A fresh approach to core equity investing in emerging markets

Written By:

|

Paul Rogers |

Paul Rogers of Lazard asset management explains how an active approach to emerging markets equity investing help with portfolio performance

As the emerging markets asset class has expanded over the past thirty years, so has investor interest in this area, triggering a proliferation of investment options, including index-tracking and style- and factor-focused products. On the one hand, passive products can neglect a significant subset of emerging markets stocks and are restricted by index construction rules. Style or factor investing, on the other hand, is prone to cycles that can result in undesirable patterns of performance. A core portfolio that transcends style considerations could prove more prudent.

Emerging market equities have become an important component of global portfolios, due to their long-term performance potential. However, this asset class is prone to oscillations in performance, whether by style (growth versus value) or factor (beta and price-to-earnings ratios for example). By its nature, investing with a style or factor¹ focus can result in undesirable patterns of performance, especially during periods of elevated volatility when stocks with a shared orientation tend to move in tandem. The concept of core investing has come about as an alternative to style-driven approaches. We believe this definition is too narrow and that an emerging markets core equity offering should include a consideration of other characteristics in an effort to improve investment outcomes.

Characteristics such as a portfolio construction process that extends beyond style to include cyclical versus defensive perspectives, and a consideration of a portfolio’s volatility relative to its benchmark should be considered. And factors such as interest rates and commodity price movements should be monitored in order to isolate any unintended positions. As a result, one would expect portfolio performance to be driven to a greater extent by company-specific instead of style-specific factors resulting in lower volatility of excess returns relative to the benchmark (what we call “lower volatility of alpha”). This could be especially attractive to the risk-aware emerging market investor seeking a more stable pattern of relative performance. In our view, this framework can serve as a central solution for emerging market equity investing.

Looking deeper into patterns of performance

By evaluating the core style of investing from different angles, including growth versus value and cyclical versus defensive, and also by disaggregating the portfolio’s volatility relative to the index, style biases can be mitigated resulting in a portfolio driven by stock-specific factors. We illustrate above how a given characteristic can be in or out of favour for extended periods.

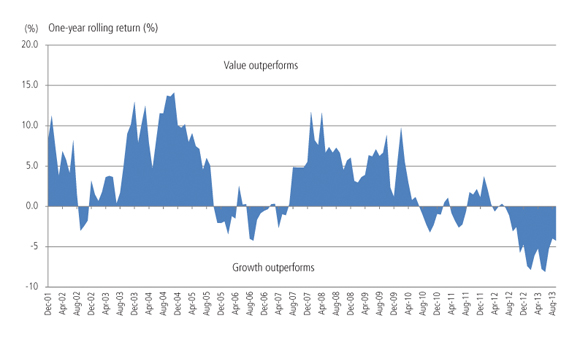

Figure 1: Value versus growth

As of 30 September 2013. Data is based on the MSCI Emerging Markets Value and Growth indices. This information is for illustrative purposes only. The performance quoted represents past performance. Past performance is not a reliable indicator of future results. This information is not intended to reflect the performance of any strategy or product managed by Lazard. Indices are unmanaged and have no fees. One cannot invest directly in an index. Source: MSCI

Using the MSCI Emerging Markets Value and Growth indices, we computed the rolling one-year excess return of the value index over the growth index from December 2001 to September 2013. Figure 1 shows that value outperformed growth most of the time, decisively and for long stretches. However, a portfolio’s cyclical or defensive tilt has been an important contributor to excess returns over this period regardless of its growth or value bias.

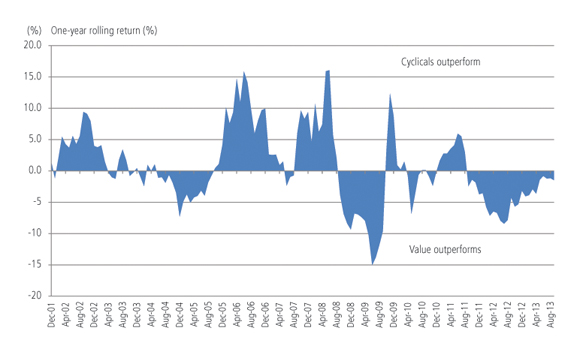

In order to compare the performance of cyclical stocks versus defensive stocks, we created custom indices based on the Global Industry Classification Standard (GICS). The Cyclicals Index includes consumer discretionary, information technology, industrials, financials, materials, and energy stocks, while the Defensives Index includes consumer staples, health care, telecom services, and utilities stocks. For both indices, sectors were weighted utilising the corresponding month-end sector weights of the MSCI Emerging Markets Index.

Figure 2: Cyclicals index versus value

As of 30 September 2013. Data is based on the Cyclicals Index2 and the MSCI Emerging Markets Value Index. This information is for illustrative purposes only. The performance quoted represents past performance. Past performance is not a reliable indicator of future results. This information is not intended to reflect the performance of any strategy or product managed by Lazard. Indices are unmanaged and have no fees. One cannot invest directly in an index. Source: MSCI, Lazard

As Figure 2 illustrates, maintaining a cyclical exposure was a key contributor to excess returns from June 2005 to June 2008. Specifically, the Cyclicals Index rose 177.5% versus returns of 121.3%, 104.5%, and 112.5% for the MSCI Emerging Markets Value, Growth, and Standard indices respectively. From this we conclude that while particular market conditions can benefit a particular style (i.e., value or growth), other factors such as a portfolio’s sector positioning should also be considered when seeking to outperform in different market environments.

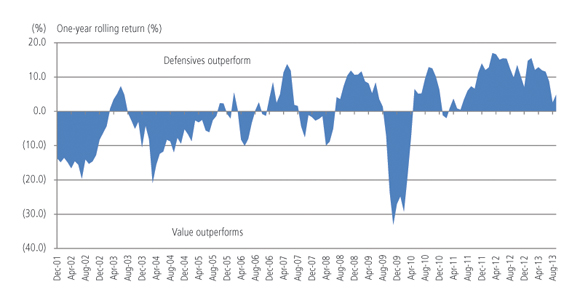

Figure 3: Defensive index versus value

As of 30 September 2013. Data is based on the Defensives Index2 and the MSCI Emerging Markets Value Index. This information is for illustrative purposes only. The performance quoted represents past performance. Past performance is not a reliable indicator of future results. This information is not intended to reflect the performance of any strategy or product managed by Lazard. Indices are unmanaged and have no fees. One cannot invest directly in an index. Source: MSCI, Lazard

Shifts in sector leadership can also be sudden, violent, and long-lasting. Figure 3 illustrates a rotation to defensive sectors that began in October 2009 and that has lasted through September 2013. During this time, the Defensives Index advanced 57.4% compared to 14.7%, 23.0%, and 18.9% for the MSCI Emerging Markets Value, Growth, and Standard indices, respectively. When we examine the returns of the value and growth indices as well as our custom cyclical and defensives indices at different points in time, it is evident that certain styles and sector orientations have done better than others at one time or another, but that none has done so in any way that could be useful to a value or growth investor. Given our analysis thus far, we believe that taking a one-sided view in a portfolio is risky and can potentially lead to sustained periods of underperformance. For example, some investors are convinced that the current dominance of defensive companies is structural. However, in mid-2005 through mid-2008, this view was applied to cyclical companies. In fact, what is frequently believed to be a “structural” phenomenon often breaks down at some point, and it usually does so quickly and dramatically.

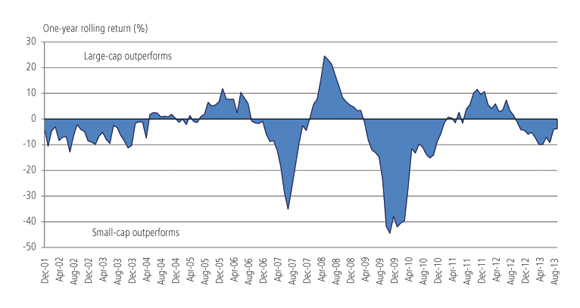

Figure 4: Large-cap versus small-cap

As of 30 September 2013. Data is based on the MSCI large- and small-cap indices. This information is for illustrative purposes only. The performance quoted represents past performance. Past performance is not a reliable indicator of future results. This information is not intended to reflect the performance of any strategy or product managed by Lazard. Indices are unmanaged and have no fees. One cannot invest directly in an index. Source: MSCI, FactSet

These comparisons suggest that investors with concentrated style or factor exposure are vulnerable to fluctuating returns with pronounced peaks and valleys. While we have furnished some examples here, more exist, including for market-cap cycles (see Figure 4). As emerging markets investors, we believe there are ways to mitigate dispersion of returns relative to the benchmark while preserving return potential.

Accessing emerging market equities through an active, core approach

The evidence suggests that timing any single style or factor is a difficult, if not futile exercise. We believe that it is more effective to rely on bottom-up stock selection to build a portfolio with relatively uncorrelated styles and factors in order to generate more consistent alpha over a market cycle. Accordingly, stock-specific factors should drive portfolio performance.

We also believe that there are opportunities to invest in companies at any stage of development. However, to identify those mispriced opportunities our choice of valuation metrics varies depending on our assessment of a company’s stage of life. This concept, which we refer to as flexible valuation, allows for standardised and disciplined company analysis and allows the team to identify those they believe are the best companies regardless of style, size, or geography.

In managing a portfolio’s risk relative to the benchmark, we feel it is best to diversify across styles and factors without explicitly neutralising any two opposing traits at any point in time. Over the long term, this can help to dampen the volatility of excess returns relative to the benchmark (i.e., lower tracking error) as well as to improve risk-adjusted performance measures, such as the information ratio.

We believe emerging markets remain an attractive source of mispriced equity opportunities. Active management appears best suited to exploit these inefficiencies given the drawbacks of passive and single-style or factor investing. A style-unconstrained approach not only widens the opportunity set, but can also reduce unintended biases that can lead to extended periods of underperformance. A stock picker’s goal is to derive outperformance primarily from stock selection, but also maintain lower volatility of alpha.

This is a financial promotion and is not intended to be investment advice. In the UK this document, which is supplied for information only, is for distribution only to professional investors and advisers authorised to carry out business under the Financial Services and Markets Act 2000.

Certain information included herein is derived by Lazard in part from an MSCI index or indices (the “Index Data”). However, MSCI has not reviewed this product or report, and does not endorse or express any opinion regarding this product or report or any analysis or other information contained herein or the author or source of any such information or analysis. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any Index Data or data derived therefrom. The MSCI Index Data may not be further redistributed or used as a basis for other indices or any securities or financial products.

Past performance is not a reliable indicator of future results. Fluctuations in the rate of exchange between the currency in which shares are denominated and the currency of investment may have the effect of causing the value of your investment to diminish or increase. Securities identified in this document should not be considered as a recommendation or solicitation to purchase, sell or hold these securities. It should also not be assumed that any investment in these securities were, or will be, profitable. Investments in emerging markets carry an above- average degree of risk due to the undeveloped nature of the securities markets in those countries. Investors should consider carefully whether or not investment in emerging markets investments is suitable for them and, if so, how substantial a part of their portfolio such investments should be.

Investing in equities may lead towards higher returns in the long term. However considerable fluctuations can apply to equity prices resulting in a greater risk that you may not get your money back.

Investors are reminded that the value of investments and the income from them is not guaranteed and can fall as well as rise due to market and currency movements. When you sell your investment you may get back less than you originally invested.

Issued and approved by Lazard Asset Management Limited, 50 Stratton Street, London W1J 8LL Lazard Asset Management Limited is incorporated in England and Wales with registered number 525667. It is authorised and regulated by the Financial Conduct Authority.

The contents of this document are confidential and should not be disclosed other than to the person or persons for whom it is intended.

More Related Content...

|

|

|