Aligning financial and climate obligations within fixed income portfolios

Written By:

|

Iain Buckle |

|

Gerrit Ledderhof |

|

Rory Sandilands |

Iain Buckle, Gerrit Ledderhof and Rory Sandilands of Aegon Asset Management debate the merits of differing short-dated bonds and give their conclusions about constructing a successful portfolio

The unique characteristics of short-dated bonds offer investors an opportunity to access a lower-volatility segment of the broader investment grade fixed income market. Short-dated investment grade bonds can be attractive to a diverse range of clients, including local authority pension schemes undergoing de-risking, or local authority treasurers seeking enhanced returns above cash to help mitigate the effects of inflation.

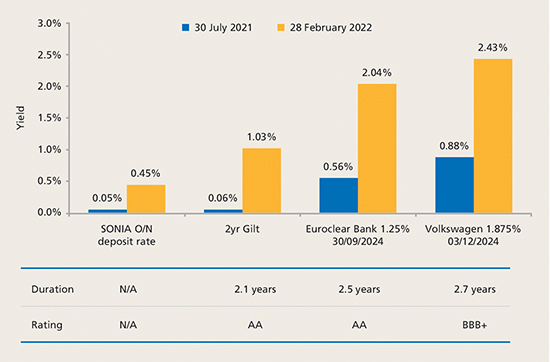

Short-dated investment grade bonds can offer attractive and relatively consistent returns against a market backdrop of negative real returns. Figure 1 highlights that risk-free returns are negligible and there is an increasing need to take on credit risk to enhance yield.

It is possible to obtain good relative returns by investing in short-dated bonds from good quality investment grade companies without taking on additional interest rate (duration) risk. Figure 1 also highlights two such examples – a large European financial institution (Euroclear) and an auto manufacturer (VW) – both of which offer attractive yields for low levels of interest rate risk and with good credit profiles.

Figure 1: Short-dated investment grade bonds offer attractive yield and spread for low duration

Source: Aegon AM. Bloomberg as at 28 February 2022

The appeal of short-dated bonds is based on a range of factors, including:

- A record of generating attractive risk-adjusted returns.

- Capital preservation qualities – individual bonds are typically much more resilient to negative company-specific events than longer-dated bonds.

- They are less susceptible to fluctuating interest rates because they derive returns through credit risk rather than duration risk.

- They can generate steady cashflows, which can be paid-out as an income or reinvested to take advantage of further opportunities.

- Short-dated bonds are inherently more liquid than their longer-dated equivalents, due to the relatively high frequency of bonds reaching maturity.

- There is no material yield sacrifice for a reduction in climate risk.

It is this final benefit that we want to explore in more detail in the remainder of this article.

Assessing climate transition risk

Understanding the potential risks to company cash flows is vital to retain the conservative nature of short-dated bond investments. Understanding and actively managing ESG risks, including climate related risks, should therefore play an important role in investment decision-making.

To assess the materiality of climate change risks for bonds, research typically focuses on the potential impacts of transition and physical risks – those arising from the economic or policy changes from the transition to a net-zero economy or from acute and chronic environmental changes respectively. Generally, this includes assessment of a range of carbon emission metrics to help investors consider the carbon footprint of their investments.

Figure 2: Transition and Physical risks

Source: Aegon AM as at 31 March 2022

When focusing on transition, the next stage in climate risk analysis is to assess companies’ ambitions, performance, and management toward net-zero. This goes beyond backward-looking emissions to form a forward-looking view of a company’s transition readiness and alignment with the energy transition.

Analysis can be conducted for issuers across a wide range of industry sectors and may consist of an examination of:

- Long-term ambition and associated targets

- Historical emissions trends and disclosure

- Climate / environmental management, governance and strategy

More in-depth analysis should be considered for issuers in sectors deemed to have a stronger ability to influence the achievement of global climate goals. This influence can be direct as a result of their emissions or products, for example oil & gas or utilities; or indirect as a result of their ability to influence the activities of others, for example banks. In these sectors, it is important to understand the idiosyncratic considerations and issues faced by companies and tailor climate analysis accordingly.

Rather than simply exclude high influence sectors, this type of research can help to identify and support those companies that have robust and credible plans to transition towards a low carbon economy. Research frameworks and related portfolio guidelines can then be designed and implemented to be compatible with external climate initiatives e.g., Net-Zero Asset Owner Alliance and the Paris Aligned Investment Initiative.

Active engagement also plays an important complementary role to enable greater understanding of a company’s climate transition risk, encouraging more aggressive climate-related targets and helping to improve the quality of disclosures.

Bond maturity and climate risks

Making investment decisions based on climate risk information can vary significantly depending on the maturity of an individual bond. This is because some of the key climate risks influencing the credit profile of an issuer will play out on different timescales.

In a shorter-dated portfolio (bonds with less than five years to maturity) the key climate risks being faced during the lifetime of the bonds relate to transition. If you are lending to climate-exposed companies over the longer term, then you can typically get paid a premium for doing so. But this is not true for shorter-dated bonds, which are much less exposed to a climate-related deterioration in credit quality during their lifetime.

To illustrate this, we refer to the example of two similarly-related issuers in the oil & gas and manufacturing sectors, the latter having lower transition risk. Both issuers have an A credit rating and have large, liquid yield curves in the Euro investment grade market including bonds around the 3-year maturity point.

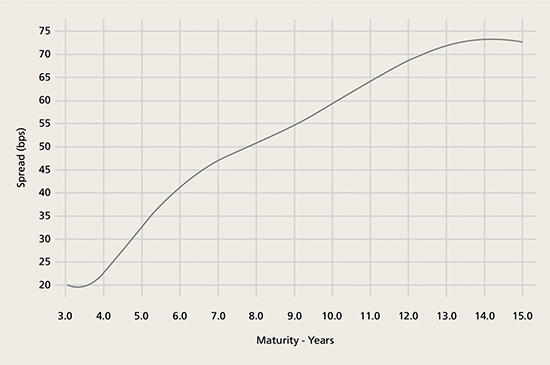

Figure 3 plots the differential between the credit spreads (over government bonds) of bonds available from each issuer through the maturity curve from 3 to 15 years. At the short end of the market, there is only a small differential in the credit spread of c20-25 basis points out to four years. Beyond that point, the differential increases significantly as the maturity of the bonds available lengthen, and then reaches over 70 basis points as you approach 15 years.

Figure 3: Credit spread differentials of bonds through the maturity curve of 3-15 years

Source: Barclays as at 29 March 2022

This means that the additional yield or premium that the oil & gas company has to pay on its debt increases significantly as you move out the maturity spectrum and suggests that the climate risk of that sector is more likely to be priced into the longer-dated bonds of those companies.

The small difference between these respective issuers at the short end suggests that transition risk is not priced in. Therefore, a more focused approach to managing climate risk can be applied at this time with minimal yield sacrifice.

Summary

It is possible to construct a climate transition focused short-dated corporate bond portfolio that does not sacrifice expected yield. Rather than simply exclude companies based on higher carbon emissions, or from the higher influence sectors, portfolios can be constructed to invest in those companies that have robust and credible plans to transition towards a low carbon economy and therefore be better aligned to investors’ net-zero goals. This is potentially attractive to local authority investors as regulatory, societal and investment pressures lead to a greater awareness of climate-related risks.

Important information

For Professional Clients only and not to be distributed to or relied upon by retail clients. The principal risk of this product is the loss of Asset Management. Please refer to the KIID and/or prospectus or offering documents for details of all relevant risks. The relevant documents can be found at aegonam.com.

Past performance is not a guide to future performance. Outcomes, including the payment of income, are not guaranteed.

Opinions and/or example trades/securities represent our understanding of markets both current and historical and are used to promote Aegon Asset Management’s investment management capabilities: they are not investment recommendations, research or advice. Sources used are deemed reliable by Aegon Asset Management at the time of writing. Please note that this marketing is not prepared in accordance with legal requirements designed to promote the independence of investment research, and is not subject to any prohibition on dealing by Aegon Asset Management or its employees ahead of its publication.

Fund Charges are taken from income but will be taken from capital where income is insufficient to cover charges.

All data is sourced to Aegon Asset Management UK plc unless otherwise stated. The document is accurate at the time of writing but is subject to change without notice.

Data attributed to a third party (“3rd Party Data”) is proprietary to that third party and/or other suppliers (the “Data Owner”) and is used by Aegon Asset Management under licence. 3rd Party Data: (i) may not be copied or distributed; and (ii) is not warranted to be accurate, complete or timely. None of the Data Owner, Aegon Asset Management or any other person connected to, or from whom Aegon Asset Management sources, 3rd Party Data is liable for any losses or liabilities arising from use of 3rd Party Data.

Aegon Asset Management Investment Company (Ireland) Plc (AAMICI) is an umbrella type open-ended investment company which is authorised and regulated by the Central Bank of Ireland.

Aegon Asset Management UK plc (Aegon AM UK) is authorised and regulated by the Financial Conduct Authority. Aegon AM UK is the investment manager for AAMICI and also the marketer for AAMICI in the UK.

AdTrax: 4652886.1

More Related Content...

|

|

|