Post pandemic era and reopening economies: a vaccine for value style

Written By:

|

Stephen Hearle |

Stephen Hearle of Nordea Asset Management UK looks at how the tide has started to turn for value-style with the most significant style rotation in decades

The last four years witnessed a significant underperformance of value style versus growth, reaching unprecedented divergence in 2020, as the Covid-19 crisis triggered a global supply shock and the fastest equity markets’ crash since 1929. The pandemic conditions – widespread lockdowns and stay at home – favoured expensive high growth companies that were well-positioned to benefit from this environment, like Amazon or Netflix. Moreover, massive support from central banks and governments fuelled risk appetite leading to a strong end of 2020, with US equities reaching new records.

Nevertheless, this recovery was uneven, as illustrated by the S&P 500 Index, which would have been flat without the strong performance of just 10 mega-cap constituents. These expensive growth stocks drove performance spreads between growth and value indices even wider than they had been in the late 90s’ Tech bubble, with MSCI Growth Index outdoing the MSCI Value Index by 35% in 2020.

However, style preferences changed in early November 2020. The release of the first vaccines sparked one of the strongest style rotation in decades as investors anticipated the reopening of the economies. This led to value style’s strongest relative quarterly return ever, which has continued in 2021.

From single factor to style investing: what are factors and styles?

Factors are explanatory performance-drivers, including both macroeconomic and style factors. Equity factors refer to quantifiable and measurable systematic characteristics driving the behaviour of stocks, meanwhile explaining differences in their respective risk and return. Factor investing was first used in the early 1960s when Sharpe developed the Capital Asset Pricing Model (CAPM) and gained traction rapidly. The CAPM was a single factor model isolating alpha from systematic sources of return (the beta, or overall market return).

Other academic studies followed, identifying further systematic performance drivers. Amidst them, the three-factor model developed by Fama and French in the early 1990s found that, beyond beta, US equities’ performance was also driven by their sensitivity to value and size factors. Concretely, this model explained around 90% of diversified equity portfolios’ performance, with returns being correlated to markets’ beta, attractive valuation (book-to-price) and lower size companies.

Growth is considered a factor too. The model identified a long-term correlation between stocks’ performance and their underlying growth behaviour measured by sales and earnings trends. By nature, Growth tends to overlap other factors over the longer term, like Quality, since quality growth companies offer more stable growth.

The distinction between factor and style stems from the fact that factors are one-dimensional and focus on stocks with high target factor capture (e.g. growth), while style investing divides equities into two sides (e.g. low and high capitalisation, value and growth). Factors tend to have higher turnover and are also used for indexing, while both factors and style investing are used for tilting portfolios’ biases. Finally, equity styles do not perform linearly, but fluctuate due to styles’ underlying nature and risk sensitivities.

Value is coming back, but not without risk!

The aforementioned styles’ cyclicality is illustrated by the relative pro-cyclicality of Value, which has historically worked well during economic recovery or expansion, but less during low growth or recession. Value stocks are typically companies whose growth is driven by economic growth (rather than fundamental growth driven by their own market, like for some technology companies). They often have a heavier capital base, which also makes their profits more cyclical. Conversely, growth tends to be less cyclical and performs well during periods of recession to moderate expansion, as sales and earnings growth are rarer in such environments.

This bias towards economic growth explains most of the recent rotation into Value. The acceleration of vaccination programmes opened up the prospect of a fast macroeconomy recovery. This drove Value stocks up indiscriminately, as investors pulled money out of some of the mega caps that had pushed indices to all-time highs, such as Tesla. In strong economic recoveries, investors want companies whose sales will rebound sharply – as will their profits and valuations – rather than Growth stocks, whose premium growth prospects have already taken them to historically high PE.

That said, Value style’s come-back is not without risk. A key reason is the uneven underlying quality of value stocks. While strong recovery can benefit Value temporarily, cheaper valuations can also be the result of weaker fundamentals; the so-called “value-trap” (deep value companies with poor fundamentals). This is referred to as idiosyncratic, or non-systematic risk, in a portfolio context. For example, airlines is one of the riskiest sectors, as most of these companies’ free cash flow has been distributed via dividends since 2008’s crisis, leaving their balance sheets very vulnerable.

From a long-term perspective, equity investing is not just a binary choice between value and growth. This is supported by the academically and empirically proven difficulty of timing markets’ style biases towards equity styles, as growth or value. Beyond these two styles, investors have further tools to enhance their portfolios’ risk-reward profiles.

So, Value style is back but investors still face challenges with style positioning, intrinsic risks of value stocks and their portfolios’ risk profile. Consequently, investors may consider adding another string to their bow.

Why style diversification matters: the case of Quality and Low Volatility

As styles are cyclical and value can be less expensive for fundamental reasons, investors should consider diversification in a portfolio context to minimise sensitivity to the economic cycle and enhance long-term risk-reward profile.

This takes us to Quality style, which is also backed by academic studies, including Fama and French who added Quality to their three-factors model, making it better at explaining portfolios’ performance behaviour. Here they found correlation between performance and companies’ earnings variability, debt ratios and profitability. As such, Quality identifies sustainable fundamentals and thus tends to benefit from flights-to-quality.

Adding Quality style to a portfolio can mitigate Value-related risks. Indeed, it can enhance the overall risk-reward profile in the long run, by reducing cyclicality of performance and reducing volatility due to low to negative correlation of their excess returns, as demonstrated by index provider FTSE Russell. Quality style inclusion can also help to dampen idiosyncratic risk and downside risk, by avoiding exposure to companies on the brink of bankruptcy.

Low Volatility is another valuable addition to consider. This factor was identified in the early 1970s by Fischer Black and focuses on stocks’ risk relative to broad markets. Concretely, it found a positive correlation between performance and lower volatility, beta and idiosyncratic risk compared to average equities. This can be explained by the fact that low volatility stocks seem to be less attractive for investors, who pay less to get exposed to them. These features characterise Low Volatility as a defensive style able to benefit from flights-to-quality, like in the dot-com bubble crash or 2008, when the MSCI World Minimum Volatility Index outperformed.

So, Low Volatility style can also help to enhance portfolios’ risk-reward profile. Similarly to Quality, its defensive nature is a good diversifier to Value, leading to lower performance cyclicality. This is also reflected by the low to null correlation of their excess returns, as demonstrated by index provider FTSE Russell.

Finally, combining Quality and Low Volatility styles with Value could represent an enhanced approach for long-term capital preservation and performance consistency. Consequently, diversification of portfolio styles generally leads to quality and lower volatility features that are key to face different market environments.

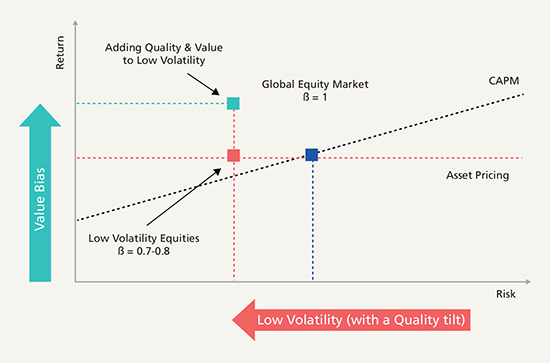

This can be illustrated by the graph shown in Figure 1. The blue dot represents the market’s beta, while the dashed black line represents the CAPM expected return – the higher the beta, the higher the return. The red dot represents the risk-reward profile of Low Beta/Volatility equities, where low-beta stocks (e.g. 0.7-0.8) proved to have better adjusted return than the broad market. Finally, the green dot illustrates the risk-reward profile that can be reached when adding Quality and Value styles to Low Volatility.

Figure 1: The benefits of equity style diversification

Source: Nordea Investment Management AB, Multi Assets. For illustrative purposes only. There can be no warranty that an investment objective, targeted returns and results of an investment structure will be achieved. The value of your investment can go up and down, and you could lose some or all of your invested money.

Why add Quality and Low Volatility to Value equities now?

Portfolios diversified across Value, Quality and Low Volatility styles seem to be well equipped to navigate a post-pandemic environment and embrace – more safely – the current strong style rotation from expensive growth to more value style.

Such a blend represents an opportunity to participate in the Value style’s comeback with an overall more robust risk profile coming from Quality and Low Volatility features. Such characteristics also bring higher earnings yield and expected return, both in absolute terms and relative to broad indices.

Considering the macro environment, this style diversification may improve capital preservation if entering a recessionary phase driven by rising yields. Stronger fundamentals and lower sensitivity to inflation could also allow the portfolio to better navigate the environment.

In conclusion, the current reflationary scenario has clearly been a catalyst for diversified equity portfolios with a Value bias to outperform and finally unlock some of the value accumulated within low risk, high quality value stocks over recent years. All in all, style diversification remains key to build attractive risk-adjusted portfolios in the long term.

Nordea Asset Management is the functional name of the asset management business conducted by the legal entities Nordea Investment Funds S.A. and Nordea Investment Management AB (“the Legal Entities”) and their branches, subsidiaries and representative offices. This document is intended to provide the reader with information on Nordea’s specific capabilities. This document (or any views or opinions expressed in this document) does not amount to an investment advice nor does it constitute a recommendation to invest in any financial product, investment structure or instrument, to enter into or unwind any transaction or to participate in any particular trading strategy. This document is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or instruments or to participate to any such trading strategy. Any such offering may be made only by an Offering Memorandum, or any similar contractual arrangement. This document may not be reproduced or circulated without prior permission. © The Legal Entities adherent to Nordea Asset Management and any of the Legal Entities’ branches, subsidiaries and/or representative offices.

More Related Content...

|

|

|