More than just low volatility: lower risk and higher return in a multi-factor framework

Written By:

|

Thomas Kieselstein |

|

Noreen Dillon |

Multi-factor low volatility equity strategies can provide a solution for investors seeking to improve risk-adjusted returns, or to maximise their sharpe ratio. Thomas Kieselstein and Noreen Dillon of Quoniam tell us more

The government’s LGPS guidance published in September 2016 makes reference to diversification. “A properly diversified portfolio of assets should include a range of asset classes to help reduce overall portfolio risk. If a single investment class is not performing well, performance should be balanced by other investments which are doing better at that time. A diversified portfolio also helps to reduce volatility.”

Of course a mix of assets should reduce a scheme’s risk. However, there is also a way to achieve solid returns in one investment class, with reduced volatility compared to the broader market. While the government’s guidance makes reference to reducing volatility, Quoniam believes that diversifying within individual asset classes (equity, fixed income, multi-asset) is also beneficial and can help mitigate some of the risks without compromising on returns.

When markets perform well, equity investing can be very rewarding. When things go wrong the results can be very problematic, and this can happen very fast. A multi-factor approach to low volatility equity investing addresses this, with market participation on the upside, and risk reduction and limiting participation in falling markets.

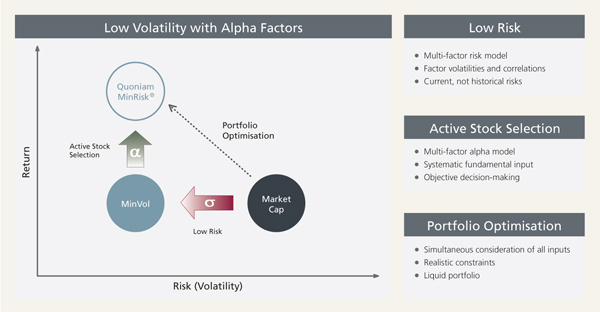

Figure 1: Low Volatility with Alpha Factors

Source: Quoniam

Variable market cycles and unforeseeable exceptional events, such as the financial and euro crises, call for multi-factor equity strategies based on robust and adaptable methodologies. In contrast, mainstream “smart beta” solutions often have a strong bias towards just one factor or style. Their results often look impressive in theoretical backtests, but they are, by their very nature, vulnerable in weak periods for the factor they exploit. This means they are unable to consistently outperform the broad market over the long term.

Multi-factor approaches are more versatile, but here too there are vast differences in how effectively they are implemented which only becomes apparent when it is too late. To maximise their chances of success, multi-factor strategies should be based on a co-ordinated, well-diversified factor allocation that can be dynamically adjusted as the market backdrop changes. If a portfolio’s factor allocation is poorly diversified, unforeseen concentration or correlation risks could result in weak performance during future crises.

A fundamental problem of some smart beta approaches is that while they sound good in theory, it is simply not feasible to implement them in practice, particularly when liquidity and capacity risks are not adequately taken into account. It may be straightforward enough to implement a portfolio with £50 million of assets, for example, but £10 billion may be a completely different story. This is particularly true for portfolios that deviate strongly from market cap, such as equal-weighted strategies. By defining and measuring risk premia, using a range of fundamental metrics i.e. multiple factors, it may be possible to avoid some of the problems that can be experienced when implementing factor investing. For example, a focus on the factors of value, quality and sentiment can result in a portfolio skewed towards companies with cheap valuations, high profitability and low debt, and whose income and stock prices are rising.

Academic studies have shown that individual risk premia, or factors, have the potential to outperform a standard market cap-based index over the long run, but not persistently over shorter periods. Therefore, it is vital to utilise several factors that drive stock returns, as any single factor is unable to outperform a standard index all of the time. A well-diversified multi-factor approach should outperform the market more consistently.

Some investors target specific companies and sectors with less volatility than the market. However, we do not consider low volatility to be a risk premium and instead we recommend volatility be managed by the overall portfolio.

In periods of increased uncertainty and volatility, investors reallocate from risky to stable investments, leading to highly dispersed returns between individual stocks, sectors and countries. In this environment, it may be prudent to lower risk with more emphasis on defensive characteristics, reducing exposure to other factors as appropriate. Conversely, in more stable and rising markets, market risk is lower and there is the opportunity to incorporate more risk in the portfolio and focus on fundamental and technical factors.

Quality, value and momentum have been proven to outperform over the long term, which ensures the risk/return potential of a multi-factor portfolio is superior to that of a pure low-risk portfolio. An additional benefit of a quantitative approach is the flexibility to incorporate filters, such as ESG considerations, into the investment process.

Conclusion

In recent years investors have become increasingly aware that portfolios following market cap-weighted benchmarks are inefficient, resulting in a sharp uptake of smart beta solutions. But not all smart beta portfolios are equal. For example, strategies which focus solely on minimising volatility are not efficient in terms of the capital market pricing theory. To maximise the chances of consistent long-term outperformance, in our view, portfolios should be based on a well-diversified multi-factor allocation that can dynamically adapt factor exposure and risk to the prevailing market backdrop.

More Related Content...

|

|

|