Multi-asset credit: delivering income and flexibility

Written By:

|

Adam Gould |

|

Renato Latini |

Adam Gould from BSP-Alcentra and Renato Latini from Brandywine Global discuss how as pension schemes mature and cashflow needs intensify, multi-asset credit offers a flexible way to generate income, manage liquidity and streamline implementation – helping investors meet changing portfolio demands with greater control

Rethinking fixed income for maturing schemes

For pension schemes facing rising cashflow demands and growing pressure to optimise portfolio efficiency, traditional credit allocations – often fragmented across multiple mandates – can fall short. They may lack the flexibility to respond to shifting market conditions to take advantage of fleeting relative value opportunities and the oversight burden they create can be difficult to justify. Traditional credit allocations may also miss out on the yield enhancing allocations that multi-asset credit can provide.

Multi-asset credit (MAC) offers a more cohesive approach. By combining a broad range of credit instruments – including high yield bonds, leveraged loans, structured credit and emerging market debt – MAC strategies provide diversified exposure that can be tailored to different liquidity, income, and implementation needs.

Aligning strategy design with scheme objectives

The appeal of multi-asset credit lies in its adaptability – but that adaptability must be matched to the scheme’s specific requirements. Strategy design matters. MAC approaches differ significantly in how they balance liquidity, credit exposure, and implementation style. This range of options allows investors to align strategy selection with their portfolio objectives and governance structures.

Some strategies offer daily dealing and broad market coverage, enabling dynamic rotation across high yield, loans, and emerging markets. Others concentrate on sub-investment grade and alternative credit exposures, targeting higher income potential with monthly or quarterly liquidity.

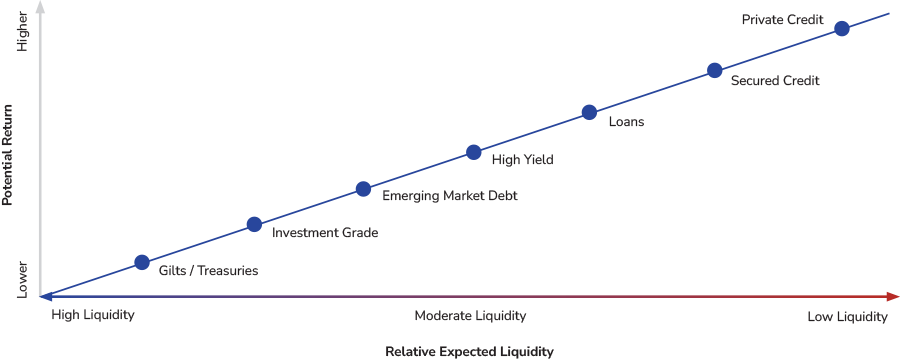

Figure 1: Relative liquidity and return potential across fixed income solutions

Source: Brandywine Global and BSP-Alcentra, as of October 2025.

The diversity of approaches allows investors to calibrate exposures to suit both short-term cashflow needs and long-term funding goals.

Blending MAC to optimise outcomes

MAC strategies can also be combined to meet multiple objectives. Rather than selecting a single approach, schemes can blend styles across liquidity tiers – balancing income generation, liquidity access, and implementation efficiency.

For example, a pension scheme might combine daily and monthly-dealing MAC strategies to broaden sub-investment grade exposure while maintaining access to liquidity. Schemes may also complement these allocations with a quarterly-dealing strategy focused on alternative credit, further enhancing diversification.

Ultimately, the right MAC solution depends on the scheme’s unique requirements – and on selecting a manager with the skill and track record to deliver consistent outcomes across market cycles.

Evaluating performance without a standard benchmark

MAC strategies offer access to a broad and flexible credit universe – but evaluating that flexibility requires more sophistication than traditional fixed income, as there is no standardised benchmark across the industry.

Three benchmarking frameworks are commonly used:

- Opportunity set benchmarks reflect the universe from which the manager can optimise returns – for example, a blend of loans, high yield, and EM debt.

- Cash-based benchmarks express return targets over cash (e.g. SONIA +450bps), providing a clearer view of expected outcomes.

- Peer group comparisons help assess consistency and style across credit cycles, though care must be taken to select appropriate peers.

Benchmarking provides useful context – but it doesn’t reveal how portfolios are constructed or how risks are managed in practice.

Integrated portfolio construction: a clearer path to consistency

MAC managers vary widely in how they build portfolios. Some operate through a series of sleeves – parcelling out allocations to high yield, loans, EM debt, and structured credit. Others manage exposures holistically, within a single, integrated portfolio.

The difference is more than operational. A unified approach allows managers to optimise across capital structures, rotate between geographies, and respond to market dislocations in real time. It also reduces the risk of unintended exposures – such as doubling up on issuers across sleeves.

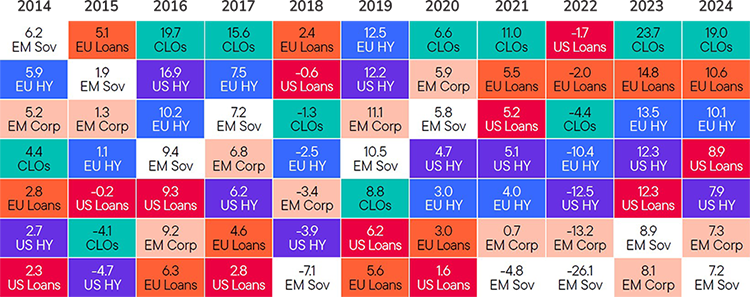

In volatile markets, this cohesion becomes critical. It allows managers to adjust exposures quickly, manage aggregate risk more effectively, and capture fleeting relative value opportunities that may only exist for days. This dynamic asset allocation – for example, rotating between US and European credit or between fixed and floating rate instruments – can be a key source of alpha given the return dispersion across MAC asset classes.

Figure 2: Return dispersion across sectors creates opportunities

Source: eVestment Alliance, as of January 2025. Indexes used for each asset class is as follows: US Loans: S&P UBS LLI, EU Leveraged Loan: S&P UBS WELLI ex USD, CLO (BB): JP Morgan CLO BB, EU High Yield: ICE BofA EU High Yield, US High Yield: ICE BofA US High Yield, EM Corp = JPM CEMBI Broad Diversified Hedged (GBP), EM Sov = JPM EMBI+ (H GBP). Past performance is no guarantee of future results.

A manager’s ability to construct a cohesive portfolio – one that reflects a unified view of credit markets and risk – is central to delivering consistent outcomes.

ESG integration: From policy to practice

Another key consideration for investors is ESG integration, which is often seen as a strategic priority. In MAC, where issuers span public and private markets and disclosure varies widely, ESG needs to be embedded in the investment process from the outset.

A robust ESG framework typically includes:

- Pre-investment evaluation using proprietary tools, third-party data, and sector-specific materiality guides.

- Portfolio construction informed by ESG analysis, with climate metrics tracked over time.

- Ongoing engagement with borrowers on governance, sustainability, and disclosure practices.

Transparency matters. ESG integration should be evident in portfolio decisions – not just the policy. Investors should be able to see how ESG risks are being managed alongside financial ones, and how those insights influence position sizing, portfolio weightings, and engagement priorities.

MAC in practice: contrasting styles in action

Having explored how multi-asset credit works in theory – from strategy design and portfolio construction to ESG integration – it’s worth considering how it works in practice.

The example below compares two Franklin Templeton strategies, managed by specialist investment managers Brandywine Global and BSP–Alcentra. Each takes a distinct approach to credit selection, liquidity, and implementation, offering different ways to access sub-investment grade credit within a MAC allocation.

Comparing strategy styles within MAC

| Feature | Brandywine Global MAC | BSP-Alcentra Global Multi-Credit Solution |

|---|---|---|

| Credit selection | Global HY, EM, structured credit (ABS/CMBS), loans* | EU and US Loans and HY, structured credit (CLOs), special situations |

| Liquidity | Typically daily/weekly dealing | Monthly dealing |

| Target Return | Mid-single digit p.a. | High single digit p.a. |

| Benchmark | Blended opportunity set index | SONIA +450bps/Blended opportunity set index |

| ESG integration | Proprietary scoring, engagement | Exclusions, scoring, stewardship, engagement |

| Vehicle availability | Separately managed account | Separately managed account, SICAV-SIF |

* Loan exposure is adjusted based on client liquidity requirements.

These distinctions reflect different approaches to portfolio construction. Brandywine Global’s strategy offers daily/weekly liquidity and EM exposure, making it suitable for schemes with more frequent cashflow needs or tighter governance constraints. BSP–Alcentra’s strategy, by contrast, combines a core liquid allocation to loans and high yield bonds with yield-enhancing alternatives of CLO tranches and stressed credit, to offer higher income with monthly liquidity and may suit investors seeking differentiated credit risk and deeper ESG integration.

Together, they illustrate how contrasting MAC styles can be selected or combined to meet specific implementation preferences – whether the priority is liquidity access, income generation, or diversification across credit types and geographies.

Conclusion: Turning credit complexity into portfolio clarity

Multi-asset credit is not a niche solution – it’s a strategic response to fixed income’s new realities. For schemes facing rising cashflow needs, governance complexity and market volatility, MAC offers a way to simplify implementation while enhancing outcomes.

It’s a flexible allocation that can be shaped to fit. Some investors may favour liquid, broad-market strategies to support short-term cashflow and operational simplicity. Others may seek higher-yielding, less liquid exposures to meet long-term funding goals. The ability to combine styles – across liquidity tiers, credit types, and implementation formats – allows MAC to adapt to a wide range of portfolio requirements.

Success depends on clarity: understanding what each strategy offers, how it fits within the broader portfolio, and how it aligns with scheme objectives. That means asking the right questions – about portfolio construction, liquidity management, ESG integration and manager discretion – and selecting managers who can deliver consistent outcomes across credit cycles.

In the hands of skilled managers, MAC transforms from a broad toolkit into a focused strategy – aligned with portfolio goals and built for dependable delivery.

Access the complete Multi-Asset Credit paper here

For Institutional Professional Investors only – not for distribution to retail clients.

Investments entail risks, the value of investments can go down as well as up and investors should be aware they might not get back the full value invested.

More Related Content...

|

|

|