A focus on affordable housing

Written By:

|

Paul Myles |

Paul Myles of BMO Global Asset Management describes exactly what is implied by affordable housing and outlines the benefits that investment in it can bring to investors and to society as a whole

Housing is a basic human need, and the provision of housing as a social mission has been established for hundreds of years.

The growing inequality between rich and poor, and the existence of chronic housing shortages in hotspot areas, make the provision of affordable housing a critical imperative to achieve the Sustainable Development Goals.

Institutional investors are now stepping into this area, which can provide appealing financial characteristics alongside positive environmental and social impact.

Partnerships with existing housing providers, and credible impact measurement and monitoring, are important steps to avoid “greenwash” and to maximise the positive attributes of investments made.

The growth of impact investing

The emerging consensus that capitalism should be less short term and more inclusive to the wider society is quickly establishing itself in mainstream investing. For years considered niche, the growth of sustainable and impact funds is facilitating genuine change in many areas of society and the environment.

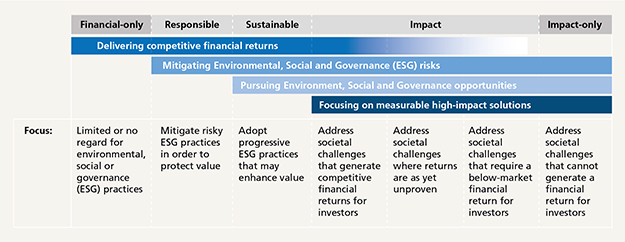

The concept of “double bottom-line” investing considers not only the financial return provided, but also the positive impact that invested capital has been able to create. Impact funds range greatly across providers and asset classes. They are generally distinguished as being investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.

Figure 1: Spectrum of capital

Source: Bridges Fund Management, as at 2017

Historically, impact investing fund structures were often more akin to private equity funds. Whilst having strong impact credentials, these often struggled with liquidity, resulting in a high proportion of investors shying away from the investment opportunity.

With the impact fund sector now in excess of US$500 billion according to the Global Impact Investing Network and a significant proportion of investors comfortable with the concept, double-digit growth is expected to continue.

Why focus on affordable housing?

A lack of affordable housing is a global issue and not one exclusively seen in developing markets, with acute issues also common in property hotspots in Western Europe and North America. Whilst there is no single definition of affordable housing, generally the term captures a wide spectrum of housing options, varying from social rent, to intermediate rent, to first-time buyer schemes aimed at getting people on the property ladder.

Affordable housing looks to support low to middle income households, such as vulnerable groups requiring housing subsidy, or key worker households that are ineligible for social housing, yet struggling to find an affordable solution in the mainstream private rental market.

The potential demand for this type of housing is huge. In the UK, the combination of a history of selling public housing to private owners, together with high population density, has led to chronic housing shortages, with affordable housing a key crunch point. There is a current estimated housing deficit of 380,000 new homes per year, with one study estimating that 133,500 of these should be either within social housing or intermediate rent schemes¹. A second report found that around 25% of UK households are living in poverty and 56% of those households are in full time work². Rent is generally the highest individual cost to tenants each month.

Affordable housing benefits not just those who live in these homes but also the community as a whole. A shortfall of affordable housing has a direct impact on the ability of employers to recruit. Key workers, for instance, are essential to a city’s prosperity – with the Covid-19 crisis a very present reminder of the importance of these workers for the functioning of society. However, this is a group that can quickly be priced out of all but the least desirable areas.

Why is institutional investment in affordable housing important?

In the UK market, legislative and tax changes have made private “buy-to-let” schemes less attractive, leading to a professionalisation of the private rental market, with institutional investors stepping in to fill the gap.

This has some important advantages over the traditional UK model of individual private landlords, for both the tenants and for society:

- Having larger, commercial property management companies overseeing rental properties can offer a higher, more standardised level of service for tenants.

- Commercial property management companies are often able to offer longer tenancies, in contrast to private landlords where tenancies may be shorter, creating a lack of certainty for tenants. Longer tenancies allow individuals to integrate into the wider community and contribute more freely, with the knowledge that the area is their home and not just a stopgap building in which to reside.

- Efficiencies for the landlord will be reflected in the occupational costs to the tenants, meaning their rental payments are more affordable – which often leads to higher occupation rates, underpinning financial returns.

- Where new build is possible, there is an opportunity to design, build and operate new homes that will almost certainly have a better environmental profile than the majority of older housing stock. This not only improves the carbon intensity of the property stock, but can also support the development of modern construction technologies, stimulating new industry and the associated employment opportunities.

These benefits do not come automatically with the shift from private to institutional money – the right partnerships and management structures have to be in place to ensure that benefits to tenants, communities and the environment are realised.

Working in partnership

A further advantage that institutional investors have in entering this space is the existence of housing associations that can, if considered a good fit, partner with one or more institutions to assist in the allocation of capital and management of properties. There are several in the UK alone with long track records of successfully delivering affordable housing schemes. These organisations often have deep relationships with local authorities that can be leveraged in the development and sourcing stages.

For the investor, having the ability to partner with an association that offers a strong cultural fit is a huge benefit to achieving impact efficiently. These organisations are generally well governed and transparent. It is essential that strong governance structures are put in place to oversee the partnership and fund’s assets.

For the Housing Association, the partnership provides off-balance sheet capital, enabling them to continue their social mission with less reliance on cross subsidy or grant funding models.

Measuring impact

Being transparent, understanding the impact achieved by investment and being able to consistently measure it are core factors to ensure investors and wider stakeholders understand investments in this area. Accusations of “greenwashing” can be extremely detrimental to the reputation of a fund and to the wider sector. It is therefore essential that thorough impact assessments are conducted and shared with investors. Impact in real estate cannot be reduced to a single metric.

There are different aspects of impact which need to be recognised and measured, and any potential housing investment may be market-leading in some areas but only reaching minimum standards in others. The governance of impact measurement also matters in providing integrity.

Affordable housing is also an important contributor to the achievement of the United Nations Sustainable Development Goals (SDGs). Adopted by all United Nations Member States in 2015, the SDGs provide a shared blueprint for peace and prosperity for people and the planet, now and into the future.

Two of the 17 goals link directly to the provision of affordable housing:

Each SDG has a set of underlying targets, with SDG 11.1 particularly relevant to the affordable housing agenda: “By 2030, ensure access for all to adequate, safe and affordable housing and basic services and upgrade slums”. The benefits of new housing stock in terms of energy efficiency also have a strong link to SDG 7 – Affordable and Clean Energy, and SDG 13 – Climate Action.

The energy efficiency benefits of new housing stock, link to goals:

Conclusion

At BMO Global Asset Management, we are optimistic about the future, and we believe in the ability of society, companies and individuals to come up with sustainable products and solutions to respond to these challenges and create opportunity from adversity.

There has already been progression within responsible investment from values to valuation, as investors came to realise that the ESG issues previously seen as purely ethical could be financially material. These are then integrated into the mainstream investment processes.

We believe a further shift is now taking place towards impact, as the financial sector takes greater responsibility for the consequences of its decisions on the wider economy and society. We believe this a positive trajectory for our industry and we will continue to strive for leadership within this area.

Ultimately, the delivery of more affordable housing can impact those from the most vulnerable to the economically active households that are ineligible for social rent, but unable to buy. Acceleration and evolvement of housing delivery to provide for these households represents systemic change and real impact for the individuals and the community in which they live.

Views and opinions have been arrived at by BMO Global Asset Management and should not be considered a recommendation or solicitation to buy or sell any companies that may be mentioned.

The information, opinions, estimates or forecasts contained in this document were obtained from sources reasonably believed to be reliable and are subject to change at any time.

© 2020 BMO Global Asset Management. Financial promotions are issued for marketing and information purposes in the United Kingdom by BMO Asset Management Limited, which is authorised and regulated by the Financial Conduct Authority. Telephone calls may be recorded. 1067099 (10/20). This item is approved for use in the following countries; UK.

1.https://www.crisis.org.uk/media/239700/crisis_housing_supply_requirements_across_great_britain_2018.pdf

2. https://www.jrf.org.uk/report/uk-poverty-2019-20

More Related Content...

|

|

|