Building more robust portfolios

Written By:

|

Dr Chris Jones |

|

Dr Toby Goodworth |

Dr Chris ones and Dr Toby Goodworth of bfinance discuss a methodology to build more robust portfolios that have a better chance of holding up in tough times

Most portfolios are constructed to be well diversified by combining uncorrelated investments, however, history has shown that in many extreme market moves, the uncorrelated becomes correlated and the diversified becomes undiversified. Furthermore, different asset classes and strategies that are assumed to be totally different from each other often exhibit periods of high overlap and/or high correlation (especially as experienced in “risk on/risk off” environments and sharp market sell-offs).

Traditional risk measurement techniques have generally either relied on the use of past returns in order to describe risk going forwards, or have been required to assume returns fit some explicitly known distributional form for computational simplicity. The last 15 years have shown us that both of these approaches tend to underestimate future risk, especially in extreme market moves and especially in more complex asset classes and strategies.

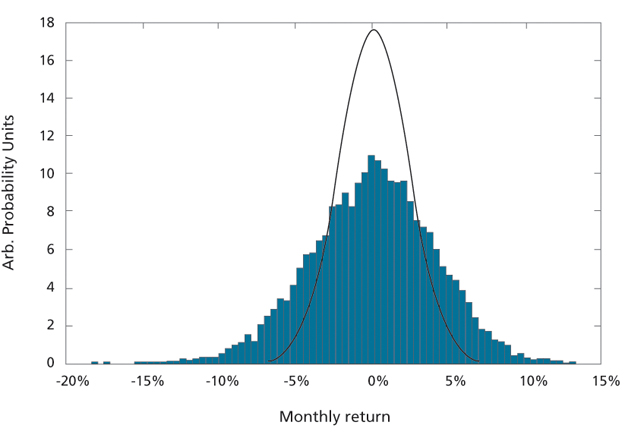

Exclusively backward-looking risk models can easily get it wrong, as historic returns only consider one of many possible outcomes (i.e. the one that occurred historically). Similarly, parametric risk models (those that rely on a known distribution) often misrepresent real returns that don’t conform to the chosen. For example, most risk models that use the normal distribution underestimate the tail risk of most private markets strategies such as real estate and private debt, as illustrated in Figure 1.

Given that most standard risk models are both parametric and backward looking, these weaknesses combine to make typical portfolio behaviour in extreme market events (such as 1998, 2000, 2008, 2011,…) a consistently nasty surprise.

Rather than rely exclusively on such traditional approaches, a more appropriate and robust way to consider overall portfolio risk is to supplement traditional risk models with the use of a top-down, non-parametric risk factor-based model: top-down to be functional in the absence of full transparency, non-parametric to better estimate tail events, and factor-based for its enhanced descriptive qualities.

We believe that such models better estimate how a portfolio will behave in extreme conditions without losing any information on its everyday behaviour. Such a model can be used in a passive way to reflect on portfolio risk, but also prescriptively to build portfolios that are not only well-diversified on an ongoing basis but are also much more robust when extreme market moves come along. Such models are slower reacting than bottom-up risk models, however, and should not be thought of as a panacea.

Factor-based risk modelling has been around for many decades and can be found in many forms from the classic models used to determine tilts in equity portfolios through to more complex multi-asset, multi-factor risk models. Generally this latter class of models look to describe portfolio risk using an array of known risk factors in order to determine and quantify a portfolio’s exposure to those factors, and therefore best explain the risk-return characteristics of the portfolio. These risk factors can then be stressed, or their correlation structure modified, in order to understand how the portfolio might respond across a wide range of different market environments.

By running a statistically significant number of these different possible environments and calculating the expected portfolio return for each, one can build up an implied factor-based return distribution which will include returns that could potentially occur but have not happened historically. As many investments have insidious risks that only rarely manifest themselves in realised returns, it is important to form such a distribution rather than rely purely on past returns and unrealistic distributions in order to help reduce the likelihood of nasty surprises. Such distributions are less easy on the eye than the smooth and symmetrical normal distribution, but form a much better description of reality in many cases.

In addition to providing a more appropriate measure of overall portfolio risk, i.e. less dependence on historic returns or an inappropriate distribution, such risk management approaches are also capable of attributing the sources of risk within the portfolio; it is this capability that lends itself particularly well to portfolio construction.

Figure 1: Factor-based implied risk portfolio (bars), overlaid with the corresponding distribution obtained by fitting historic data with a normal distribution

As well as constructing more conventional marginal risk contributions by strategy or fund, one of the additional benefits of factor-based risk modelling is the ability to obtain marginal risk contributions by risk factor, for which there is no direct comparable in the capital weighted space. Such marginal contributions to risk by risk factor are only possible because the set of risk factors used to model the portfolio are the equivalent of a universal language, applicable whatever the asset class or investment style, be it alternative or traditional, thus allowing all portfolio constituents to be assessed under a single all-encompassing risk framework. For example, different strategies and asset classes may appear to be uncorrelated but each may hold risk to a certain risk factor that adds up to be a considerable but insidious risk. By understanding the origins and styles of risk across the portfolio in this way it becomes relatively straightforward to identify where multiple risks are converging, or conversely which elements are actually acting to diversify the overall portfolio.

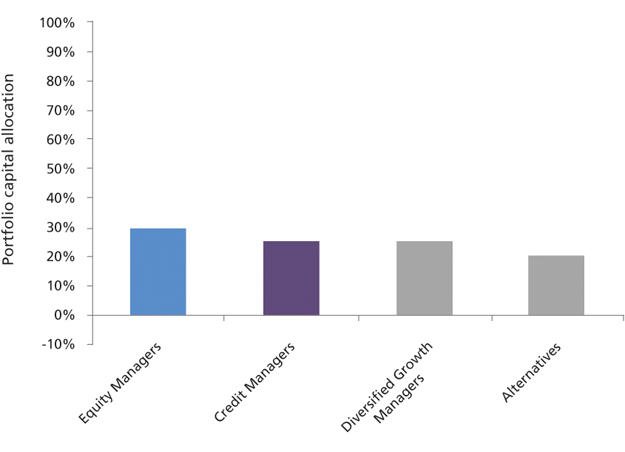

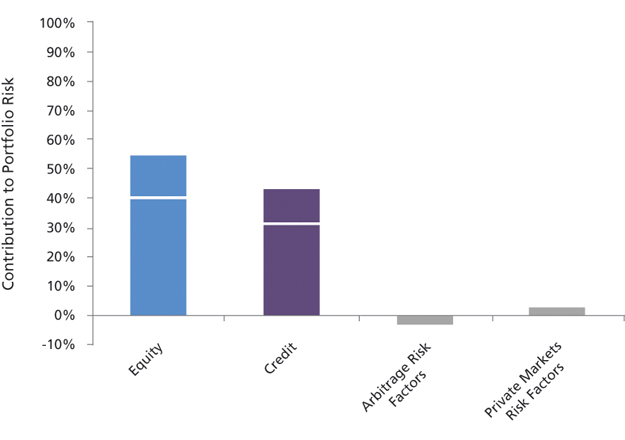

Furthermore, looking at your portfolio from a factor-based risk perspective can be very enlightening if your portfolio itself is comprised of multi-asset investments such as Diversified Growth, Balanced, or Multistrategy funds, as many of the sources of risk across these investments have the potential to be common in origin. Figure 2, below, demonstrates how an apparently well-diversified portfolio by capital weight can show a high degree of risk factor concentration.

In short, risk factor modelling is a way to cut through the arbitrariness of strategy and fund labels. Looking at total portfolio risk along multiple dimensions in this way is not only useful for risk management purposes, but it is also very relevant as an input into strategic asset allocation and portfolio construction discussions. By understanding how individual funds or strategies behave in the context of the overall portfolio, rather than in isolation, asset owners can establish important characteristics relating to investments such as their ability to diversify the portfolio, or the extent to which a fund doubles up on existing exposures already present in the portfolio. It can also help provide quantified answers to questions suchas: ‘Am I taking risk where I thought I was?’, ‘Do I have too much equity exposure in my portfolio?’ and, ‘Are my alternative investments really uncorrelated to the rest of my portfolio?’.

In this context the most useful attributes of an advanced risk model are (1) non-parametric, (2) factor-based, (3) able to accurately estimate risk distributions for a wide range of strategies and asset classes including more complex ones and (4) aims to be forward looking and less tethered to past returns.

Ten years of practical application suggests that the resulting empirical risk distribution has improved descriptive qualities, especially at the tails, and the combined factor exposures uncover otherwise overlooked risk and return drivers at a portfolio level.

Figures 2 and 3 show a typical portfolio composition from two differing perspectives. Figure 2 shows the portfolio composition by capital allocation while Figure 3 shows the contribution to portfolio risk by risk factor group. Where a horizontal line in the risk contribution is shown, this separates risk originating from managers in that strategy and risk contributed to that factor from other strategies, e.g. equity manager risk and non-equity manager risk.

Figure 2: Portfolio composition by capital weight

Figure 3: Portfolio composition by grouped risk factor contribution (upper part is contribution to that risk from other strategies)

An example of robust portfolio construction

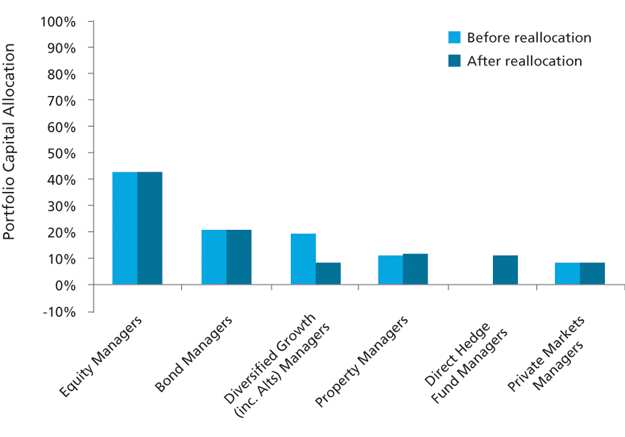

The example we use is one of a UK pension plan. Initial analysis of the portfolio showed that equity risk was far more dominant in their portfolio than they had anticipated, and their alternatives portfolio was far more additive to risk than was desirable. They were not willing to reduce their core equity investment as the plan needed the return potential associated with these investments.

We worked with the CIO to identify the risk factors driving the portfolio risk and return, and to structure their alternative portfolio to have minimal contributions to these risk factors, thus maximising the diversification obtained from these investments.

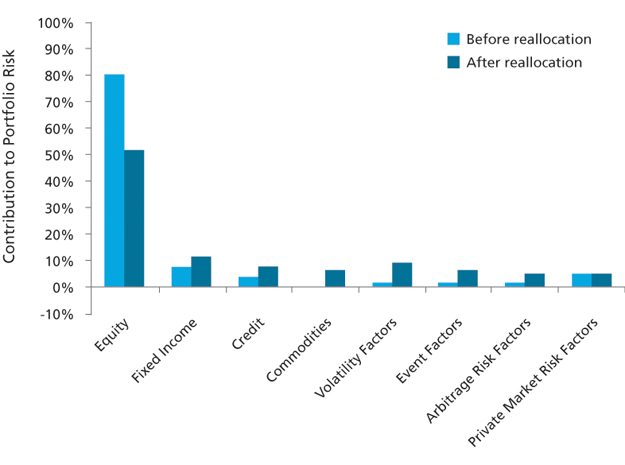

We have found that structuring the multi-asset and alternatives part of a portfolio in this way – essentially as a completion fund – can facilitate a more robust portfolio whilst maintaining core positions in line with the strategic and tactical views of the CIO. It also maximises the impact from what is typically the part of the portfolio with the highest fees. Figures 4 and 5 illustrate the effect of these changes from a capital allocation, and corresponding factor-based risk exposures basis. Figure 4 shows capital allocation before and after rebalancing, whilst Figure 5 shows the corresponding risk factor contributions.

Figure 4: Capital weights before and after reallocation process

Figure 5: Component risk contributions by factor group before and after reallocation process

As we have discussed above, traditional risk models tend not to work well in assessing the true risk in more complex asset classes. Similarly, superficial correlation-based portfolio construction techniques can render portfolios undiversified in extreme market conditions, just when diversification is most needed. A solution to both these significant problems can be to use a risk framework that is not totally driven by past returns and correlations, nor assumes all financial returns are normally distributed, and to be able to understand factor-based exposures within such a framework.

However, as a note of caution, one must realise that it is impossible to encompass risk into a single measure or methodology, therefore the approach outlined here is often best used as a complement to existing position-level reporting and analysis rather than a replacement, since such analysis is much more sensitive to big portfolio changes in the short term. Together, however, this can be a powerful combination.

This article was first published in ‘Global ARC Thought Leadership Book 2014’

More Related Content...

|

|

|