Seeking income from real estate

Written By:

|

James Allum |

James Allum of Columbia Threadneedle Investments makes the case for investment in long-lease real estate to provide reduced risk exposure plus income returns in excess of gilts and inflation

Pension fund trustees are living through an income-starved age. With bond yields at historic lows, investors are looking for alternative sources of income and many are turning to alternative assets offering attractive risk-adjusted returns over Gilts and inflation.

In such a low-yield environment, pension schemes seeking to de-risk their portfolios and find such a reliable source of income are increasingly turning to real estate funds, which offer a steady stream of cash through rental payments. Property, if effectively managed, offers local government pension scheme (LGPS) funds the all-important consistent stream of income which is needed to pay members’ pensions.

The case for real estate-backed solutions within matching portfolios is well established. Pension schemes have long sought the tangible strong and lowly-correlated returns offered by UK real estate, underpinned by capital value and rental income growth – irrespective of their funding status or cash flow needs. This has never been clearer than in the current investment environment, where the asset class offers a 412-basis point income yield advantage over UK Gilts1.

The case for income today

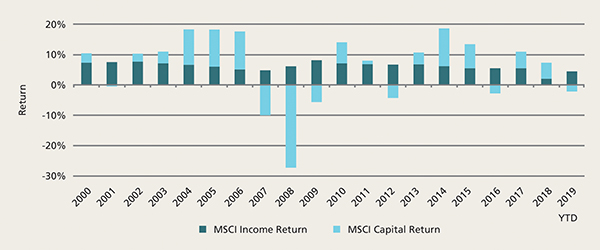

Commercial real estate is essentially an income proposition. Alongside appreciation, rental income is a consistent, solid and reliable part of the asset class. Indeed, if you look at income before the credit crisis in 2009, it has not materially changed since then; and if you take the MSCI UK commercial real estate index back 20 years, 69% of the total return from real estate has come from income (Figure 1).

Figure 1: MSCI total returns, income and capital appreciation contributions

Source: MSCI UK Monthly Index, as at 30 September 2019

There is a very pronounced investment appetite for commercial real estate, with a vast amount of money seeking to gain access to the market. This is creating competition for the right assets – although less so than previous years – and pricing is holding up. The UK market also remains popular with overseas investors.

The potential performance and diversification advantages gained by including real estate within balanced portfolios is well understood. The challenge for pension schemes has always been how to access the illiquidity premium offered by the asset class while mitigating the associated risk. Consequently, real estate has traditionally been associated with the growth component of pension fund portfolios. But as schemes mature and cash flow needs increase, the inclusion of the asset class within matching portfolios is now being explored.

Mitigating risk

As with all asset classes, investment is not without risk. In the case of real estate, the restructuring of the retail landscape and associated use of insolvency remedies including company voluntary arrangements (CVAs) and “pre-pack” administrations have become the most visible symbols of the industry’s short-term challenges.

The answer, however unimaginative, lies in forensic due diligence, oversight and governance. Assessment of risk requires a comprehensive understanding of both credit and real estate fundamentals on a tenant-by-tenant and asset-by-asset basis. When appraising potential investments, consideration must be given to both company creditworthiness and the real estate-level profit contribution to a tenant’s businesses. This due diligence minimises the impact of CVAs and administrations on our portfolios.

Those strategies with mandates to mitigate risk coupled with in-depth knowledge of industry sectors and credit issuers are well-positioned to deliver the superior risk-adjusted returns required by pension schemes.

So where is the opportunity?

The popularity of real estate within matching portfolios has seen exponential growth of the market over the past few years. The opportunity set has expanded to include income strips (self-amortising cash flows), as well as more traditional ground lease and direct-let assets. The underlying operational assets now encompass numerous uses (e.g. healthcare, leisure, hotels, residential and retail), requiring tenants to amortise capital over lengthy periods of time.

In such a diverse and increasingly complex market, where does the opportunity lie? Our analysis of secure income transactions has identified a point pricing differential in favour of smaller assets. This is partly explained by the huge growth in the size of funds managing long-lease assets: as funds scale, they trend towards larger assets to keep pace with investor demand.

We believe that within open-ended portfolios, smaller lot sizes offer pricing and diversification benefits, which is why they have always formed the core component of our portfolios. By applying the same philosophy to the long-lease market, focusing on smaller assets other managers miss or discount, we have sourced a pipeline of purchasing opportunities which allows us to effectively deploy capital and capture that additional yield advantage.

Conclusion

We believe a strategy investing in long-leased real estate is ideal for investors seeking a reduction in their risk exposure while generating income returns in excess of Gilts and inflation. A consistent real estate investment approach and depth of resource across asset classes provides several key differentiators in this part of the market, which help position a manager to deliver value for clients from the asset class, these being:

- Focus on smaller lot sizes and a flexible buying strategy to deliver pricing and diversification benefits

- Fully integrated real estate and credit expertise to enable forensic asset-level due diligence, to fully understand risk and deliver sustainable risk-adjusted performance

- Effective investment resource with proven deal-sourcing track record ensuring efficient deployment of capital (speed to market)

1. Columbia Threadneedle Investments comparison of (1) MSCI Monthly Index Net Initial Yield 5.07% and (2) FTSE Actuaries UK Conventional Gilts All Stocks Index Gross Redemption Yield 0.95%, 31 October 2019.

Important Information: For internal use by Professional and/or Qualified Investors only (not to be used with or passed on to retail clients). Past performance is not a guide to future performance. The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested.

This material is for information only and does not constitute an offer or solicitation of an order to buy or sell any securities or other financial instruments, or to provide investment advice or services. The analysis included in this document has been produced by Columbia Threadneedle Investments for its own investment management activities, may have been acted upon prior to publication and is made available here incidentally. Any opinions expressed are made as at the date of publication but are subject to change without notice and should not be seen as investment advice. Information obtained from external sources is believed to be reliable, but its accuracy or completeness cannot be guaranteed. Issued by Threadneedle Investment Services Limited. Registered in England and Wales, Registered No. 3701768, Cannon Place, 78 Cannon Street, London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority. Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies. columbiathreadneedle.com

More Related Content...

|

|

|