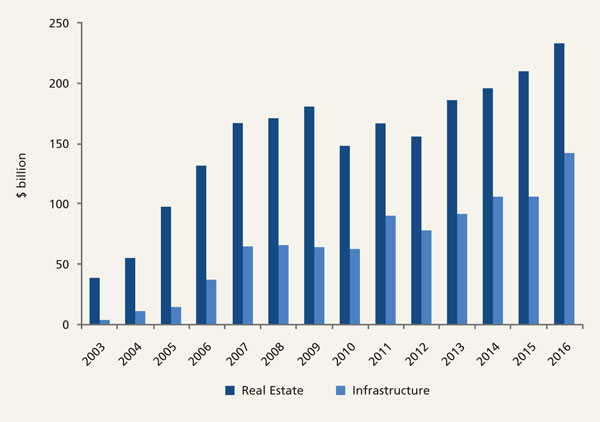

Unfortunately, many of the asset classes that are candidates for addressing these preferences are becoming increasingly crowded, putting upward pressure on asset pricing. This is particularly true of those asset classes that are expected to combine both capital growth and inflation-linked yield, which can be very appealing in pension fund asset-liability management. As an example of this, Figure 3 shows the level of unfunded commitments in closed-end private real estate and infrastructure funds that are waiting to be invested.

Figure 3: Unfunded commitments in closed end funds

Source: Preqin

To address these challenges, pension funds should consider their asset allocation in the context of the following:

Does the portfolio rely too heavily on passive market returns to achieve future growth?

Investors should consider extending the contribution of two other important return sources; returns from active management (alpha) and compensation for accepting illiquidity (illiquidity premium).

Is the portfolio’s asset allocation limited to markets with strong capital supply?

While the previously referenced real estate and infrastructure markets are important components of many pension fund portfolios, investors should consider markets that are relatively capital constrained, where entry pricing and returns expectations could be more attractive.

Is the portfolio fully utilising its ability to invest in private investments?

Schemes should take full advantage of their tolerance for illiquidity for a number of key reasons. Firstly, carefully selected private investments may offer an illiquidity premium. In addition, private markets offer investment opportunities that are a distinct relative to the broader portfolio, contributing to both portfolio diversification and expected returns through a focus on market segments where access to capital is more limited. Finally, private market investing may offer the closest connectivity between ownership and management. This presents opportunities to be an unencumbered active investor with specialist managers that drive returns that are less dependent on market movements, and affect positive corporate, social and environment change.

When selecting inflation sensitivity for the portfolio, does the selection process test the robustness of the inflation protection?

Pension funds should consider all asset classes not only in terms of their headline sensitivity to inflation, but also the reliability of that sensitivity (considering changes in sensitivity over time) and also the efficiency of the inflation linkage (considering the expected real return relative to its expected volatility). This process can help allocators find sources of inflation sensitivity that are underestimated by other investors.

Building a portfolio with this framework in mind is difficult to achieve in practice because many of the potential investments are harder to source and evaluate. However, when resources are applied to finding, selecting, and monitoring investments through this lens, the rewards for this effort can be material and, in the next section, investment in farmland is considered as an example.

Case Study: Farmland

Farmland is a physical asset in finite supply that has an essential function; creating food, fuel and fibre through biological growth. The sector is expected to benefit from demographic trends that support long-term demand fundamentals for staple and high value farming output, as the global population increases and preferences evolve. For example, it is estimated that the consumption of meat will rise over 70% by 2050, requiring significant growth in both livestock and grain feed production.1 Dietary shifts also extend to non-staple food types such as high value fruits and nuts, through a preference for healthier snacks and ingredients. Additionally, rising global demand for alternative energy is expected to boost demand for energy-rich crops such as corn and sugarcane. Despite this rising demand, the supply of farmland is severely constrained by urbanisation, degradation and resource scarcity, factors which are expected to support land values over the long term.2

Farmland investments may include annual crops, permanent crops (typically fruits and nuts), livestock, and dairy through various operating arrangements, from leasing between owners and tenant farmers to direct farming, which includes full participation in the farm level operations. Institutional farmland investment has historically been focused on the North American and Australian markets, with investors also recognising emerging opportunities in South America and Eastern Europe.

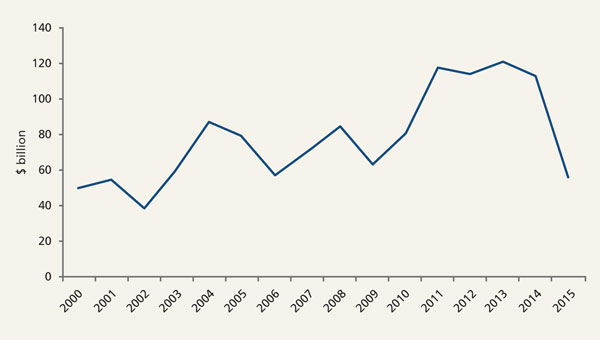

While the long term supply and demand balance appears to be very supportive for farmland earnings and asset prices, the short term outlook is different. A softening in demand from China, record agricultural production, the fall in the price of oil, and the removal of regional quotas have suppressed commodity prices.3 This in turn has lowered farmland values, which are derived from net operating income (shown on Figure 4), and presented a compelling entry point for investors.

Figure 4: United States Department of Agriculture yearly net farm income

Source: Bloomberg and United States Department of Agriculture

Relative to more mature real assets such as real estate and infrastructure, institutional ownership in farmland is estimated to represent a very small component of the global investable universe. This lack of institutional penetration creates opportunities to acquire inefficient operations that have lacked access to capital at attractive pricing. There appears to be a rich opportunity set for targeting value-add investments that require capital expenditure for initiatives such as change of land use, farm infrastructure additions and upgrades, agricultural technology enhancements, and the introduction of modern farming techniques. All value-add initiatives should be selected to ensure they are accretive to both sustainable management practices and investment returns, leading to capital growth that is relatively independent of overall market returns, and a positive impact on the environment.

Active investment initiatives in agriculture can also extend beyond the farm gate. As the upstream component of the value chain, there is a risk that farm operations become disconnected from consumers, becoming price takers for a homogenous output in the wholesale market, without maximising the value of production. For example, consider an orange farm that sells its produce to a packing operation for a fixed price. The packing operation sorts the oranges by quality and uses price discrimination to capture the prices customers are willing to pay in markets that require different quality fruit. This pass-through of value from upstream to midstream operations is a risk to farmland investment returns. An active investment strategy can aim to mitigate this risk through selective midstream investments that combine with farmland investments to form vertically integrated operations. As well as capturing additional value, integrated investments also have an embedded protection against increases in supply. A period of high supply is likely to cause a short term reduction in the commodity price that could negatively impact revenue at the farm level, but processors and packing facilities are likely to benefit from an increase in volume, which would at least partly offset the impact of lower prices on farm operations.

As well as offering capital growth opportunities, farmland is underpinned by an attractive income component that can vary significantly depending on the region, commodity type, and the mix between lower risk leasing and higher risk operating exposure. The source of this income is the biological growth of the farm’s production, which can provide valuable portfolio diversification benefits as returns have demonstrated low correlation with other asset classes.4 Farmland also offers attractive inflation features. When considering only the absolute sensitivity to inflation, our analysis suggests that real estate, for example, has historically offered a superior inflation linkage. However, when also considering the reliability of the inflation sensitivity and the efficiency of accessing inflation through each asset class, we recognise that farmland has historically offered the most attractive solution relative to other real assets.

In summary, an allocation to farmland would benefit from the increasing demand for agricultural goods alongside a declining supply of arable land. Farmland returns are expected to comprise an attractive income yield, efficient and reliable inflation sensitivity, and potential diversification benefits from a unique return source; biological growth. Finally, the capital constrained nature of the sector presents compelling opportunities to enhance assets, supporting an increasingly common objective to achieve capital growth through positive impact investing.

It is worth repeating that building a portfolio of investments that can provide the required features, such as farmland, is challenging in the current market. Portfolio diversification is critical, but local knowledge and operational expertise from investment managers are also essential to realising potential returns and mitigating risks. The conflict that managers face in targeting both investment diversification and local experience should be considered very carefully. With this in mind, pension funds should consider building a diversified portfolio of specialist investment managers with focused expertise. This preferred approach expands the resources that a pension fund requires to source, evaluate, select, and monitor a portfolio’s investment managers, but it will also contribute to solving the asset allocation challenges that schemes face.

The document has been prepared solely for information purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The material contained herein has not been based on a consideration of any individual client circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

The views expressed herein are those of Morgan Stanley Investment Management (“MSIM”) as of the date hereof and not as of any future date. They are subject to change based on market, economic and other conditions and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis, and opinions of MSIM. These conclusions are speculative in nature, may not come to pass, and are not intended to predict the future of any specific Morgan Stanley investment.

All investing involves risks, including a loss of principal. Alternative investments are speculative and involve a high degree of risk. These investments are designed for investors who understand and are willing to accept these risks. Performance may be volatile, and an investor could lose all or a substantial portion of his or her investment. Morgan Stanley does not render advice on tax and tax accounting matters to clients.

1. World Agriculture Towards 2030/2050 – FAO, The 2012 Revision

2. World Agriculture Towards 2030/2050– FAO, The 2012 Revision, and the United States Department of Agriculture

3. Morgan Stanley Investment Management’s Portfolio Solutions team’s view based on data sourced from Bloomberg and the United States Department of Agriculture

4. Morgan Stanley Investment Management’s Portfolio Solutions team’s analysis based on data sourced from Bloomberg and the United States Department of Agriculture

More Related Content...

|

|

|