An Audience With Jennifer Devine

Interviewee:

|

Jennifer Devine |

Jennifer Devine, Head of Wiltshire Pension Fund, has been at the forefront of steering the fund through a period of transformation. From leading ESG integration to leveraging technology for improved member services, Jennifer shares her insights on local investments, stakeholder engagement, and the future of pensions administration. In this exclusive interview, she reflects on Wiltshire’s pioneering approach to sustainability and her experiences leading one of the UK’s most forward-thinking pension funds. With a deep commitment to responsible investment and member engagement, Jennifer outlines what’s next for the fund and offers advice for the next generation of pension fund leaders.

Wiltshire Pension Fund has shown a keen interest in local investments, particularly in infrastructure and housing. How does this approach impact local communities, and how do you balance local with national opportunities?

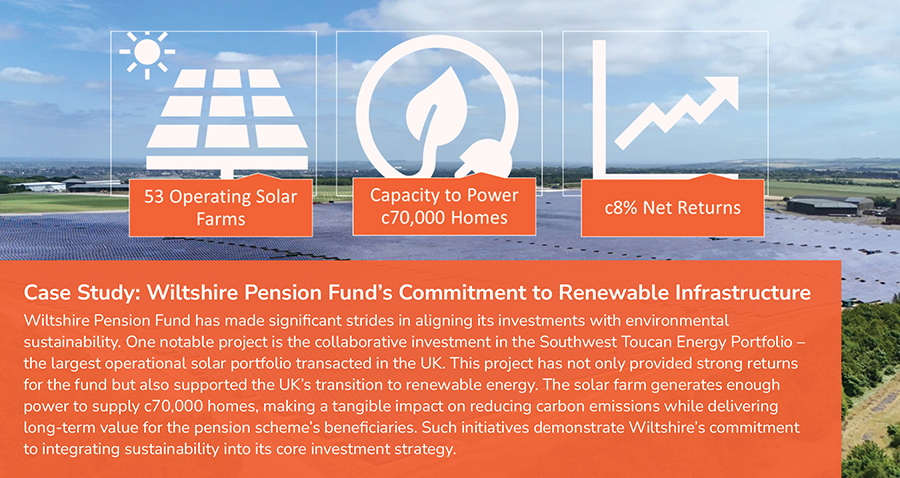

We get really excited about local investments. While we don’t have a dedicated Wiltshire allocation, we do have a lot invested across the UK. When it comes to portfolios that deliver impact, such as affordable housing or renewable infrastructure, we take particular interest in those close to home. It’s incredibly rewarding to stand on a solar farm and see firsthand the impact our investments are having.

We’ve also done some research into where our members are based, and it turns out many have stayed within the county. While “local” to them might mean Wiltshire, for us it means the UK – though we certainly focus on the Southwest where possible.

ESG has become a core element of modern pension strategies. How has Wiltshire Pension Fund integrated ESG considerations into its investment strategy?

ESG is integrated at every level of our investment approach, and it’s something we’re incredibly proud of. We’ve won multiple awards for our responsible investment approach, including at the LAPF Investment Awards in both 2021 and 2023. From setting strategy and selecting portfolios to appointing and monitoring managers, ESG principles guide us throughout.

We’re also very engaged with the member side – conducting regular surveys to gauge member priorities and incorporating their views into our decisions. Transparency and communication are key, ensuring that ESG isn’t just a tick-box exercise but a deeply embedded practice.

Can you share specific examples of how ESG principles have directly influenced Wiltshire’s investment decisions?

A prime example is our use of climate scenario modelling, which we began in 2020. This helped us understand the risks our fund faced in the transition to net zero and led us to make significant changes. As a result, we allocated more to sustainable equities and renewable infrastructure. We’ve since expanded that to include climate solutions, creating a dedicated Climate Opportunities Portfolio.

It’s about more than just mitigating risks – we’re also looking to seize opportunities and ensure our fund benefits from the transition to a greener economy.

What challenges have you encountered in aligning your investments with ESG principles, and how have you addressed them?

In listed equities, it’s relatively straightforward to get data on things like emissions. However, it becomes more challenging with other asset classes. For example, in property portfolios, we have to rely on our managers to assess risks such as physical climate risks.

We’ve tailored our approach, focusing on carbon reductions in portfolios where we expect to see a positive environmental impact. Another challenge is not getting too caught up in the numbers – you also need to look at the broader context. Stats can paint a picture, but we make sure to assess whether a company is genuinely committed to change or just ticking boxes.

Technology plays an increasingly crucial role in pension fund management. How is Wiltshire leveraging tech to streamline administration and improve member services?

Technology is essential to delivering better outcomes for our members. We’ve focused on using reporting tools from our admin system to provide strong management information, allowing us to forecast and prioritise tasks. This has really helped improve our key performance indicators (KPIs), ensuring we deliver what’s needed, when it’s needed.

We’ve also made strides in communications, using tools to assess the effectiveness of our outreach. We can track who’s engaging with our messages and adapt our strategies, accordingly, making our communications more impactful.

How does stakeholder engagement shape your investment strategy, particularly regarding ESG?

Stakeholder engagement is a cornerstone of our approach to stewardship. We can’t deliver better outcomes without understanding what our beneficiaries want. We survey our members every three years to avoid overwhelming them, and the message is clear – there’s strong support for a sustainable investment strategy.

While member views don’t dictate our decisions outright, they are an essential part of the decision-making process. We balance this with other factors, like risk and return, but we certainly aim to invest in line with our members’ values where possible.

With technology increasingly involved in shaping the future of pensions, what role do you think the pensions dashboard will play in this, and how is Wiltshire Pension Fund preparing for it?

Dashboards have been in development for a while now, but we’re focused on the fundamentals. The key message I give my team is to keep working on clearing backlogs and maintaining up-to-date records. If the data isn’t current, dashboards won’t serve their purpose.

There’s some anticipation that dashboards might trigger a wave of enquiries as people log on to check their pensions, but we’ll just have to wait and see how that plays out.

Looking ahead, what are the priorities for Wiltshire Pension Fund in 2025 and beyond?

We’re working through a three-year business plan and are focused on resolving some legacy administration issues to provide outstanding service to our members and employers. We’re on track to meet those goals and are incredibly proud of the progress we’ve made as a team.

Long term, once we’ve embedded these improvements, our focus will shift to ensuring that both members and employers truly value the scheme. It’s a significant financial asset, and we want people to recognise that.

What has been the most rewarding aspect of your career in pensions so far?

Working in the LGPS has been incredibly rewarding, especially at Wiltshire, where I’ve had the opportunity to lead and shape the fund’s direction. Moving from a team member to a team leader has been a huge step in my career, and I’m grateful for the trust and confidence placed in me.

One of the highlights has been our work on sustainability – making real progress and implementing ideas that align with our long-term goals. Building a positive culture within the team has also been deeply satisfying.

What advice would you give to emerging leaders in the LGPS?

Continuous learning is crucial. It’s important to reach out and build a strong network with colleagues across different funds. Sharing knowledge and working together will get you further than trying to go it alone. My advice is to stay curious and never stop developing your skills.

More Related Content...

|

|

|