Alternative investment grade: a means to safe yield enhancement

Written By:

|

David Crawford |

David Crawford of Nordea Asset Management UK spells out the benefits of investment grade private credit for institutional investors

Since the global financial crisis, central banks have created an unprecedented environment of low yields and artificially low defaults. Looking at the Bank of England, the central bank balance sheet has skyrocketed and interest rates have reached historic lows.

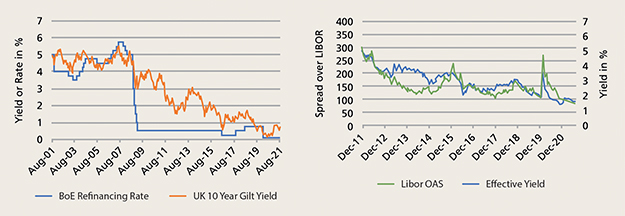

Figure 1: Long-term rate development (left chart) and UK corporate bonds (UR00 index) (right chart)

Source: Bloomberg, September 09, 2021

In April 2021, the 10-year Gilt yield reached close to zero, with UK corporate bond yields and spreads close behind, and yields look likely to remain low for some time. This creates issues for institutional investors as investment grade (IG) assets form a significant part of their portfolios. According to a Mercer study, the allocation for Defined Benefit Pension Schemes in the UK was 55% investment grade bonds, sovereign and corporates, on average in 2020.

Why such a high allocation given the limited return potential? And is there a possible replacement for IG?

Here, we need to differentiate Defined Benefit (DB) Pension Schemes according to their ongoing strategy and their funding status. For the many schemes approaching a buy-out end-game, an allocation to IG assets offers a hedge against buy-out pricing risk. If IG spreads tighten further, insurer pricing will become more expensive. At the same time, however, the funds’ IG assets will also benefit, thereby hedging this risk to some extent. For funds already in an endgame situation with a potential insurer buy-out planned, the IG allocation is usually moving towards an insurance company’s asset allocation driven by Solvency II and respective restrictions as well as capital requirements.

For DB schemes that are well funded, the spread on IG is still sufficient to provide an expected return, currently LIBOR plus ~85bps for UK corporate bonds (see Figure 1). For DB schemes with a lower funding position, however, return on capital becomes a major topic. In 2004, according to Mercer, UK DB schemes were invested 64% in equity, 34% in bonds and 2% in alternative assets. By 2020, the allocation had changed dramatically, with equity representing a mere 18%, fixed income (probably for some of the before mentioned reasons) 55% and finally alternatives representing 27%. This last figure includes a significant proportion in growth-oriented fixed income, which includes strategies like high yield, emerging markets fixed income and private debt strategies. This shift reflects the need to reduce portfolio risks while still seeking a return on capital to mitigate the funding gap. So how can an investor enhance return on capital while keeping risks at bay?

Bank loan co-investments enhancing return, controlling risk

Since the global financial crisis, the regulatory environment for banks has changed significantly. One significant change, introduced by Basel II, is the increase in risk capital required to hold certain investments. This has forced banks to limit how much they lend, thereby creating an opportunity for collaboration between banks and other investors in the form of bank loan co-investments.

Bank loans with a real asset backing, like infrastructure or commercial real estate, have the potential to be a game changer for institutional investors. They can offer duration, strong collateral, good covenants and finally an implied IG rating (based on bank internal models accepted by regulatory bodies). The actual loan pricing reflects risks – both probability of default (PD) and loss given default (LGD), with PD being the main influence on pricing levels. Although pricing and internal models vary from bank to bank, an exemplary study for Sweden showed that yield requirements set by banks increased by 0.6% points to 1.0% points at low risk levels (numbers reflect an increase in PD from up to 0.4% to 0.6%). Note that the general spread level of bank loans also reflects the increased complexity, which is partly due to individualised credit risk protection, and the limited liquidity of the loan compared to traded bonds.

Due to the IG nature of the loans and the issuing bank’s intention to hold until maturity (or until prepayment), loans are kept on the balance sheet at amortised cost. This provides a clear benefit in terms of lower volatility as long as there is no impairment. These unique features of elevated yields, appealing risk protection and diversification to public bond markets may offer a solution for investors concerned by the depressed returns and spreads offered by liquid investment grade bonds.

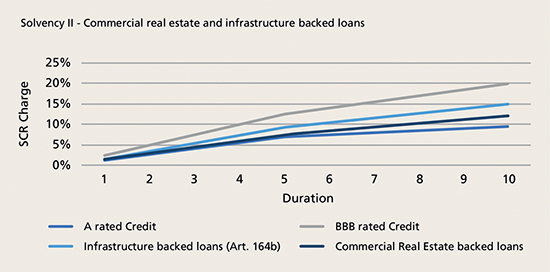

For DB schemes moving closer to their insurance buyout endgame, commercial real estate (CRE) and infrastructure-backed bank loans offer a strong value proposition. They bring not only yield enhancement and diversification as noted before, but also an advantage with respect to Solvency II rules. As a general rule, loans backed by CRE with a loan-to-value of below 75% are treated similar to an A-rated corporate bond. Combining the low capital charge with a significant yield pick-up creates a highly efficient instrument for insurance companies. This is reflected in large insurance companies’ demand for this type of assets in a cooperation with banks, either in club deals or in syndications. This should serve DB schemes well with respect to potential buyout as this type of asset is efficient from a regulatory perspective.

Figure 2: An illustration: the Nordic Bank market

Source: EPFR, Bernstein analysis. Data as at February, 2021.

The Nordic bank market

Bank loan co-investment may be accessible in many markets, however the Nordics is more a “traditional” relationship-driven and relatively closed loan market. Based on data from the European Banking Authority (EBA) from Q1 2021, Sweden together with Denmark, Finland and Norway show strong asset quality (lower non-performing loans) compared to their European counterparts. In many facets, Swedish banks are actually leaders in the lending market. Further, local banks dominate the Nordic market with unilateral transactions as well as club deals. The “originate to hold” model prevails and offers an additional form of protection as the partner bank keeps significant part of the loan on the balance sheet. In other words: there is risk- and interest-alignment with the bank keeping skin in the game.

In terms of spread above IBOR, the markets are not fully homogeneous. Figure 3 is an overview on spreads for commercial real estate transactions in Sweden. With a five year horizon, spreads hover around 130 to 150bps over SIBOR, offering a higher return than IG rated corporate bonds of similar credit risk and maturity. These spreads don’t include the additional upfront fees of 15 to 30bps that is owed to the co-lending partner(s).

Figure 3: Overview on spreads for commercial real estate transactions in Sweden

Pricing in Finland and Norway can be expected to be slightly higher, whereas pricing in Denmark tends to be slightly lower than the numbers shown above. Overall, investors in Nordic IG bank loan co-investments should expect to earn 100 bps to 150bps over similar credit risk in the public market.

Why should institutional investors consider IG private credit?

Most institutional investors utilise private assets as part of their growth-asset allocation, but typically not as a low risk alternative to IG. There are several good reasons why they should.

Endgame, hedging buy-out pricing: Hedging requires building an attractive portfolio for an insurer. IG private credit, for many insurers, is a core asset class in their own portfolios.

Matching, default and discount rates: As demonstrated, IG private credit investing has lower drawdown, better investor protection, and improved “quality” when compared to public IG. Therefore, although not completely immune to downgrades, it offers a quality improvement and mitigates concern about default/downgrade risk when comparing against liabilities. The correlation between IG private credit and an institutional investor’s liability discount rate further demonstrates the attractiveness of the asset class. Furthermore, the inherent stability of IG private credit yields provides greater stability compared to its public counterpart.

The asset class typically offers investors the certainty of both income and returns that you would traditionally get from fixed income, but with higher returns. For institutional investors searching for diversification and yield enhancement without taking on excess credit risk, investment grade private credit has become an attractive option.

Nordea Asset Management is the functional name of the asset management business conducted by the legal entities Nordea Investment Funds S.A. and Nordea Investment Management AB (“the Legal Entities”) and their branches and subsidiaries. This document is advertising material is intended to provide the reader with information on Nordea’s specific capabilities. This document (or any views or opinions expressed in this document) does not amount to an investment advice nor does it constitute a recommendation to invest in any financial product, investment structure or instrument, to enter into or unwind any transaction or to participate in any particular trading strategy. This document is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or instruments or to participate to any such trading strategy. Any such offering may be made only by an Offering Memorandum, or any similar contractual arrangement. This document contains information only intended for professional investors and eligible investors and is not intended for general publication. © The Legal Entities adherent to Nordea Asset Management and any of the Legal Entities’ branches and/or subsidiaries.

More Related Content...

|

|

|