The rise and rise of multi-asset credit

Written By:

|

Justin Bourgette |

|

Jeff Mueller |

|

John Redding |

Current conditions challenge pension funds to achieve their target income without significantly increasing portfolio risk. Justin Bourgette, Jeff Mueller and John Redding of Eaton Vance identify the key components of a fixed-income portfolio for a typical LGPS fund, with a focus on multi-asset credit strategies

Since the global financial crisis, Local Government Pension Scheme (LGPS) funds have had to reckon with an increasing governance burden relating to the adoption of more robust and often more complex investment strategies in order to close funding shortfalls. Painfully aware of the lessons of the financial crisis, pension schemes have been prodded to embrace new investment strategies promising differentiated sources of return that can potentially improve overall returns and offer more robust diversification benefits. However, limits on governance budgets have hampered many schemes’ ability to take advantage of them. In this article, we offer some thoughts on how LGPS funds can navigate this conundrum, with a particular focus on new approaches to credit allocation.

At this point in time, it is abundantly clear that the “Goldilocks” period for fixed income investing has ended. Over the past 20 years, it would have been difficult for institutions not to meet typical fixed income return targets. For example, a simple passive allocation to the BofA Merrill Lynch Sterling Broad Market Index, from its inception on 31 December 1996 to 31 March 2016, would have delivered 6.6% annualised in sterling terms (Source: Bloomberg). The same cannot be said for the next 20 years. Income levels from nominal bonds, for instance, currently fall far short of what most pension schemes require from their fixed income allocation.

Looking forward, hopes for a meaningful acceleration in global growth appear to be on hold. Notwithstanding receding fears of a US recession, underlying uncertainty in markets persists. Late February 2016, for example, saw Japan issuing benchmark 10-year government bonds with a yield below zero for the first time. Soon afterwards, the European Central Bank fired yet another salvo at deflation, Norway hinted it might become the next country to join the zero-interest-rate-policy club and the language from the Federal Reserve became decidedly more cautious. Interestingly, despite the global rally in risk assets in March, an equivalent sell-off of safe-haven assets did not occur.

At least for the foreseeable future, the challenge for pension schemes of achieving a desired target income without also significantly increasing portfolio risk will likely persist. The tepid growth outlook aside, the recent uptick in volatility – notable in the second half of 2015 and early 2016 – looks set to continue. Reasons include political uncertainty in the US, the UK and Middle East, ongoing uncertainty about the pace of policy normalisation in the US and, not least, diminishing returns from incremental central bank actions. In Japan, for example, the surprise move to negative interest rates has had a negative impact on banking sector confidence.

The search for yield by LGPS funds has become more poignant given the increasing maturity of liabilities, increasing the demand for liability-matching assets and increasing the proportion of bonds held relative to equities. LGPS funds – constrained in many cases from being able to take full advantage of the recovery from credit dislocations in 2009/2010 due to limits on trustee governance budgets – have been looking for ways (for example, greater use of multi-asset mandates), that afford them greater investment flexibility for the future.

Going forward, we believe the key components of a fixed income portfolio for a typical LGPS fund will be drawn from the following:

- A liability-matching (LDI) portfolio of long-dated Gilts and index-linked Gilts, and/or inflation and interest rate swaps

- A multi-asset credit fund/portfolio. These access the global credit universe. They typically have a meaningful exposure to alternative credit but also allocate to traditional credit (investment grade sovereigns and investment grade corporates) as appropriate

- A combination of absolute return or total return/unconstrained bond funds

- Alternative credit. Alternative credit embraces a broad universe that includes high yield, bank loans, emerging markets debt, asset-backed securities, mortgage-backed securities, convertibles and so-called illiquid credit (e.g. direct lending, distressed debt, real estate debt and infrastructure debt)

Among the above-mentioned components, one of the most in-demand and promising strategies is multi-asset credit. Multi-asset credit (MAC) strategies seek to capitalise on market opportunities that have arisen as a result of volatility and dislocations in credit assets since the financial crisis. They offer meaningful exposure to alternative credit along with the flexibility to shift emphasis across to investment grade credit or cash/cash equivalents when it becomes prudent to de-risk the portfolio.

The appeal of MAC includes:

- The potential to ease the governance burden on pension schemes of overseeing multiple “unconstrained” fixed income managers. MAC incorporates multiple credit strategies into a single portfolio, offering an efficient, one-stop solution – one customisable to specific risk tolerances, return targets and liquidity objectives

- The potential to enhance the Sharpe ratio of an overall portfolio. MAC strategies access differentiated return streams – the underlying risk drivers for investment grade credit differ from those for alternative credit – and allow, in the hands of a skilled active manager, for dynamic, value-enhancing allocation between and within a broad and diverse credit opportunity set. In essence, MAC strategies have the potential to deliver long-term returns higher than those of government bonds – although lower than those of equities – without exposing investors to equity-like risk.

- The opportunity for credit diversification. Given the substantial deterioration in the risk/reward trade-off for traditional fixed income strategies in recent years (for example, the BofA Merrill Lynch Sterling Broad Market Index, as at 18 April 2016, had a yield-to maturity of 1.9% and an effective duration of 10 years), MAC can provide an effective route to achieving effective credit diversification, particularly for investors who have hitherto had very narrow “satellite” credit exposures

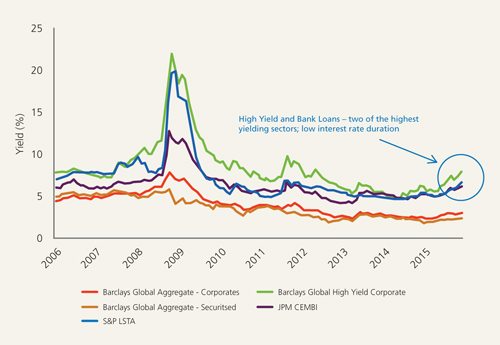

Figure 1 below helps to highlight the case for a multi-asset credit approach, showing the yields for different asset classes over the 10 years to 31 December 2015.

Figure 1: Yields of different asset classes (as of 31 December 2015)

Source: Bank of America Merill Lynch, Credit Suisse, iBoxx

MAC strategies tend to be long-biased, with derivative usage limited to efficient portfolio management (e.g. hedging, reducing volatility). They have less interest rate sensitivity relative to traditional bond investments (typically there are large allocations to bank loans, asset-backed securities and other floating rate instruments), relatively more exposure to credit and liquidity risk, and offer excess return potential over sovereign debt.

MAC return targets typically range from 5-8% with a volatility range of 6-10%. That said, MAC products come in a wide variety of flavours. A recent study by consultant bfinance has identified three different risk/return “buckets” within this universe (Source: bfinance, Dissecting the ‘MAC’ Universe, March 2016):

- “Defensive” products with a cash plus 2-4% target

- “Intermediate” products with a cash plus 5-7% target

- “Aggressive” products with a cash plus 7% target

Some MAC products have a cash benchmark; some use a variety of benchmark indices. The Eaton Vance Multi-Asset Credit Strategy, for example, is benchmarked to a blended index comprising 50% BAML Global High Yield and 50% S&P/LSTA Leveraged Loans, and seeks to outperform this blended index over a full market cycle.

Despite the rise in popularity for MAC offerings, alternative credit still appears to be under-allocated by pension plans. Investment consultant Towers Watson highlights that while alternative credit (excluding illiquid credit) comprises around 25% of the global credit universe, their clients – comprising mainly pension plans – have an aggregate allocation of just 8% to alternative credit, and just 1% to illiquid credit within their total credit portfolios (Source: Towers Watson Perspectives: Alternative Credit, allocation data as at 31 December 2014).

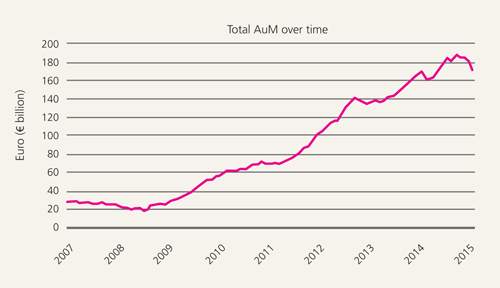

Figure 2: Growth in MAC Assets: September 2007-2015

Source: Spence Johnson and Morningstar

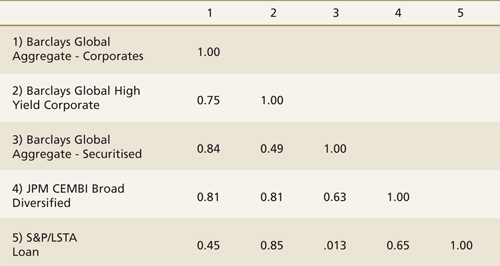

Choosing the correct MAC strategy does, however, require a great deal of care. LGPS funds need to satisfy themselves that the short-listed investment managers have the requisite expertise across the full range of underlying credit asset classes as well expertise in asset allocation. By way of example, consider Figure 3 below, which shows average correlations for various credit assets over a multi-year period.

Figure 3: Correlation of various credit asset classes (Jan ‘07 – Dec ‘15)

Source: Eaton Vance as at 31 December 2015

The diversification benefits per se of a MAC approach are clear. However, what this analysis doesn’t show is that, at specific points within a multi-year time frame, correlations can and do differ substantially from their longer-run averages. A good MAC manager therefore needs to be able to assess how correlations are likely to change under different scenarios and at different points in the cycle. Pension plans need to pay particular attention to the quality of a prospective investment manager’s credit franchise, including that manager’s track record in adding value from both asset allocation and security selection in different market conditions.

More Related Content...

|

|

|