Are there alternative homes for cash?

Written By:

|

Alistair Wilson |

The investment of short-term cash has become more difficult in recent times as returns have fallen whilst risks have risen. TwentyFour Asset Managment’s Alistair Wilson outlines an option for investors

There has been significant downward pressure on yields as the ECB deposit rate has been cut to zero and central banks have flooded the banking sector with cheap funding. At the same time, bank credit rating downgrades have reduced the available investment universe. Returns on bank deposits, short-term money market instruments and Money Market Funds (“MMFs”) have been low to non-existent.

This weakening of returns on short-term cash has been accompanied by an increase in risk as depositors are now exposed to potential losses from “bail-in” haircuts. Losses for depositors at the Bank of Cyprus were the first instance of this in Europe, with no protection for assets greater than just €100,000 – far too small an amount for it to be practical to allow institutional treasurers to spread deposits around a number of banks. Furthermore, subsequent bank failures at SNS, a major Dutch bank, and the Co-op Bank in the UK have shown that the risk is not just limited to peripheral banks.

Whilst short-term cash investors have used MMFs to reduce bank concentration risk, they are unable to immunise themselves from bail-in risk as most MMFs are heavily invested in bank credits of one form or the other. Furthermore, there are ongoing regulatory concerns surrounding MMFs which continue to concern investors. Proposed changes to European regulations could mean that constant Net Asset Value (NAV) funds are forced to become variable NAV and there could be a ban on future MMF bail-outs by sponsors, not to mention uncertainty over MMF ratings.

Potential solution

So are there any alternatives to holding cash in banks or in MMFs? Something that may provide a more attractive yield whilst dissipating some of these risks? Not surprisingly nothing is perfect, but one potential answer may surprise many: the use of senior secured bonds, part of the asset backed securities (“ABS”) universe much maligned during the credit crunch.

So why might ABS help? Firstly, secured bonds are backed by specific asset pools, where the coupons and principal have direct recourse to the underlying assets. The deals themselves cover highly granular asset classes, including residential mortgages, car loans, credit cards and SME loans; all of which are highly transparent and can be analysed in great detail. The underlying assets sit within a segregated, bankruptcy-remote legal framework, thereby protecting them from outside events including bank bail-in regulations. They are also typically structured into tiers (or “tranches”) of risk, meaning the originating/issuing bank and junior tranches can act as loss absorbers to holders of the most senior tiers. Importantly, European ABS has seen excellent underlying performance throughout the credit crunch and should be seen very differently from US sub-prime issues that saw so much coverage at the time. European ABS is even the collateral of choice for the ECB!

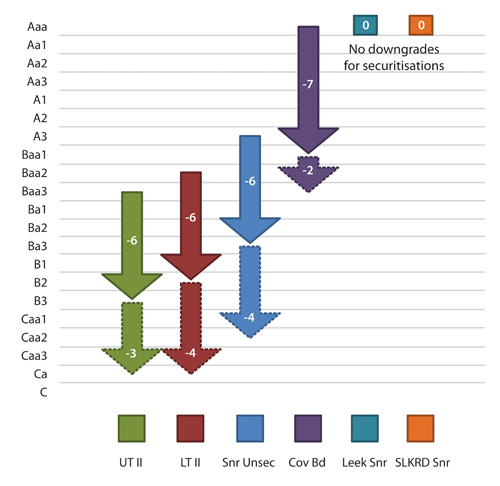

Figure 1: Co-op Bank bond issues – Moody’s ratings performance

Source: Moody’s

Moody’s initially downgraded all of the bank’s obligations by six or seven notches in early May 2013 followed by further multiple notch downgrades a month later. Whilst the securitisations were put on negative watch, due to Co-op’s involvement in the servicing and collection of the mortgage payments, they have since been reaffirmed after the bank was given time to put back-up providers of these services in place, which they subsequently did.

Issuance in the European ABS market is dominated by Residential Mortgage Backed Securities (“RMBS”) from the UK and Holland, two of the most stable economies in core Europe, where the senior tranches are all rated AAA at launch (there are almost no issues from Germany, as mortgage lending there is principally funded by Pfandbrief). Notably, there have been no defaults of any senior tranches through the credit crisis, and in repeated studies by entities such as the rating agency Fitch, none are projected. This robustness is reinforced by credit ratings performance where there have been no collateral related downgrades of UK or Dutch prime RMBS AAA ratings.

The experience of the Co-op Bank situation has done a useful job in showing the strengths of holding asset backed securitisations compared to bank debt itself. Not surprisingly, as the bank went through its numerous problems in 2013 the bank’s bonds suffered massive credit-rating downgrades, which was also reflected in the price performance of their bonds. Meanwhile however, the Co-op’s bankruptcy-remote RMBS issues; Silk Road and Leek (secured by mortgages originated by the Co-op and its subsidiaries) suffered far less price volatility and no downgrades at all to their ratings.

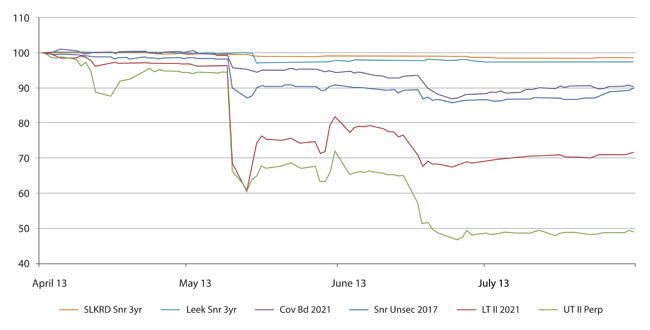

Figures 1 and 2 show the appalling relative ratings and price performance of the various tiers of the Co-op Bank’s debt (including the covered bonds, which many people falsely believe are bullet proof – the nine notches of downgrade and >10% in lost value proves they are not) compared to the almost benign performance of the RMBS issues during that time.

Figure 2: Relative price performance of Co-op Bank bonds during the downgrade period

Source: Bloomberg/Markit

Prices of all tiers of bank debt were severely affected by the downgrades and the subsequent speculation as to the financial health of the bank. Prices in the securitisations did fall marginally but remained stable due to their bankruptcy-remoteness.

In late 2013 TwentyFour Asset Management launched the Senior Secured Bond Fund. The fund invests only in senior tranches of ABS and predominately in AAA (80%+) and AA securities, and therefore the fund is rated Aaabf by Moody’s. It avoids certain parts of the market including securities backed by commercial properties (which are more difficult to value and therefore more volatile), CDOs and those issued from peripheral countries; which clearly don’t meet the rating requirements. All the assets are floating rate, keeping interest rate exposure to a minimum. The fund is a UCITS-regulated entity and therefore required to meet strict diversification requirements. Although the fund is daily dealt, it has a variable NAV and slightly longer settlement times than a MMF meaning it is best suited for hard-core cash holdings, rather than for meeting day-to-day working capital needs.

In summary, we believe ABS funds such as the Senior Secured Bond Fund provides investors with a secure home for their hard-core cash and offers a useful pick-up in yield over traditional cash investments.

TwentyFour Asset Management LLP, 24 Cornhill, London EC3V 3ND. Registered in England & Wales no. OC335015. Authorised and regulated in the UK by the Financial Conduct Authority, FRN No. 481888.

More Related Content...

|

|

|