Digital infrastructure from a sustainability perspective

Written By:

|

Benjamin Kelly |

|

Antonio Botija |

Benjamin Kelly and Antonio Botija of Columbia Threadneedle Investments discuss the benefits of investment in sustainable digital infrastructure, demand for which is being stimulated by the huge increase in the use of digital technology fuelled by Covid-19

When you think of infrastructure you might immediately picture transport networks, buildings or sewage, water and electrical systems. But as with most things in a world in which the Covid-19 outbreak has shaken up long-held beliefs, the infrastructure sector is changing too.

Crises typically accelerate pre-existing trends: the sharing economy blossomed after the global financial crisis. Likewise, the post-Covid-19 era will be defined by a combination of new technologies and companies enabling people to work, relax and eat “remotely”, and the shift from offline to online across all sectors and demographics.

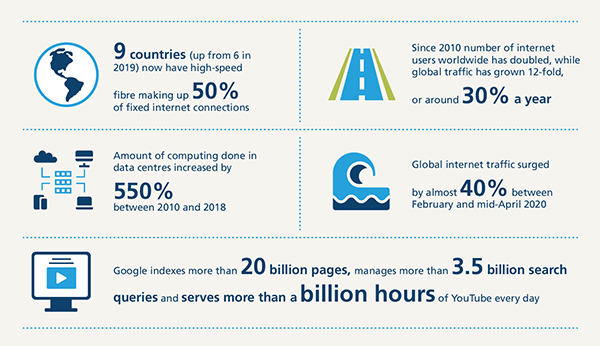

Thus, Covid-19 is accelerating the need for digital transformation which should be considered an infrastructure sector in its own right. The user numbers and growth it has seen over the past decade are phenomenal, as seen in Figure 1 below.

Figure 1: Growth in demand for digital services

Source: OECD broadband statistics update, March 2020 / Science, Recalibrating global data center energy-use estimates, 27 February 2020 / Google, Google Data centers: sustainability, innovation and transparency, 7 April 2020

Future projections also indicate exponential growth in demand:

- An increase from 7% to 25%-30% in people working from home on multiple days a week in the US¹

- Global internet traffic expected to double by 2022 to 4.2 trillion gigabytes²

- Nearly two-thirds of the global population will have internet access by 2023, with 5.3 billion internet users in total, up from 3.9 billion in 2018. The number of devices connected to IP networks will be more than three times the global population by 2023³.

What does digital infrastructure include?

Digital infrastructure assets include everything from the towers that carry data traffic across mobile networks, to the fibre optic networks required to connect businesses and homes, and data centres, which organisations use to house their critical networks of computer and storage resources.

Increased demand for data, and data on-the-move in particular, is behind the continued growth in mobile towers/masts over the past decade. Increased data traffic means operators need to build more towers or hang ever more equipment on existing towers. Meanwhile, the growth in online gaming and streaming services such as Netflix, Amazon Prime and Disney+ is behind the growth of fibre in the home, as is the recent upsurge in the number of people working from home.

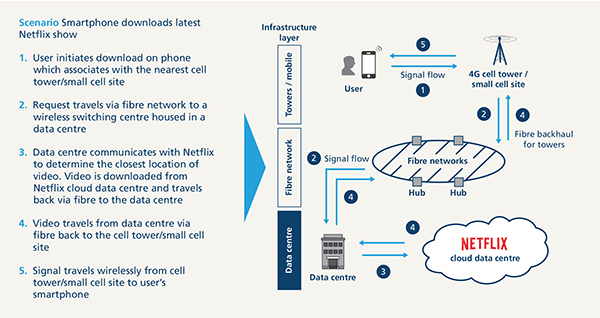

Data centres, meanwhile, have been at the heart of business for the past 30 years, and provide the critical infrastructure that supports remote working, as well as education and TV streaming. The EU believes data volume will rise by five times between 2018-25.⁴ But the burgeoning digital economy requires a different type of data centre, one that enables seamless interconnection and the global and rapid exchange of data traffic. These carrier-neutral locations are where the major mobile, content and cloud providers can co-exist, or co-locate (Figure 2).

Figure 2: From user to data source and back again

Source: Solon, 2020

Beyond this there is the migration of information into the cloud. This involve massive amounts of data and requires equivalent storage capacity, known as “hyperscale”.

Suffice to say, all of this technology demands security, reliability and resilience. Modern businesses, digital customers, people working from home – geography is no longer a hindrance to what you do or where you do it, but connectivity can be. If anything, Covid-19 makes even more compelling the case for high-security, high-capacity, highly resilient and broad-reaching digital infrastructure.

Investment opportunity

So the demand is beyond doubt, and the infrastructure elements are in place – but the latter is simply not capable of delivering the former. The rapid pace of change of this sector of the past 20 or so years means networks created in the last century are no longer fit for purpose.

Prior to the pandemic, the most recent analysis of 5G spending by Greensill, a non-bank provider of working capital, had the total bill for the 5G rollout across the world as likely to top $2.7 trillion by the end of 2020 alone.⁵

This will require a mix of public and private funding – a recent survey of infrastructure investors by M&E Global Inc found that 32.4% thought government support was key to unblocking digital infrastructure investment⁶. But despite these costs, investors want to get involved: the same survey found that more than half of respondents think digital infrastructure is key to re-booting economies in a post-Covid-19 world.

After all, these are long-life assets providing essential services, with strong cash-flows with the ability to potentially deliver long-term growth in a down or flat market, as is the case now. This is key for institutional and other investors.

An opportunity for serious investment into sustainability

What digital infrastructure investing also promises is the opportunity for significant investment in sustainability. Greater connectivity and the huge increase in data use, traffic and streaming is not without environmental consequence: it is estimated that energy demand from data centres and transmission networks accounts for around 1% of global electricity use in 2019⁷.

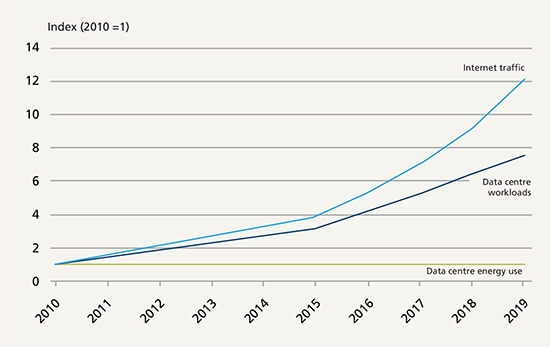

However, the growth in demand currently continues to be offset by efficiency improvements in servers and data centre infrastructure (Figure 3). Given future projections of demand growth, data centres formed on a basis of sustainability are a necessity not a luxury.

Figure 3: Data infrastructure energy use

Source: International Energy Agency, June 2020

Companies are actively integrating sustainability factors into the business decisions they are making about their digital infrastructure. Google, for example, has matched 100% of the energy consumed in its data centres through renewable energy purchases since 2017, and is now the world’s largest buyer of renewable energy – last year it bought $2 billion-worth, which is more than any other business⁸. Apple claims a similar 100% matching figure⁹. All in all, ICT companies account for about half of global corporate renewables procurement in the past five years¹⁰.

A further vital part of the sustainability conversation comes with data centres themselves, and their location and operation. Hyperscale, or very large, data centres are far more energy efficient than smaller, local servers. The increasing shift towards them is evident in the flat line of energy consumption despite increased use. Google plans to invest $3 billion in a European expansion alone¹¹, and the construction of these hubs will, according to the firm, minimise the use of water and energy, with fully integrated and bespoke cooling systems.

All of which is part of an increasing shift for corporations to take greater ownership of their emissions, which runs concurrent with the same desire from shareholders. The sustainability implications of data centre choices for firms, for data storage and the shift to the cloud, are now an integral part of the conversation.

While such hyperscalers are actively integrating sustainability into their investment decisions around digital infrastructure, private investors have not yet been as progressive – but that doesn’t mean there aren’t opportunities for infrastructure investors.

For example, such sustainability considerations were key determinants of the decision by the Columbia Threadneedle European Sustainable Infrastructure Fund to invest in Lefdal, a Norwegian data centre, earlier this year.

Energy efficiency is a key factor when determining the sustainability characteristics of a data centre. This is commonly measured by a PUE ratio (Power Usage Effectiveness). This metric shows how much power a data centre consumes in addition to the installed servers, and cooling is the most significant factor. For instance, a PUE of 1.7 means that 70% of the power used in the data centre is used for cooling and other things, in addition to keeping the servers in operation. Lefdal has a PUE guarantee ranging from 1.10-1.15. This is industry leading, and possible due to using cold water as a cooling resource independent from weather conditions. In addition, all energy consumed by Lefdal is from renewable sources, meaning zero CO2 emissions¹².

Digital infrastructure should understandably be assessed on its environmental characteristics, but don’t underestimate the significant social impact. It contributes positively to productivity and economic growth, with the World Economic Forum estimating that the combined global value of digital transformation to society and industry will exceed $100 trillion by 2025¹³. All these benefits can also be appropriately mapped to the United Nations’ Sustainable Development Goals (SDGs).

If the Covid-19 pandemic has shown anything, it is that what might have previously been considered inconceivable is now highly practicable, cost-efficient, and environmentally sound. The future of work promises to be quite different from the past, and digital infrastructure has a vital role to play in this.

Important Information

For use by Professional and/or Qualified Investors only (not to be used with or passed on to retail clients). This is an advertising document. This document is intended for informational purposes only and should not be considered representative of any particular investment. This should not be considered an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Investing involves risk including the risk of loss of principal. Your capital is at risk. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The value of investments is not guaranteed, and therefore an investor may not get back the amount invested. International investing involves certain risks and volatility due to potential political, economic or currency fluctuations and different financial and accounting standards. The securities included herein are for illustrative purposes only, subject to change and should not be construed as a recommendation to buy or sell. Securities discussed may or may not prove profitable. The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Threadneedle Investments (Columbia Threadneedle) associates or affiliates. Actual investments or investment decisions made by Columbia Threadneedle and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be suitable for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Information and opinions provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This document and its contents have not been reviewed by any regulatory authority.

In EMEA: Threadneedle Management Luxembourg S.A. Registered with the Registre de Commerce et des Societes (Luxembourg), Registered No. B 110242, 44, rue de la Vallée, L-2661 Luxembourg, Grand Duchy of Luxembourg. In the UK, issued by Threadneedle Asset Management Limited. Registered in England and Wales, Registered No. 573204, Cannon Place, 78 Cannon Street, London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority. This document is distributed by Columbia Threadneedle Investments (ME) Limited, which is regulated by the Dubai Financial Services Authority (DFSA). For Distributors: This document is intended to provide distributors’ with information about Group products and services and is not for further distribution. For Institutional Clients: The information in this document is not intended as financial advice and is only intended for persons with appropriate investment knowledge and who meet the regulatory criteria to be classified as a Professional Client or Market Counterparties and no other Person should act upon it.

Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies.

1. US Federal Bureau of Labor Statistics, 2019 National Compensation Survey

2. International Energy Agency, https://www.iea.org/reports/data-centres-and-data-transmission-networks, June 2020

3. Cisco Annual Internet Report: https://www.cisco.com/c/en/us/solutions/collateral/executive-perspectives/annual-internet-report/white-paper-c11-741490.html

4. European Union, 2020

5. Greensil, Financing the Future of 5G, 21 October 2019

6. IJ Global/M&E Global Inc, https://ijglobal.com/articles/149235/ij-survey-digital-infra-to-re-boot-economies, 5 August 2020

7. International Energy Agency, https://www.iea.org/reports/data-centres-and-data-transmission-networks, June 2020

8. Google, Google Data centers: sustainability, innovation and transparency, 7 April 2020

9. Apple, Apple now globally powered by 100 percent renewable energy, 9 April 2018

10. International Energy Agency, https://www.iea.org/reports/data-centres-and-data-transmission-networks, June 2020

11. Reuters, Google to invest 3 billion euros in European data centers, 20 September 2019

12. Lefdal Mine Data Center, https://www.lefdalmine.com/cooling/#:~:text=European%20leading%20Cooling%20solution%20Lefdal%20Mine%20Datacenter%20is,used%20for%20cooling%20with%20a%205%20KW%2Frack%20configuration

13. World Economic Forum, Unlocking $100 Trillion for Business and Society from Digital Transformation, May 2018

More Related Content...

|

|

|