Active value opportunities in secondary property

Written By:

|

Phil Clark |

Phil Clark, Kames Capital’s Head of Property Investment, shares his view of the UK commercial property market and the opportunities for local authority pension funds

What is your view on the UK economy recovery?

The gathering pace of the economic recovery in the UK has seen unemployment fall, a string of positive confidence surveys, renewed business investment by some companies and a strong return to near-trend levels of GDP growth.

Of course, supportive monetary policies in the UK, as they have been elsewhere in the developed world, have helped bring about this post financial crisis bounce. A widespread low interest rate policy and quantitative easing have seen government bond yields fall – and prices rise – to historically expensive levels.

What has this meant for investors?

Even as economic data has improved, central banks continue to indicate that interest rates will remain low for a long time. Even in the UK, where growth has rebounded more strongly than in most economies, the Bank of England continues to nurse the economy’s rehabilitation.

For income investors the search for yield has widened beyond the realms of government bonds. They have increasingly had to chase riskier assets, such as high-yield bonds to meet their requirements. In turn, yields in credit markets have been squeezed lower as heavy demand and relatively low levels of new corporate bond issuance have seen prices soar. Even in equity markets, dividend yields have become less attractive because rising share prices have outpaced the rate of dividend growth.

As a result, we have seen more investors looking to property as an income-producing asset. As money has flowed into the asset class there have been solid capital returns. According to the most recent IPD monthly survey, capital growth reached 3.3% in the second quarter, up from 2.3% in the first quarter of 2014.

Which parts of the market have been performing well?

Like much of the rest of the economy, prime commercial property has been a strong-performing sector. This strength has been aided by international investors chasing prime assets and “trophy” buildings, mainly in central London. Following the financial crisis there was a ready supply of available property as banks and hedge funds were compelled to reduce their over-extended balance sheets. Once supply was overtaken by investor demand, the property market strengthened, which was also helped by improved occupier demand. Prime market capital returns, particularly in London, surged while rental income – which traditionally represents around two-thirds of property returns – took a back seat.

How much further can the prime property rally go?

According to IPD’s monthly index, at the end of June, the net initial yield for all UK commercial property was around 3.0% above the government’s 10-year Gilt. In short, this means that the income-bearing characteristics of large swathes of the UK property asset class still remain relatively attractive against government bonds. However, compared with historical property valuations, and compared with other parts of the property market, valuations on prime real estate look increasingly stretched.

Where should property investors be focusing now?

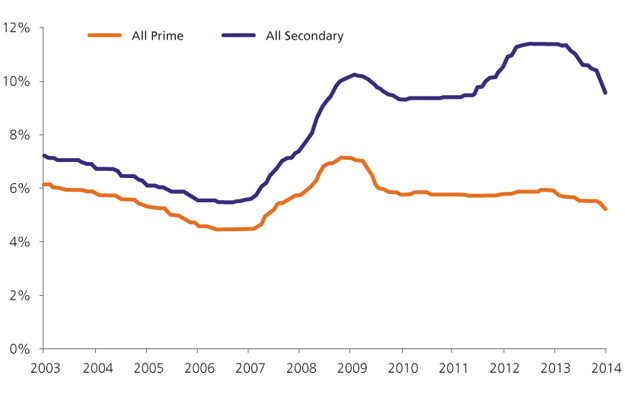

We have already started to see property values rebound across the UK. The appetite for risk has increased, and investors have begun to look further afield for potential returns as, even within the property sector itself, there are strong yield differentials. Between prime and secondary property for instance, the gap between yields widened out significantly between 2007 and 2013, making the secondary market look relatively attractive.

As Figure 1 illustrates, the yield differential between these submarkets is currently close to 4%, while the long-run average gap has been around 2%. Although there has been some narrowing of late, the margin remains wide. We believe rising demand from yield-hungry investors will force secondary property prices to rise and slowly narrow this yield gap, moving it closer to long-run norms.

Figure 1: Prime vs. secondary property yields (ex. Central London)

Source: CBRE, Kames Capital. From 1 June 2003 to 1 June 2014

What is the outlook for property?

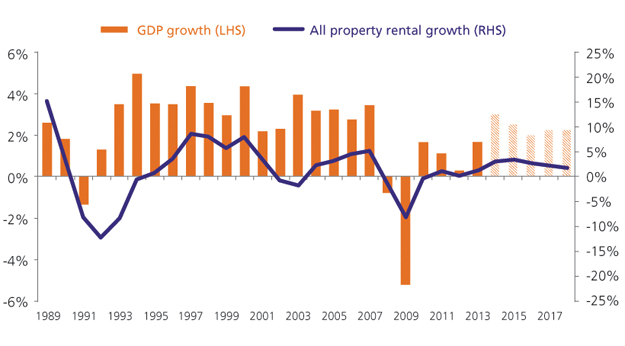

Unsurprisingly, GDP growth has a strong correlation to rental growth. As Figure 2 illustrates, rental growth typically picks up around 18 months after GDP growth has advanced beyond 2%. In quarter three of 2013, GDP growth was reported at 2.7% on an annualised basis, and has been growing further from there.

Given the “lower for longer” mantra of many central bankers, including the Bank of England’s Mark Carney, even when rates do rise, the changes will be slow and steady. The size of the current differential between property initial yields and 10-year Gilt yields is large enough to provide something of a cushion that should keep property – particularly secondary property – looking attractive for longer compared to the rest of the market.

Figure 2: Annual GDP and rental growth

Source: PMA, Kames Capital. Forecasts from 2014 to 2018

This all means that the prospect of improved rental returns is getting closer. Combining a rental uplift with the potential for capital gains gives secondary property an added attraction. In the past six months, there has been a discernable shift in the sources of performance, with secondary property returns starting to improve at a faster rate, catching up somewhat on the prime market. For example, in the second quarter, returns in UK property were increasingly broad-based, with industrial units in the rest of the UK and distribution warehouses nationwide achieving total return growth in quarter two of 5.4% and 5.7% respectively. This compares to prime offices in the West End of London and the City returning 5.7% and 4.5%.

While we expect some continuation of the strong returns from the central-London office market in the near term, we also believe the recovery will broaden out from here. Commercial property returns should ripple out across the UK, although not everywhere will benefit equally. This is a stock picker’s market, which favours an investment team with a strong and discerning process to uncover the selective areas of the secondary market – particularly higher-quality property within this sub-sector – that should benefit most.

At Kames Capital, we have a good record of looking for mispriced properties that will profit from active management to enhance the value of the asset and increase the rental and capital returns. The opportunities differ for each individual property, so, given the right approach to management of the right asset in the right location, there are opportunities to reduce vacancy rates, develop and extend lease terms, improve tenant quality and undertake refurbishments. We believe that a careful and intensive fundamental approach can help to maximise returns while the gap between secondary and prime property yields returns to more normal historical levels.

This article is not intended for retail distribution and is directed only at investment professionals. It should not be distributed to, or relied upon by, private investors. The information in this document is based on our understanding of the current and historical positions of the markets. The views expressed should not be interpreted as recommendations or advice. Past performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and is not guaranteed. Awards and ratings are highlighted to demonstrate our investment capabilities.

Where funds are invested in property, investors may not be able to switch or cash in their investment when they want because property in the fund may not always be readily realisable. If this is the case we may defer a request to switch or cash in units. Whilst property valuation is conducted by an independent expert, any such valuation is a matter of the valuer’s opinion. Property funds invest in a specialist sector, which may be less liquid and produce more volatile performance than an investment in broader investment sectors.

Kames Capital is an AEGON Asset Management company and includes Kames Capital plc (Company Number SC113505) and Kames Capital Management Limited (Company Number SC212159). Both are registered in Scotland and have their registered office at 3 Lochside Crescent, Edinburgh, EH12 9SA. Kames Capital plc is authorised and regulated by the Financial Conduct Authority (FCA reference no: 144267). Kames Capital plc provides segregated and retail funds and is the Authorised Corporate Director of Kames Capital ICVC, an Open Ended Investment Company. Kames Capital Management Limited provides investment management services to AEGON, which provides pooled funds, life and pension contracts. Kames Capital Management Limited is an appointed representative of Scottish Equitable plc (Company Number SC144517), an AEGON company, whose registered office is 1 Lochside Crescent, Edinburgh, EH12 9SE (FCA reference no: 165548).

More Related Content...

|

|

|