Advocating stewardship in fixed income portfolios

Written By:

|

Martin Price |

|

Natasha Landell-Mills |

Martin Price and Natasha Landell-Mills outline why ESG factors can be key when making investment decisions

Many institutional investors are looking to their asset managers to take greater account of environmental, social and governance (ESG) factors in their equity investment strategies. Although the equity asset class appears to have been in the vanguard of this development, it makes little sense to apply responsible investment criteria to equity share capital and not to corporate debt. Assessing ESG risks for government issuers presents different challenges to the analyst, but is no less relevant; indeed, there are very good reasons why bond fund managers should be looking to incorporate insights from ESG analysis across portfolios. The opportunities for ESG integration into bond analysis go far beyond green bonds. It is this broader application that we believe offers new avenues for active fixed income managers to improve performance.

Considering governance in capital risk

The primary concern for a bond holder is that income payments are secure and insolvency is not a risk. Bonds are issued around par value and redeemed years later at par; over the full term, there is no capital gain to be had. The capital risks are asymmetric: at best, interest payments are made on time and capital is returned; at worst, the issuer defaults, leaving lenders with a residual recovery value. In short, the key focus of analysis is on protecting capital against downside risk.

Traditionally, governance has always been part of a credit analyst’s review. At the end of the day, corporate bond investors want to know if they can trust the company to repay the money borrowed. Environmental and social factors have not been considered to be so relevant to the assessment of solvency risk. But as we have seen, an environmental disaster can pose major risks for an oil and gas company and it may also represent a risk to solvency. The 2010 BP Macondo disaster caused an uncomfortable, if in this case not enduring, spike in BP bond yields.

The sustainability of the issuer needs to be considered in the widest sense to judge the robustness and predictability of cash flows. Transparency is an important corporate virtue as a means of avoiding delivering those unwanted surprises to investors. Ultimately, management track record indicates whether or not managers can deliver on their business plans. Management that looks to strong capitalisation, appropriate leverage and a desire to create and maintain its reputation with lenders will receive a sympathetic hearing in the credit world.

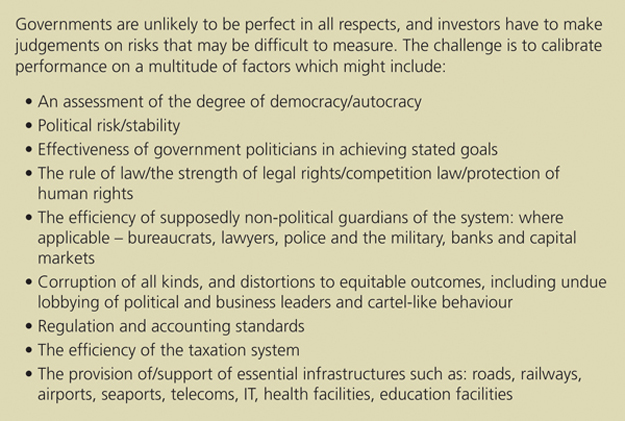

When it comes to assessing governments, government agencies and supranational organisations, the same criteria on cash flow, transparency and “management” ability still apply. This time, though, the “management” is normally a treasury department. But investors will also want to look at a wide range of other factors. Environmental policy and social issues may start to weigh more heavily, and this is where the analysis starts to become more involved.

Analysing governments on ESG criteria creates special challenges

Source: Sarasin & Partners

ESG also matters to sovereign solvency

When it comes to sovereign debt, rating agencies responsible for assessing the risk of default have tended to give relatively low priority to environmental and social factors. But it stands to reason that environmental and social analysis can offer valuable insights. Where a country has depleted its natural resources to such an extent that it can hinder economic growth, this could well impact its ability to repay debt. Or, where a country suffers from severe levels of corruption and social breakdown so that political stability is at risk, as occurred a few decades ago in Argentina and is occurring currently in Ukraine, it matters to a bond investor’s view of solvency risk.

A framework for incorporating ESG considerations

The challenge is how best to frame the analysis to integrate the material insights ESG analysis can offer, such that the fund manager can deliver improved returns. Here, Sarasin & Partners believes a different approach is called for – one which places capital protection at its heart. As already noted, this is the core preoccupation of a bond investor.

It is thus entirely logical for bond investors to look at the capital base on which wealth is generated. The traditional focus on physical and financial capital is too limited. We believe that it makes more sense to also consider entities’ natural capital (their resource base), human capital (their labour force, level of dependency, health, education, etc.) and socio-political capital (for countries: legal systems, property rights, cultural norms, etc.). With this more holistic “capitals approach”, investors will be far better placed to understand the most material risks to solvency over the long term.

A capital-based approach to fixed income analysis

Source: Sarasin & Partners

Putting the concept into practice

Analysing these additional factors, and correctly interpreting what they tell us about risks to solvency, demands resources. But the aim should not be to add on layers of tick-box analysis. Rather, the goal is to provide fund managers with new avenues for gaining unique insights about the issuing entity.

Ultimately, there is no formula or simple model. In the end – as with all equity and fixed income analysis – managers’ success will depend on detailed knowledge, wide experience and sound judgement.

More Related Content...

|

|

|