Why we need to rethink the SDGs to address the climate crisis

Written By:

|

Pierre Abadie |

Pierre Abadie of Tikehau Capital discusses how and why we need to rethink the UN Sustainable development goals

The fundamental effectiveness of the Sustainable Development Goals (SDGs) is undeniable. They replaced the former MDGs (Millenium Development Goals) as one of the major outcomes of the UN Conference on Sustainable Development in 2012. Today, they are widely accepted as a universal set of goals to address important environmental, social and economic challenges worldwide.

Over the last 15 years, the SDGs have come a long way in achieving this purpose. The world has been fortunate enough to witness several medical and social breakthroughs in the provision of clean water and sanitation, treatment of curable diseases, improved maternal health, reduced child mortality and free primary education to name but a few.

Indeed, the SDG framework has undeniably served its purpose well in this regard. However, there is still a fundamental problem with their overall presentation: they are static icons and therefore vulnerable to differences in interpretation/ application. To that end, we have reconsidered each SDG in terms of its level of urgency as dictated by scientific evidence and research.

Why the SDGs must be reshuffled

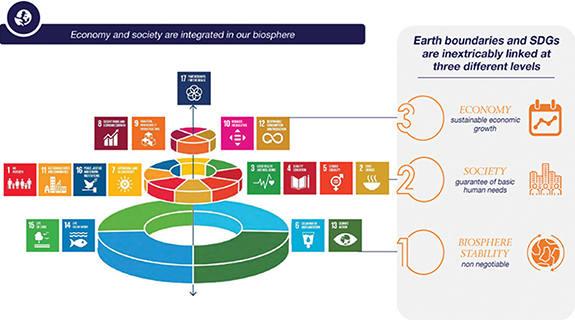

Our approach primarily focuses on directing capital towards the SDGs that we consider to be “non-negotiable” i.e those with a “Tier 1” level of urgency. Tier 1 SDGs relate to the most serious and most urgent of all UN and Paris Agreement objectives: biosphere stability. Approximately 5% of our investment activities focus on SDG 13: Climate action. This is a starting point we want to accelerate.

If Tier 1 SDG objectives are not met, Tier 2 and 3 focused SDGs become irrelevant. Obviously, we need a stable environment to accommodate humanity before we can focus on refurbishing our societal structure and values whilst regenerating our economies. On the other hand, this does not mean that we accept child labour in the solar supply chain, human rights, anti-corruption and other social and governance risks are systematically considered alongside material negative externalities (or principal adverse impacts).

In our view, there are eight priority SDGs to consider within four crucial themes:

- Climate Change (SDG 13: Climate action & SDG 7: Affordable and clean energy)

- Innovation (SDG 9: Industry innovation and infrastructure, SDG 11: Sustainable cities and communities & SDG 12: Responsible consumption and production)

- Health (SDG 3: Good health and well-being)

- Social inclusion (SDG 10: Reduced inequalities & SDG 8: Decent work and economic growth)

Figure 1: Rethinking SDGs in the light of global limits

Source: Centre ressource du développement durable – June 2021, Tikehau analysis

What are the Nine Boundaries and why do they matter?

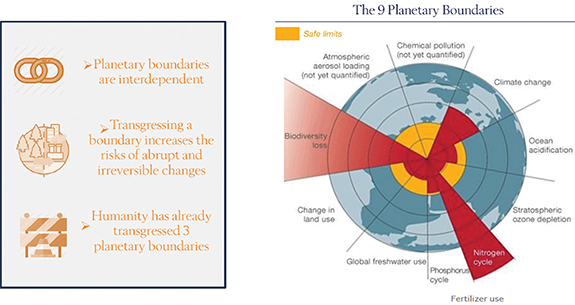

Since 2018, Tikehau has been developing an impact investment platform based on leading scientific research. The platform is underpinned by our interpretation of the UN’s Sustainable Development Goals (SDGs) in conjunction with the “Nine Planetary Boundaries” defined by Johan Rockström from the Stockholm Resilience Center.

The analogy is based on nine fundamental planetary boundaries which are, crucially, interdependent. Like a domino effect, this means if we contravene just one of these boundaries, the risk of abrupt and irreversible damage sharply increases. The Tikehau impact platform has been shaped specifically to address the three boundaries that we have already contravened; namely, biodiversity loss, nitrogen cycle (agriculture) and climate change.

Figure 2: The nine boundaries we must respect in order to keep our planet habitable

Source: Johan Rockström from the Stockholm Resilience Center

Climate action in practice: three pillars of ESG transformation

Viewing the SDGs in a new light, with the benefit of recent scientific insight is the first step. The second step is putting this into practice by ensuring that financial performance is reconciled with the most urgent global and societal challenges including the climate emergency. Investment and ESG teams must collaborate closely with portfolio companies to define a “theory of change” or logical impact framework to address these. This is a key pillar of any impact process as it involves demonstrating intentionality.

The second pillar of this process is additionality. This means that instead of waiting for automatic non-financial outcomes linked to an investment, investment teams provide support to scale up a given solution or approach to transition towards a more sustainable and inclusive economy. The use of ESG ratchets in unitranche and corporate lending financing is a good example of this, whereby interest rate margins of credits can be adjusted based on the achievement of ESG targets. A deal team could typically negotiate three to five relevant ESG criteria and related ambitious targets with the company and/or the company’s equity sponsor. If annual targets are met, borrowers are rewarded with a marginal reduction of the interest rate that could range from -5 to -25 basis points depending on the ambition of the roadmap. Eventually, the proposed mechanism could also provide for a marginal upward adjustment if targets are not met.

Finally, the third pillar in this process is impact measurement. In addition to monitoring financial performance, impact measurement provides transparency for investors regarding the companies under consideration. Impact measurement therefore has several advantages: (i) in terms of investments, it provides a management tool to encourage companies to take action; (ii) at fund level, it provides a clear and actionable view of the investment thesis; and (iii) in terms of communication, it contributes to improving transparency vis-à-vis interested stakeholders (i.e. subscribers, companies and the general public) on non-financial topics.

Key take-aways

Clearly the SDG (former MDG) framework has gone a considerable way towards serving its intended purpose over the last 15 years. Several humanitarian breakthroughs in health and education have manifested since their inception in 2012 and this is to be celebrated.

However, their static nature has meant that certain SDGs such as 13 (climate change) have not been given the attention they deserve. The pandemic has only exacerbated the issue, as global governments have been forced to dedicate most of their resources to combatting the virus. As such, we have now reached a tipping point where we must focus our efforts on SDG 13 and halve our carbon emissions by 2030 to prevent a climate catastrophe.

Clearly this doesn’t not mean every SDG is without critical importance – but science tells us we must focus on climate now – our planet is crying out for it.

What does this mean in practice? It means financing corporates who are focused on the decarbonisation of our economy. It also means partnering with these businesses beyond capital and adopting a three pillared approach to impact investment; 1 – intentionality, 2 – addtionality, 3 – impact measurement.

The asset management industry has a collective responsibility to operate in this way. The clock is ticking and we are all in the net-zero race together. CO2 is the common enemy and we must collaborate to achieve our shared goal or ultimately, we all lose.

Disclaimer

This document is for professional clients only and is provided on a confidential basis. Any investment product referred to in this document is only available to such clients. This document is not an offer of securities for sale or investment advisory services. This document contains general information only and is not intended to represent general or specific investment advice. Past performance is not a reliable indicator of future results and targets are not guaranteed. Certain statements and forecasted data are based on current expectations, current market and economic conditions, estimates, projections, opinions and beliefs of Tikehau Capital and/or its affiliates. Due to various risks and uncertainties, actual results may differ materially from those reflected or contemplated in such forward-looking statements or in any of the case studies or forecasts. All references to Tikehau Capital’s advisory activities in the US or with respect to US persons relates to Tikehau Capital North America. The communication of any document or information concerning the investment funds managed by Tikehau Investment Management and/or its affiliates (“Tikehau Capital”) may be restricted in certain jurisdictions. This document is for information purposes only.

More Related Content...

|

|

|