Driven by dividends

Written By:

|

Piers Hillier |

Piers Hillier of Kames Capital explains why a global equity income approach is attractive for pension funds.

I can think of few investments better suited to a pension fund than to profit from the powerful compounding effect of reinvested dividends. This can be achieved by investing in a portfolio of mostly large and occasionally “dull” companies which have the quality and persistency to grow their dividend income streams. Such companies typically have strong corporate governance disciplines, dominant presences in the markets in which they compete, strong brands or high barriers to entry for competitors. Portfolios of such companies can look very different to traditional indices. But they are worth seeking out.

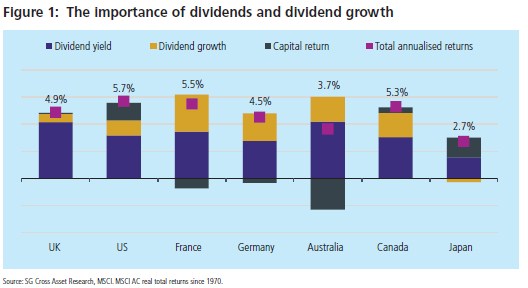

History teaches us that over 90% of long-term global equity returns come from reinvesting dividend income. Figure 1 below illustrates their importance as a component of overall return for a range of developed markets since 1970. Compared to capital growth, the dominance of dividend yield and dividend growth across major markets has been profound.

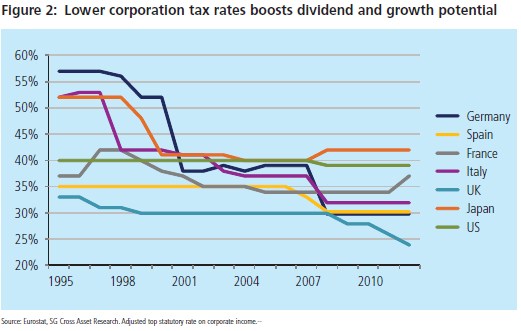

We are seeing a healthier environment for dividends. As Figure 2 (over) illustrates, in many developed economies rates of corporation tax are on a downward path. This includes the UK, where George Osborne has already announced a target rate of 22% within the life of the current parliament and a long-term goal of getting this down to 20%. Lower tax provides additional revenue for businesses, which support higher levels of dividends.

We have also seen several high profile examples of corporate headquarters relocating, such as WPP to Ireland where the corporation tax rate is just 12.5%. This is helping to focus the UK government’s attention on keeping corporation taxes low to encourage investment in the UK.

Why a global approach?

The UK has a deserved reputation as a high-yielding equity market. After the US, the UK has the most companies – around 50 – that have consecutively grown their dividends over the past 10 years. And looking at the FTSE 100, over 70% of revenues come from outside the UK, making it one of the most globally diverse stock markets in the world. This, combined with the discount to global equity markets, offers an attractive risk/reward trade-off for those looking for global exposure at a reasonable price.

So why look internationally?

Other markets are catching up with the UK, as an increasing number of international companies pay dividends to shareholders. Indeed, of the world’s top 100 high yielding equities, 92 are listed outside the UK.

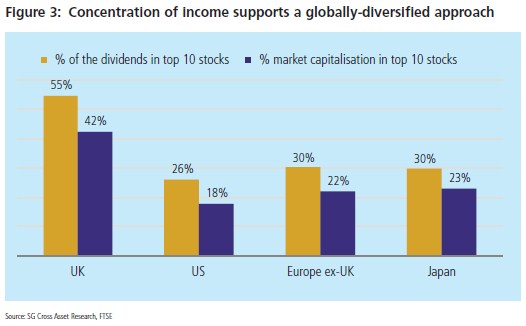

Also, a global equity income strategy helps to manage concentration risk. The chart below shows the concentration of the top 10 stocks in the UK, US, Europe ex-UK and Japan by both market capitalisation and dividend income. This shows how particularly concentrated the UK stockmarket is, where just 10 stocks contribute over 50% of the market’s total dividend income. This concentration had a severe impact in the credit crunch when high yielding banks were forced to cut or suspend dividend payments in 2008. In addition, the Deepwater Horizon disaster caused BP to cancel and suspend its dividend in 2010 and reset it at half its previous quarterly run rate in 2011.

Sustainability of income

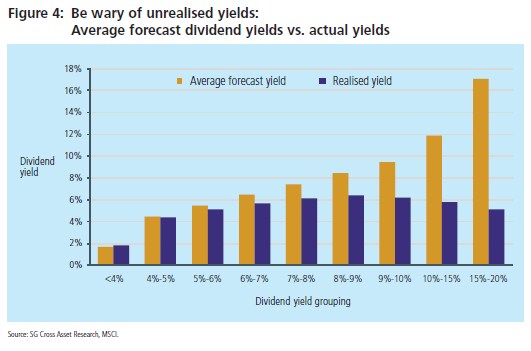

I believe there is an opportunity for pension funds to profit from the powerful compounding effect of reinvested dividends. A focus on sustainability of income is vital, because higher prospective dividend yields often lead to unfulfilled expectations. To illustrate this, Figure 4 below compares average forecast dividend yields with the actual yields that were realised for a range of yield groupings.

The chart shows the degree to which abnormally high yields fail to deliver the forecast level of income. This is because very high yields can be an indicator of distress at the company level. The point at which forecast and realised yields “decouple” is typically around 6%. This “sweet spot” is where average forecast yield is closely matched to realised yield, thereby reducing the volatility of returns.

For many pension funds, very low nominal yields are a big problem when their obligations to beneficiaries are rising in line with inflation. This means that they could face an income shortfall in both the short and medium term, as they would expect nominal income to cover their net cash obligations.

So it is important that, when we forecast dividend yield expectations for the next 12 and 24 months, we are actually able to deliver that for clients. This means avoiding dividend cutters. It would certainly be a mistake to focus on the highest yielding equities, which can signal companies in distress. We classify them by three main types:

1. Compounders – These are the consistent, reliable dividend growers such as McDonalds, Nestlé, Novartis and Johnson & Johnson.

2. Hoarders – Companies which have under-distributed income in the past and have the operating momentum and balance sheet strength to increase their dividend payout ratios by significant margins. An example is BMW, which was majority owned by the family, but has a growing external investor base which has a desire for income. Another example is Sky, which has been through a capital expenditure phase and is now producing a strong cash flow.

3. De-equitisers – Companies which are taking advantage of the markets to issue cheap debt, at a low spread over government bonds, and then using the funds to buy back equities which are yielding a higher income. Current examples include Abbott, Pfizer, Swedish Match and Reynolds American.

We combine companies in each of these categories into a concentrated portfolio of our 30-50 best ideas, diversified across sectors and regions. We aim for the portfolio to yield 150% of the yield on the MSCI AC World Index. As our return emphasis is on the long-term compounding benefits of income, our portfolio turnover is low, with an average holding period of three years. With no prospect of an end to a nearzero interest rate policy, the generation of income is becoming increasingly important for many different types of investor. This should help ensure that dividends remain a strong market theme for the foreseeable future.

More Related Content...

|

|

|