Active on the equities front

Written By:

|

Simon Brazier |

Simon Brazier of Threadneedle on how fluctuations in market conditions can provide growth opportunities for active investment managers.

For the last 12 years equities have struggled to regain the peak seen at the height of the technology bubble in 2000, despite the steady growth in corporate profits since that time. Partly this reflects the extreme over-valuation of markets in 2000 and partly it is explained by ebbing investor confidence (and actual investment) in equities. In fact, in mid- 2012, the Financial Times reported a widespread view that we were witnessing the death of equities.

In reality, though, equities have performed very strongly since the end of the financial crisis in 2009. And since the FT published its article at the end of May 2012, the MSCI AC World index has delivered a total return of 17.5% in sterling terms to end of January 2013. Here in the UK, the FTSE kicked off 2013 with its strongest January performance for 24 years. Investors are taking note – $70 billion of net inflows into equity funds in the US in the first five weeks of this year has sparked debate amongst observers on whether, after a 20-year bull market in bonds, we are now witnessing signs of the “Great Rotation” away from bonds into equities. In other words, is this now actually the beginning of a structural bull market in equities?

Part of the reason for the recent run of strong performance has been an improved outlook for global economic growth. With tail risk significantly reduced in Europe on the back of ECB policy actions, highly accommodative monetary policy in place across the developed world, a recovery in housing activity, measures now being taken to tackle the fiscal cliff and debt ceiling in the US, and a growth resurgence in China, there has been a significant revival in risk appetite. This, in particular, creates a favourable backdrop for equity markets with a significant international profile. In the UK, for example, 75% of UK companies’ earnings are derived from overseas, and over 50% from outside Europe (see Figure 1). This not only partially insulates the UK market from the current tough domestic economic conditions, it also provides investors with access to the fast- growing international markets through companies that are global leaders in their field and subject to advanced corporate governance standards.

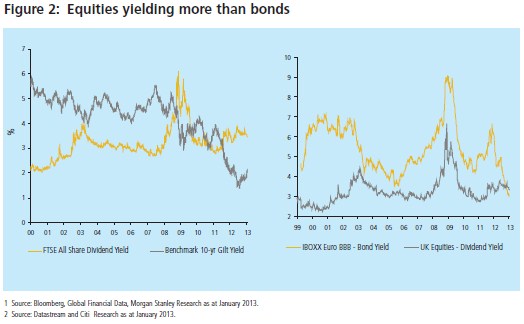

Markets have rallied hard on this improved outlook, but we still remain cautious on global growth, and maintain our below-consensus forecasts. Even in a low growth environment, however, a compelling case can also be made for most equity markets based on valuation. Price-toearnings, price-to-cash- flow, and priceto- book value ratios are in most cases below their long-term averages, even after the recent rally. Companies continue to generate healthy cash flows and are returning much of this cash to shareholders, mostly in the form of dividends. High-quality companies in a diverse range of sectors are offering above-market yields, backed up by historically low pay-out ratios. This compares favourably with the “return-free risk” of government bonds that offer record low, financially repressed yields, yet with enhanced credit risk from weakened government finances. And with increased investor appetite driving down yields on alternative bond investments, dividend yields are now even outpacing the yields on corporate bonds as well (see Figure 2).

Corporates have made substantial progress rebuilding their balance sheets since the financial crisis, and in many cases have increased their cash positions significantly. As a result, dividend yields are not only higher than the yields on bonds, but with dividend cover also above long-term averages, they are now far more sustainable than they were before the 2008 crisis. With the added dimension of exposure to equity market upside, the capacity for dividend growth, and the potential for value enhancing M&A activity that balance sheet strength and low interest rates provide, investors are increasingly looking at equities in their search for yield.

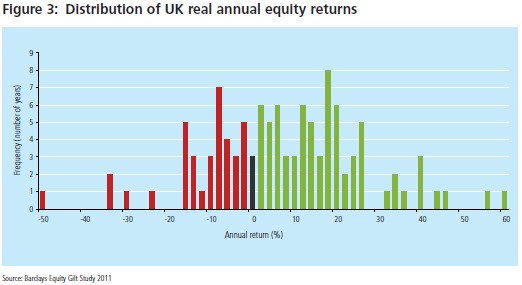

Equity investing is not, however, without risk, and volatility has been a key characteristic of markets in recent years. The experience of many seasoned investors has been coloured by the relatively low volatility conditions of the 1980s and 1990s, which marked a time of low inflation, geopolitical stability, popular share ownership and consumer capitalism. Looking back over history, however, negative real return years are not unusual and there have been decades, such as the 1910s and 1960s in the UK, when there were more down years than up. The shock of the 2000s was compounded by the fact that the previous two decades had been unusually prosperous, with just two years of negative real returns between 1980 and 1999 in the UK. On top of that, as the Barclays Equity Gilt Study shows, annual returns do not follow a normal distribution – over the past 111 years, there is a wide, flattish peak in returns, with just as many +25% returns as +8%, zero, -10% and -15% (see Figure 3).

Despite challenges and periods of intense volatility, equities have still outperformed other asset classes, delivering an average annual return after inflation of 5% since 1900. Volatile markets should not be feared, therefore, and neither should they be a trigger to panic and adopt an overlymyopic approach. Market shorttermism, together with the structural shift to passive investing, creates many opportunities for the active manager as it increases equity market inefficiencies. By adopting an approach based on detailed analysis of long-term company valuations, active managers can see past short-term distortions, and use short-term market volatility to exploit longer-term valuation opportunities.

Conclusion

Whilst the investment outlook has certainly improved, we continue to expect low economic growth in the developed world over the medium term, as consumers carry on paying back debt, banks rebuild their balance sheets, and developed world governments focus on deficit reduction. Within equity markets, however, the combination of attractive valuations, global exposure and balance sheet strength, against a backdrop of low equity ownership and inefficient volatile markets, should provide active managers with a strong basis on which to deliver continued positive returns.

Important Information: Past performance is not a guide to future performance. The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested. The research and analysis included in this document has been produced by Threadneedle Investments for its own investment management activities, may have been acted upon prior to publication and is made available here incidentally. Any opinions expressed are made as at the date of publication but are subject to change without notice. Threadneedle Asset Management Limited. Registered in England and Wales, No. 573204. Registered Office: 60 St Mary Axe, London EC3A 8JQ. Authorised and regulated in the UK by the Financial Services Authority. Threadneedle Investments is a brand name and both the Threadneedle Investments name and logo are trademarks or registered trademarks of the Threadneedle group of companies. www.threadneedle.com

More Related Content...

|

|

|